Speculative Attack

Introduction

Bitcoin naysayers[1] wring their hands over how Bitcoin can't go mainstream. They gleefully worry that Bitcoin will not make it across the innovation chasm:

- It's too complicated

- It doesn't have the right governance structure[2]

- The security is too hard to get right

- Existing and upcoming fiat payment systems are or will be superior

- It's too volatile

- The government will ban it

- It won't scale

The response from the Bitcoin community is to either endlessly argue over the above points[3] or to find their inner Bitcoin Jonah[4] with platitudes like:

- Bitcoin the currency doesn't matter, it's the block chain technology that matters

- It would be better if the block chain technology were used by banks and governments

- Bitcoin should continue to be a niche system for the bit-curious, it's just an experiment

- Fiat and Bitcoin will live side-by-side, happily ever after

- Bitcoin is the Myspace of 'virtual currency'

The above sophisms are each worth their own article, if just to analyze the psycho-social archetypes of the relevant parrots.

A few of the criticisms mentioned earlier are correct, yet they are complete non sequiturs. Bitcoin will not be eagerly adopted by the mainstream, it will be forced upon them. Forced, as in "compelled by economic reality". People will be forced to pay with bitcoins, not because of 'the technology', but because no one will accept their worthless fiat for payments. Contrary to popular belief, good money drives out bad. This "driving out" has started as a small fiat bleed. It will rapidly escalate into Class IV hemorrhaging due to speculative attacks on weak fiat currencies. The end result will be hyperbitcoinization, i.e. "your money is no good here".

Thiers' Law: Good Money Drives Out Bad

Historically, it has been good, strong currencies that have driven out bad, weak currencies. Over the span of several millennia, strong currencies have dominated and driven out weak in international competition. The Persian daric, the Greek tetradrachma, the Macedonian stater, and the Roman denarius did not become dominant currencies of the ancient world because they were “bad” or “weak.” The florins, ducats and sequins of the Italian city-states did not become the “dollars of the Middle Ages” because they were bad coins; they were among the best coins ever made. The pound sterling in the 19th century and the dollar in the 20th century did not become the dominant currencies of their time because they were weak. Consistency, stability and high quality have been the attributes of great currencies that have won the competition for use as international money.

Bitcoins are not just good money, they are the best money.[5] The Bitcoin network has the best monetary policy[6] and the best brand.[7] We should therefore expect that bitcoins will drive out bad, weak currencies.[8] By what process will bitcoins become the dominant currency? Which fiat currencies will be the first to disappear? These are the interesting questions of the day, as the necessary premises for these questions are already established truths.[9]

1. Fiat Bleed

Bitcoin's current trend is to increase in value on an exponential trend line as new users arrive in waves. The good money is "slowly" driving out the bad. Two factors drive this:

- Reduction in information asymmetry – people are learning about Bitcoin and coming to the realization that bitcoins are indeed the best money. Possible overlapping motives:

- ADHD – compulsive novelty fetichism induced by our post-war consumer culture and/or innate biological processes

- FOMO – fear of missing out, see Regret Theory and ingroups, aka avarice and status-seeking

- PISD – post-internet stress disorder, aka "disruption", "next big thing", "internet of money"

- Increasing liquidity – buying bitcoins is more convenient and has fewer fees attached today than a year ago. One can reasonably predict that this will also be the case a year from now. Why? Because selling bitcoins is a profitable and competitive business. Why? Because people want bitcoins, see above.

Due to group psychology, these newcomers arrive in waves. The waves have a destabilizing effect on the exchange rate: speculators are unsure of the amplitude or wavelength of adoption, and amateurish punters let their excitement as well as subsequent fear overwhelm them. Regardless, once the tide has pulled back and the weak hands have folded, the price is a few times higher than before the wave. This 'slow' bleed is the current adoption model, and commentators generally assume one of the following:

- Slow bleed never occurred, it's a fiction based on misleading data

- Slow bleed has stopped, the above motives only affect lolbertarians and angry teens

- The process will taper off now, as all the super tech-savvy people are already getting on board

My own prediction is that slow bleed has been accelerating and is only the first step. The second step will be speculative attacks that use bitcoins as a platform. The third and final step will be hyperbitcoinization.

2. Currency Crises

It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy. Once it gets bootstrapped, there are so many applications if you could effortlessly pay a few cents to a website as easily as dropping coins in a vending machine.

Slow bleed leads to currency crisis as the expected value of bitcoins solidifies in people's minds. At first they are conservative, they invest "what they can afford to lose". After 12-18 months, their small stash of bitcoins has dramatically increased in value. They see no reason why this long term trend should reverse: the fundamentals have improved and yet adoption remains low. Their confidence increases. They buy more bitcoins. They rationalize: "well, it's only [1-5%] of my investments". They see the price crash a few times, due to bubbles bursting or just garden-variety panic sales – it entices them to buy more, "a bargain". Bitcoin grows on the asset side of their balance sheet.

On the liability side of the Bitcoiner's balance sheet there are mortgages, student loans, car loans, credit cards, etc. Everyone admonishes people to not borrow in order to buy bitcoins. The reality is that money is fungible: if you buy bitcoins instead of paying down your mortgage's principal, you are a leveraged bitcoin investor. Almost everyone is a leveraged bitcoin investor, because it makes economic sense (within reason). The cost of borrowing (annualized interest rates ranging from 0% to 25%) is lower than the expected return of owning bitcoins.

How leveraged someone's balance sheet is depends on the ratio between assets and liabilities. The appeal of leveraging up increases if people believe that fiat-denominated liabilities are going to decrease in real terms, i.e. if they expect inflation to be greater than the interest rate they pay. At that point it becomes a no-brainer to borrow the weak local currency using whatever collateral a bank will accept, invest in a strong foreign currency, and pay back the loan later with realized gains. In this process, banks create more weak currency, amplifying the problem.

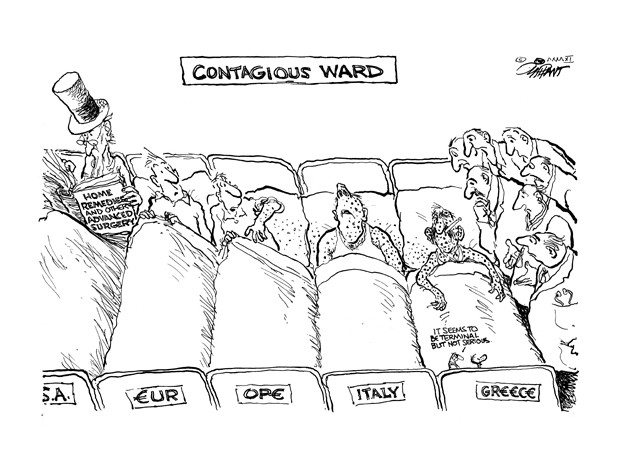

The effect of people, businesses, or financial institutions borrowing their local currency to buy bitcoins is that the bitcoin price in that currency would go up relative to other currencies. To illustrate, let's say that middle-class Indians trickle into bitcoin. Thousands of buyers turns into hundreds of thousands of buyers. They borrow Indian Rupees using whatever unencumbered collateral they have – homes, businesses, gold jewelry, etc. They use these Rupees to buy bitcoins. The price of bitcoins in Indian Rupees goes up, a premium develops relative to other currency pairs. A bitcoin in India might be worth 600, while in the U.S. it trades at 500. Traders would buy bitcoins in the U.S. and sell them in India to net a $100 gain. They would then sell their Indian Rupees for dollars. This would weaken the Indian Rupee, causing import inflation and losses for foreign investors. The Indian central bank would have to either increase interest rates to break the cycle, impose capital controls, or spend their foreign currency reserves trying to prop up the Rupee's exchange rate. Only raising interest rates would be a sustainable solution, though it would throw the country into a recession.

There's a huge problem with the Indian central bank raising interest rates: bitcoin's historical return is ~500% per year. Even if investors expected future return is 1/10th of that, the central bank would have to increase interest rates to unconscionable levels to break the attack. The result is evident: everyone would flee the Rupee and adopt bitcoins, due to economic duress rather than technological enlightenment. This example is purely illustrative, it could happen in a small country at first, or it could happen simultaneously around the world. Who leverages their balance sheet and how is impossible to predict, and it will be impossible to stop when the dam cracks.

Which countries are most vulnerable to a currency crisis? Business Insider provides a helpful list here. Bitcoins will have to reach certain threshold of liquidity, indicated by a solid exchange in every financial center and a real money supply – i.e. market cap – of at least $50 billion, before they can be used as an instrument in a speculative attack. This will either coincide with or cause a currency crisis.

3. Hyperbitcoinization

A speculative attack that seems isolated to one or a few weak currencies, but causes the purchasing power of bitcoins to go up dramatically, will rapidly turn into a contagion. For example, the Swiss will see the price of bitcoins go up ten fold, and then a hundred fold. At the margin they will buy bitcoins simply because they want to speculate on their value, not due to an inherent problem with the Swiss Franc. The reflexivity here entails that the reduction in demand for Swiss Francs would actually cause higher than expected inflation and thus an inherent problem with the Swiss Franc. The feedback loop between fiat inflation and bitcoin deflation will throw the world into full hyperbitcoinization, explained by Daniel here.

Conclusion

Bitcoin will become mainstream. The Bitcoin skeptics don't understand this due to their biases and lack of financial knowledge. First, they are in as strong an echo chamber as Bitcoin skeptics.[10] They rabidly search for evidence that confirms their view of Bitcoin. Second, they misunderstand how strong currencies like bitcoin overtake weak currencies like the dollar: it is through speculative attacks and currency crises caused by investors, not through the careful evaluation of tech journalists and 'mainstream consumers'. To honor these soon to be extinct skeptics, the Nakamoto Institute has launched A Tribute to Bold Assertions.

No, seriously, there are people on the Internet spending a non-trivial amount of time writing about a currency they think is going to fail yet continues to succeed beyond anyone's expectations. I get schadenfreude from their lack of schadenfreude. Granted, a few of them are being paid to write controversial click bait and/or just concern trolling – both activities that I respect and understand. ↩︎

This is generally stated by people who are in the 'out-group' and fantasize about being in the 'in-group' through politics/pedigree rather than economic/meritocratic processes. Demographically, they probably overlap with fans of The Secret. Economically, they are without exception bezzlers. ↩︎

Bitcoin has entered its Eternal September, where every person new to Bitcoin thinks they have a unique understanding of Bitcoin and everyone ought to hear about it. There's an endless flood of newbies 'concerned' about such and such 'problem' with Bitcoin. The Bitcoin community does these arrivistes a real disservice by taking them seriously instead of just telling them 'read more'. ↩︎

The opposite of Bitcoin Jesus. Bitcoin Jonah is a defeatist, self-sabotaging, and timid 'man' who is on a permanent quest to confirm Bitcoin's weakness. ↩︎

Bitcoin is the Best Unit of Account by Daniel Krawisz ↩︎

The Bitcoin Central Bank’s Perfect Monetary Policy by Pierre Rochard ↩︎

Bitcoin Has No Image Problem by Daniel Krawisz ↩︎

Hyperbitcoinization by Daniel Krawisz ↩︎

If you disagree then either you have not been learning or you have not been engaging in the debate, go back to square one. ↩︎

'I live in a rather special world. I only know one person who voted for Nixon. Where they are I don't know. They're outside my ken. But sometimes when I'm in a theater I can feel them.' - Pauline Kael ↩︎