Working and Saving are Revolutionary Acts

Government exists because it is, de facto, the equilibrium solution to providing judicial and defense services. This equilibrium is the result of ideology, high transaction costs, and strong asset specificity. To change this equilibrium, should we try to persuade people that our ideology is the right one, or should we work on reducing transaction costs and weakening asset specificity?

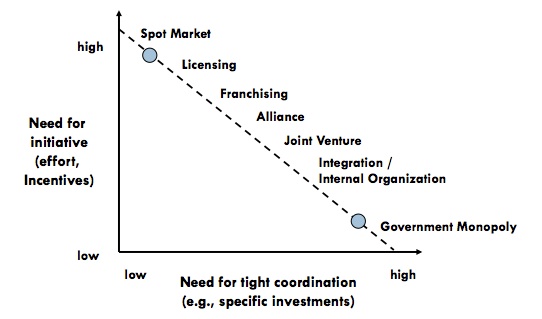

The graph below visually explains how the market structure for a given good or service is the result of endogenous constraints:

Our goal as libertarians is to shift economic activity away from government monopolies and towards focused firms buying and selling in spot markets. Thankfully this shift automatically takes place as society’s stock of capital increases; regardless of government intervention or political activism. New capital formation is the impetus for two trends that push the equilibrium of all industries towards decentralized markets: increasing technological sophistication and a deepening of the division of labor.

Companies and individuals cannot develop new technologies without having savings or capital set aside to engage in or finance speculative research. Once commercialized, technology reduces search and information costs (Google, Wikipedia), bargaining costs (Amazon, eBay), and enforcement costs (Visa, Paypal). Technology also weakens the asset specificity of government institutions with new tools like the printing press, firearms, computers, cameras, and crypto-currencies.

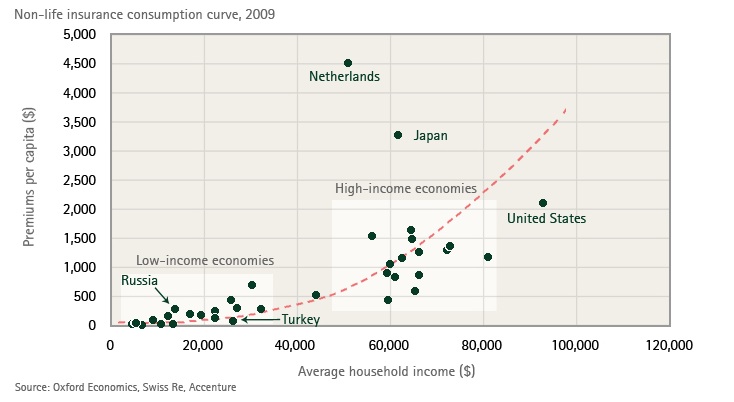

The division of labor in the insurance industry is especially important to libertarians since insurance companies are specialized in handling risks associated with life, contracts, and property. The division of labor enabled by capital accumulation has been so great that the industry evolved from only providing maritime insurance in the 17th century to covering everything from pets to political risk. The following graph highlights how insurance grows as a function of society’s wealth.

Insurance and reinsurance companies have an increasing amount of resources dedicated to preventing risks from being realized and mitigating losses when those risks are realized. These include services like fire fighting, security, and risk management. As the size of insurance carriers continues to grow, so will their incentive and ability to transact with effective private firms for what are traditionally considered government services. Insurance companies already participate in private arbitration because it is less expensive and time consuming than government courts. It’s only a matter of time before the clout of insurers engenders a completely private judicial system and government loses its primary competitive advantage: a monopoly on law.

The counterargument to this optimistic view is that governments will also have more resources and technology; counteracting any gains the private sector will make, i.e. economic growth fuels the growth of the State and we should all go Galt or agorist. This counterargument ignores government’s completely unsustainable fiscal/monetary practices as well as its inclination to tax at rates low enough to permit economic growth. The former leads to State self-destruction, while the latter ensures the continued growth of the private economy.

Given that a private law society is inevitable over the longterm, what is left for the young libertarian activist to do?

If you enjoy politics, then by all means continue to advocate ending the Fed and lowering entitlement spending. Just understand that your efforts mirror those of the White Rose; noble yet inconsequential in the grand scheme of things. There is also an opportunity cost attached to lobbying, electioneering, and otherwise yelling from street corners.

A healthier and more fulfilling approach is to maximize capital formation by:

- Developing a career in a specialized field that you love and creates real value

- Not being a political operative

- Not joining a multi-level marketing scheme

- Not becoming an academic

- Saving as much of your income as possible and insuring yourself, loved ones, and property

- Investing in innovative entrepreneurship, whether it’s within the company you work at, on your own, or with partners

This approach results in personal prosperity, an increase in society’s capital stock, technological progress, and accelerates the inevitable demise of governmental monopolies. Most importantly, it frees you from having to impose your acrimonious political opinions on relatives during the holiday season.

Read in 한국어 and Português Brasil