April 22, 2011 • $1.40

Niels van der Linden

Amateur economist, VforVoluntary.com

April 22, 2011 • $1.40

Amateur economist, VforVoluntary.com

May 8, 2011 • $3.85

Software engineer

June 20, 2011 • $17.51

Journalist

June 20, 2011 • $17.51

CEO, Euro Pacific Capital, Inc.

August 9, 2011 • $9.80

Journalist

September 7, 2011 • $7.16

Nobel Prize-winning Economist

December 24, 2012 • $13.43

Journalist

March 5, 2013 • $40.67

Amateur trader

April 3, 2013 • $131.38

Finance and Economics Editor, The Guardian US

April 9, 2013 • $230.68

Contributing editor, Vanity Fair

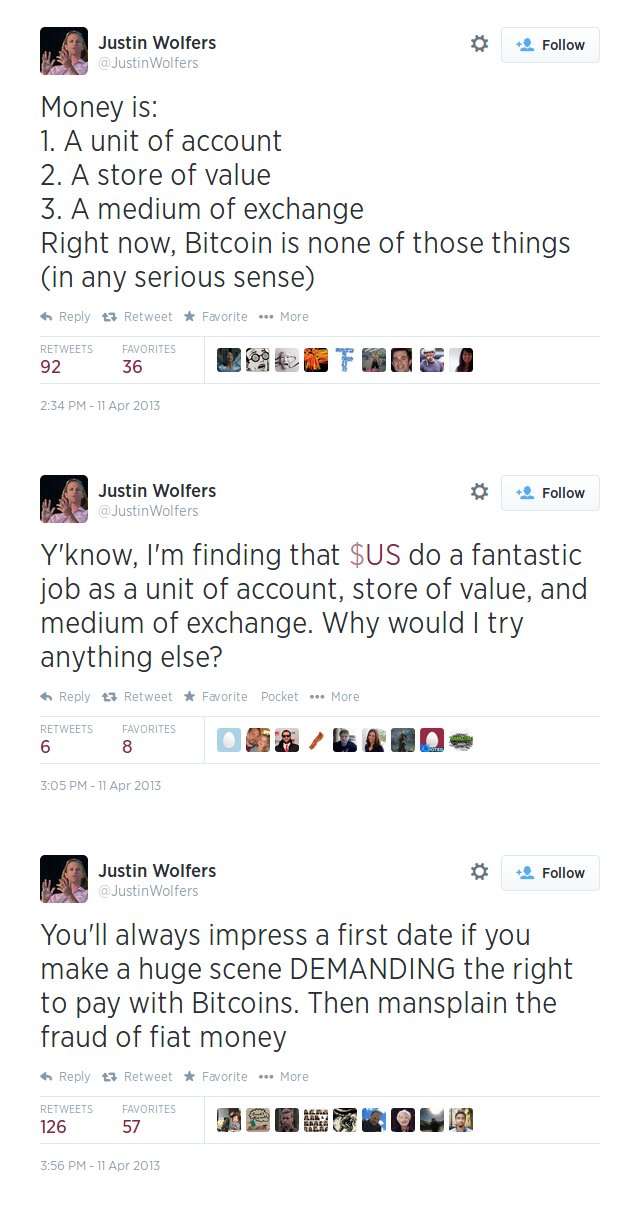

April 11, 2013 • $82.90

Economist, Brookings Institution

May 10, 2013 • $117.69

Journalist

May 14, 2013 • $107.87

Founder and President, Eurasia Group

October 16, 2013 • $138.33

Chairman of the Global Economics Group

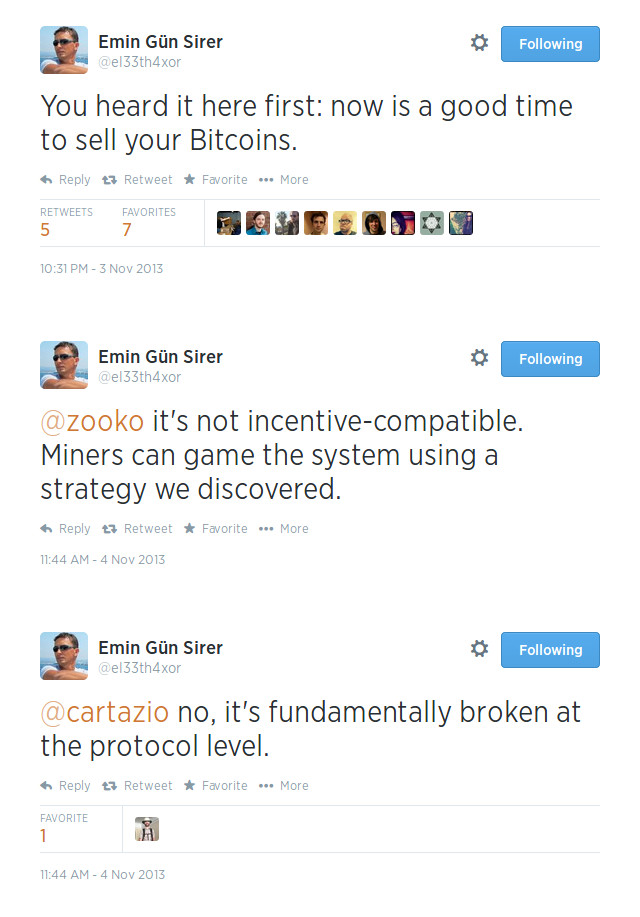

November 3, 2013 • $210.28

Professor, Cornell University

November 6, 2013 • $263.21

Executive Editor, Business Insider

November 8, 2013 • $333.75

Co-founder, Digg

November 21, 2013 • $720.76

Journalist

November 29, 2013 • $1,128.73

Economist

December 2, 2013 • $1,040.81

Executive Editor, Vox

December 5, 2013 • $1,027.41

Finance Professor, Boston University

December 18, 2013 • $526.12

Author

December 18, 2013 • $526.12

Economics Editor, Reuters

December 18, 2013 • $526.12

Developer and Angel Investor

December 28, 2013 • $715.85

Professor of Economics, U.C. Berkeley

January 15, 2014 • $841.09

"Serious Economist"

January 23, 2014 • $810.92

President & CEO, JPMorgan Chase

January 29, 2014 • $793.38

CEO, Elliott Management Corporation

March 1, 2014 • $567.53

Nobel Prize-winning Economist

March 9, 2014 • $640.58

TV Actor, Shark Tank

March 9, 2014 • $640.58

Professor of Economics, New York University

March 14, 2014 • $628.31

Chairman & CEO, Berkshire Hathaway

October 14, 2015 • $253.14

CEO and Founder & Chairman, Uphold (formerly Bitreserve), respectively

January 14, 2016 • $429.82

Lead Platform Engineer, R3CV

January 19, 2016 • $378.16

Contributor, The Washington Post; Tryhard

November 17, 2016 • $735.32

CEO, Circle

November 21, 2016 • $736.51

Senior correspondent, technology and economics, Lead writer for "New Money", Vox Media

January 3, 2017 • $1,032.61

Editor, Financial Times

June 2, 2017 • $2,479.42

Macro Strategist, GMI

July 26, 2017 • $2,522.32

Co-chairman, Oaktree Capital

October 9, 2017 • $4,777.53

Professor of Economics and Public Policy, Harvard University; Former Chief Economist, IMF

October 23, 2017 • $5,888.25

Citigroup shareholder

April 24, 2018 • $9,652.21

Founder & CEO, Personal Capital; Former CEO of PayPal and Intuit

November 28, 2018 • $4,208.48

Nobel Prize-winning Economist; Failed and bailed out co-founder, Long-Term Capital Management

July 24, 2019 • $9,792.79

United States Secretary of the Treasury

"I can assure you I will personally not be loaded up on bitcoin" in 10 years, says Treasury Secretary Mnuchin #bitcoin pic.twitter.com/0J5acWQwRO

— Squawk Box (@SquawkCNBC) July 24, 2019

January 1, 2020 • $7,170.63

Chief Economist, LendingTree

February 12, 2021 • $47,525.21

Flaneur, or something like that