Gradually, Then Suddenly (#15)

Bitcoin is One for All

First published on Unchained Capital Blog

At the Democratic National Convention (August 2020), Congresswoman Alexandria Ocasio-Cortez described the Bernie Sanders presidential campaign as, “a movement that realizes the unsustainable brutality of an economy that rewards explosive inequalities of wealth for the few at the expense of long-term stability for the many.” That the current economic system is working very well for a few at the expense of the many has become more widely recognized and accepted across both sides of the political aisle in recent years. While there is vehement disagreement on the appropriate solution, most everyone at least agrees that there is a problem. Fortunately or unfortunately, there is no political solution to a problem that is inherently of economic origin. It is unfortunate because politicians of all ideologies will make promises of grandeur while further dividing the nation as they hopelessly search for a political solution which does not exist. At the same time, it is fortunate that the solution is not political, as bridging partisan divides has historically proven to be a fool’s errand.

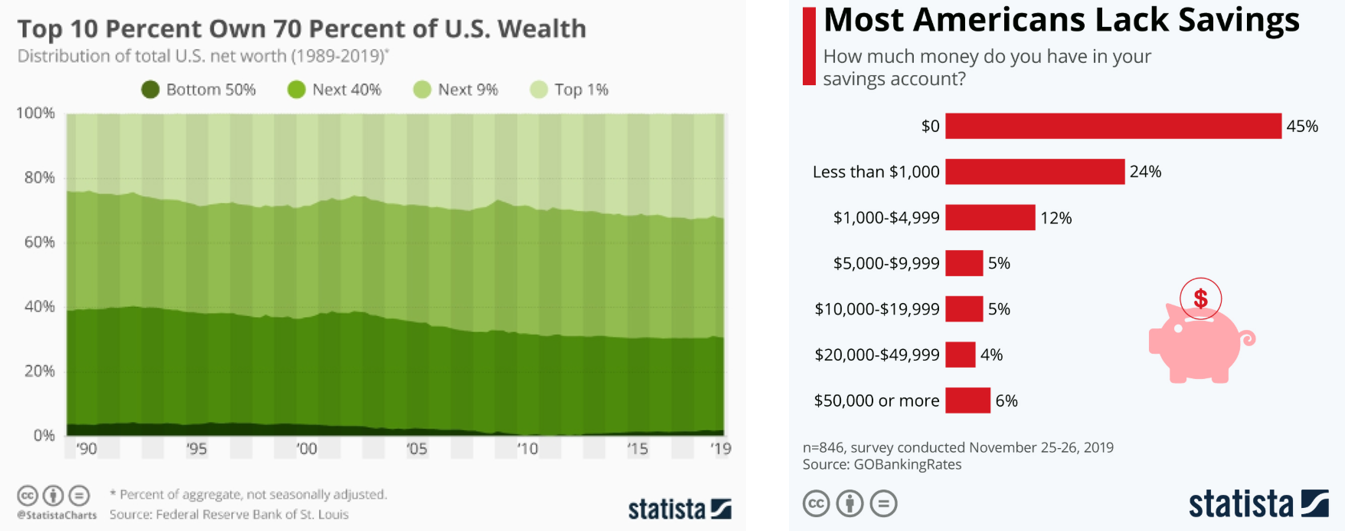

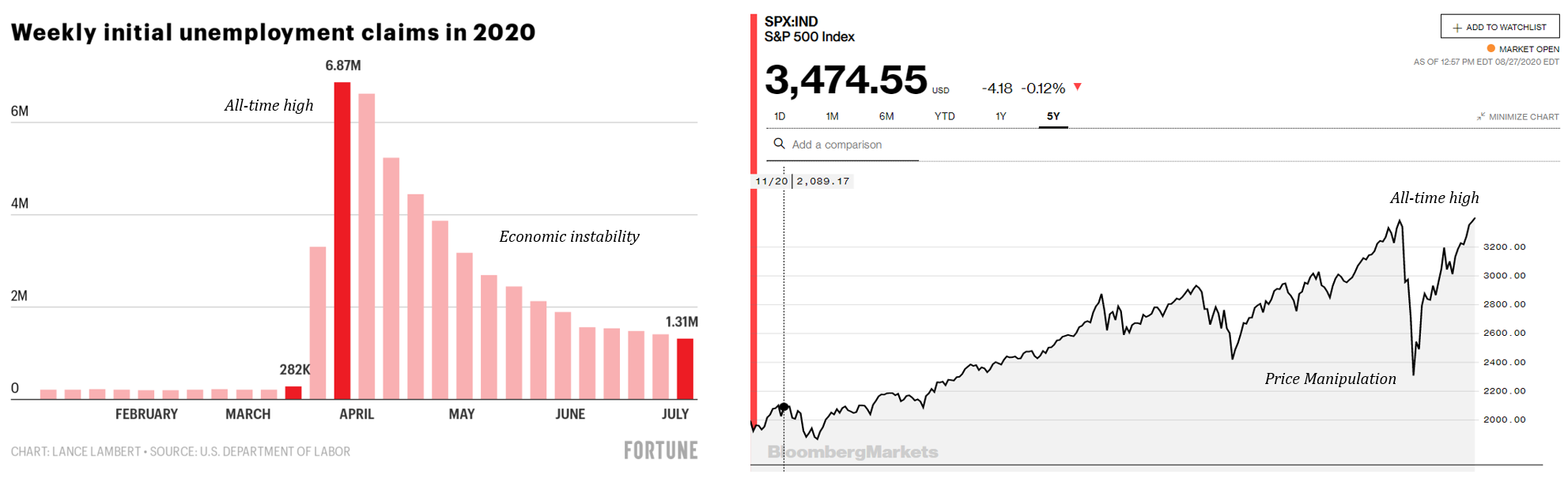

Without doubt, the economic structure is broken. Wealth gaps are only becoming wider, it is unsustainable, and economic instability is everywhere. The stock market and national average home values are back at all time highs while tens of millions of Americans are filing for unemployment and half of society has practically no savings. Economic equations do not add up. That is a hard-to-deny reality; it is suffocating many and it applies globally. Politicians simply are not the answer. The fundamental problem with the current economic structure lies not in politics, but in the currencies which coordinate economic activity (e.g. the dollar, euro, yen, peso, bolivar, etc.). The chink in the armor is in the foundation. No politician can fix problems that stem from structural flaws inherent to modern money. Once the foundation is fixed, then solutions to higher order challenges can follow suit, but until then, any efforts will continue to prove ineffective.

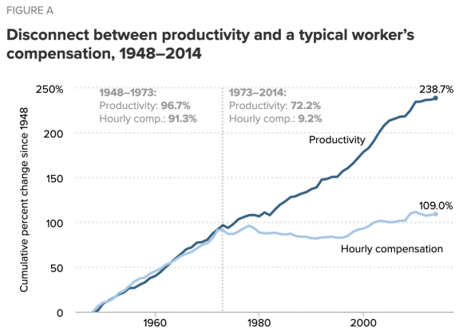

A currency is the foundation of an economy because it coordinates all economic activity. If an economy is functionally breaking down, it would be more appropriate to say that the underlying currency is not effectively coordinating economic activity; the currency is the input and the economy is the output. In short, the fly in the ointment is the money. While many are focused on how to solve the problem of massive wealth inequality, very few connect that the greatest source of inequity lies in the tool that everyone is using to coordinate the entire orchestra. It is not just that the economy is not working for many; it is that the dollar (or euro, yen, etc) as the primary mechanism coordinating economic resources is failing for everyone. Economic imbalance and growing inequality is the new normal, but there is nothing natural about sustained economic imbalance. In fact, it is an economic oxymoron. Balance is critical to the functioning of any economy, and when functioning properly, an economy would naturally eliminate imbalance in its normal course. If an economy fails to do so, and instead allows imbalance to be sustained, that is evidence of a broken economic structure. But, the massive and growing economic imbalance which exists today is not the inevitable and unavoidable consequence of free market capitalism; instead, it is principally a result of central bank monetary policy, which allows economic imbalances to be sustained in ways that would otherwise not be possible.

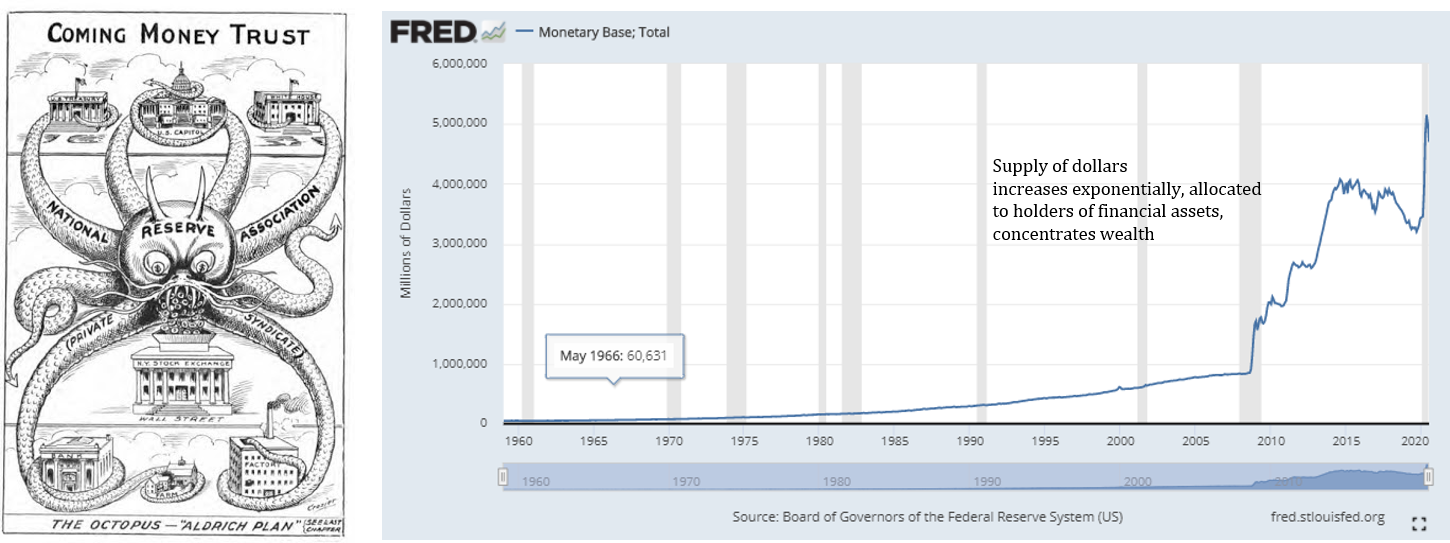

Central bank monetary policy is the exogenous force creating massive economic distortion and extreme levels of inequality. The mere existence of economic inequality is not in itself an inequity; in fact, unequal outcomes are both natural and entirely consistent with economic balance. On the other hand, the inequality which has been created and exacerbated by a flawed monetary system is an inequity, and it is not natural to a free market economy. It is exogenous. The structural flaw inherent to the dollar currency system (or any fiat currency system) is the force most responsible for sustained economic imbalance. Unsustainable and extreme wealth disparity follow from that imbalance. Every other distortive economic action or policy exists at higher orders than the issues created by the manipulation of the money itself. That is the root of all structural economic problems, and until it is fixed, the world will remain suspended in an increasingly fragile state. The legacy monetary system centralizes and consolidates wealth; that is the output of sustaining and exacerbating economic imbalance. It is a system that works for a few in the short-term but fails for all in the long run because the end game of monetary manipulation and an ever-growing economic imbalance is instability. The currency’s ability to coordinate economic activity degrades gradually and eventually fails completely; everyone pays that inevitable price.

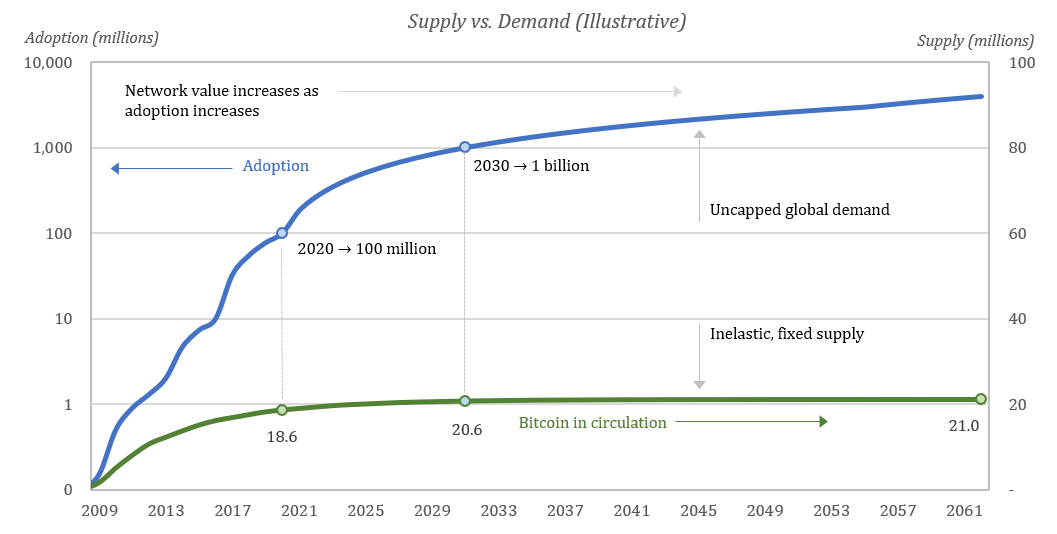

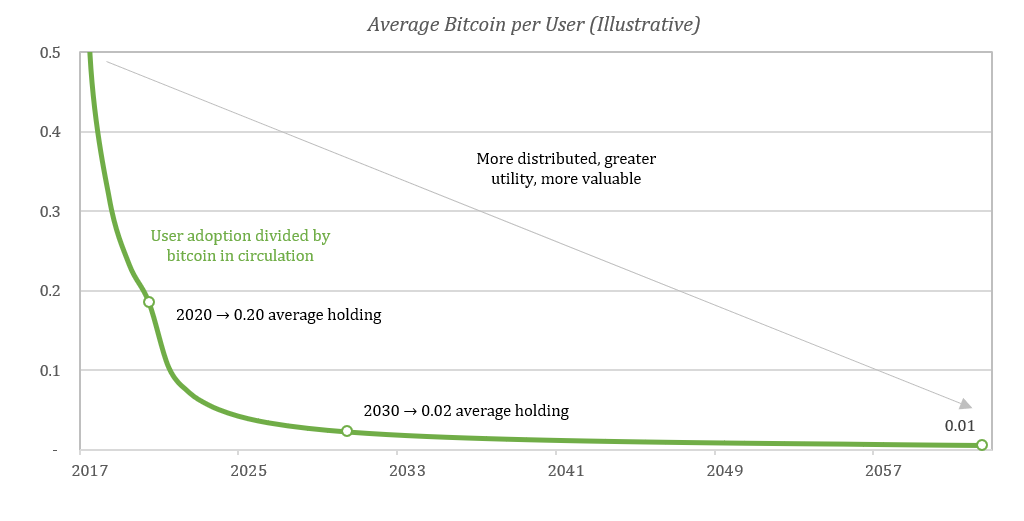

Bitcoin is the polar opposite. It is one currency that works for all, now and in the future. It eliminates imbalance as a natural function, wherever and as soon as it appears, because its supply cannot be manipulated. With a fixed supply capped at 21 million and an ever-increasing adoption curve, more and more people own bitcoin, and each person controls a smaller and smaller share of the same fixed pie. The ownership of the currency naturally becomes more distributed and less concentrated over time, which provides the foundation for greater balance. Bitcoin levels the playing field and ensures that the monetary system cannot itself be a source of extreme inequity. It does so by guaranteeing certain inalienable rights. Every holder of the currency is provided the assurance that more units of the currency will not be arbitrarily produced, and each unit of the currency is treated equally within the network. Bitcoin more effectively coordinates economic activity because its pricing mechanism cannot be distorted or manipulated by exogenous forces, which is the fatal flaw of the legacy currency system. A fixed supply, equal protection, and true price signals deliver greater balance. Bitcoin fixes the economic foundation for everyone such that everything else can then begin to fix itself.

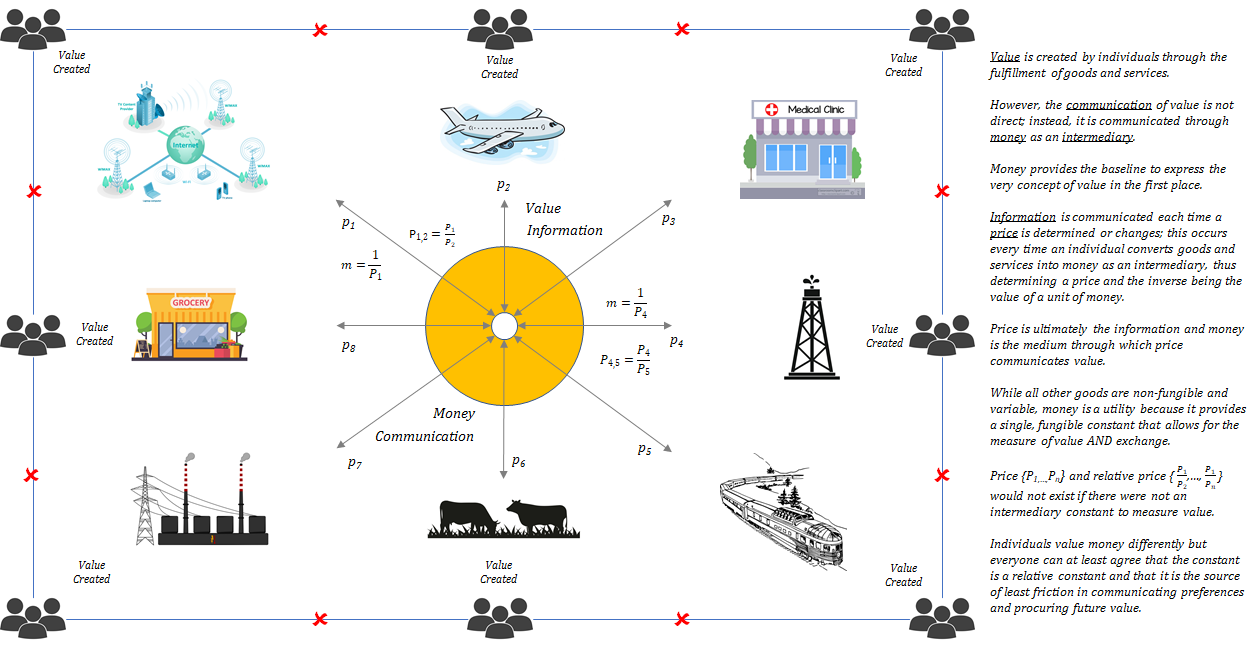

The Role of Money and the Price System

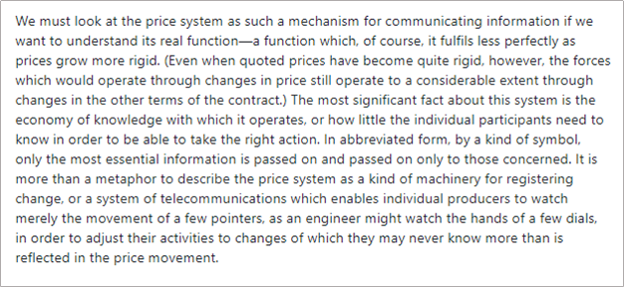

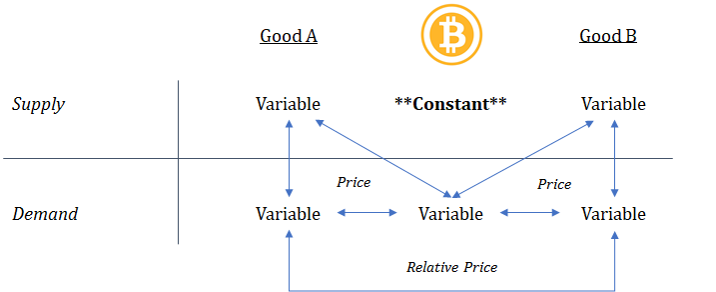

As a simplified construct, think about money as the coordination function within an economy. The utility of money is to intermediate a series of exchanges. Receive, hold, spend (h/t @pierre_rochard), that simple. Money is the intermediary good used to both establish and trade value. As the market converges on a common form of money, a price system emerges, which allows for the subjective concept of value to be more objectively measured. Money is the pricing mechanism and the output is a pricing system. The price system communicates information; it aggregates individual preferences within an economy and communicates those preferences through local prices, as measured in a common monetary medium. Change in prices reflects changes in preferences.

Because preferences are ever changing, so too are prices. Within a developed economy, there are millions of goods, each with individual prices resulting in billions of relative price signals. Relative price signals ultimately communicate exchange ratios between various combinations of goods. While the value of any single good may be static for a period of time, certain prices are always changing within an economy, which dictates that relative prices are ever changing. An economy constantly works to find balance through the aggregate changes in price levels. Anyone and everyone within an economy reacts to the price signals most relevant to their own preferences, which naturally change and become dynamically influenced by changing prices themselves. Through the price system, individual market participants learn both what others value and what they need to produce to meet their own needs. As prices change, behaviors change, and everyone adapts. The price system is the visible hand which allows for balance to be achieved and for imbalance to be identified and eliminated. Long-term economic stability is achieved because variable information is constantly communicated through the price system. It is the fluctuation in prices inherent to undistorted markets that actively prevents large scale and systemic imbalances from forming.

Flaws of the Central Bank Mandate

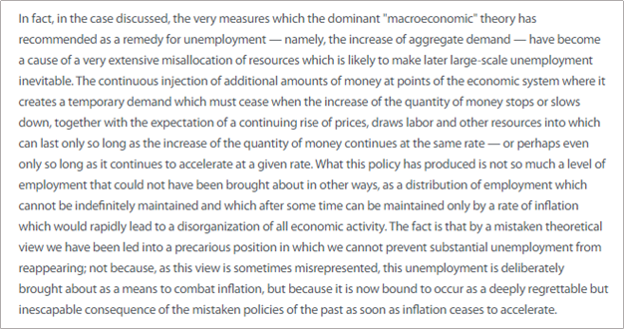

The foundation of the economy is broken because the money coordinating economic activity is actively manipulated. Most central banks, including the Fed, have the authority to create money arbitrarily at no cost and have a mandate to maintain stable prices (i.e. a price stability mandate). This combination is fatal to the functioning of any price mechanism and ultimately to the underlying economy. When a central bank targets the stability of any price level, it is actually working in opposition to the natural course of an economy, which seeks to find balance and to adapt to a change in preferences through the price system. Worse yet, the means by which a central bank works to achieve price stability is through the manipulation of the money supply, which distorts the entire pricing mechanism underpinning the economy. With every exogenous attempt to achieve price stability, the central bank actively allows imbalances to be sustained and distributes bad information to every person within the economy through false price signals, which in turn causes further imbalances to grow. Imagine this happening each time the economy tried to find balance. By sustaining imbalance, those that principally benefited from the existence of imbalance are continuously advantaged at the expense of everyone else.

Made worse, it actively impedes the ability of those on the lower end of the economic spectrum to contribute and to command a greater share of the resources within an economy.Artificially inflated asset prices create an uphill battle for those that do not own assets, and false signals induce poor economic decisions, disproportionately harming those lowest on the economic spectrum who can least afford errors and setbacks. False and distorted economic signals, created through the manipulation of the money supply, are counterproductive for all in the long run, but in the short-term, benefit those to whom the imbalance is positively skewed.

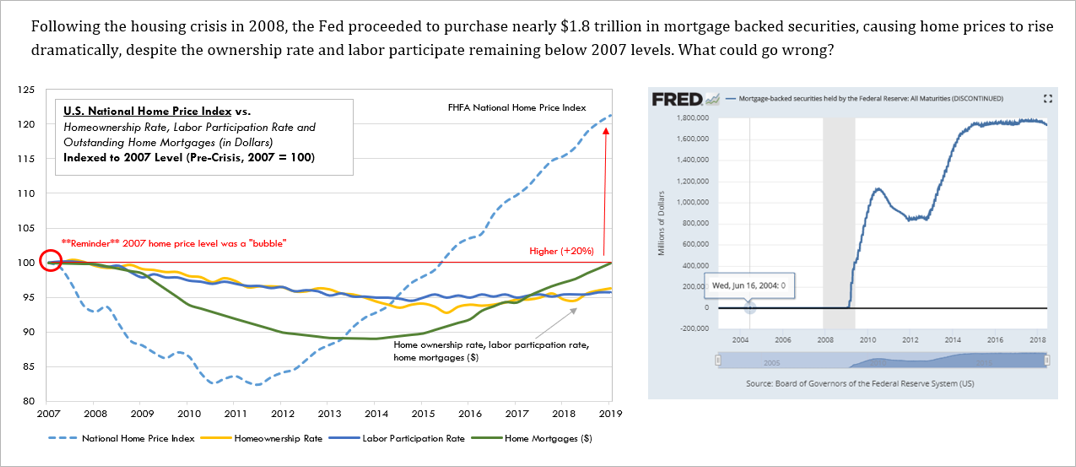

For example, when the value of real estate was declining during the 2008 financial crisis, the price mechanism of the economy was communicating that there was an imbalance. In aggregate, market participants were communicating an increasing demand for money relative to a decreasing demand to hold real estate. At that particular moment in time, the actual amount of money and the available supply of real estate were not rapidly changing. Instead, preferences within the economy were shifting as were relative price signals. Rather than allow the economy to find balance and eliminate imbalance, the Fed increased the supply of dollars in an effort to “stabilize” the dollar value of real estate. More literally, it created $1.7 trillion dollars and used those newly minted dollars to purchase mortgage-backed securities as a direct means to support the value of real estate. Those that owned real estate (e.g. housing) or operated businesses dealing in the production (or financing) of real estate benefited disproportionately at the expense of those that did not. The benefit skewed to the side of existing imbalance, as it always does when imbalance is being sustained artificially.

Not only did the Fed manipulate the value of real estate, it manipulated and distorted all price signals within the economy by significantly increasing the money supply. The market function to eliminate imbalance would have been for prices to change. The Fed’s solution was the opposite. It devalued the money (by increasing its supply), such that the value of real estate (among other goods) as priced in dollars would change the least. Rather than eliminate imbalance, the Fed’s actions allowed imbalances to be sustained and actually grow. Once one actually appreciates the fundamental role which money and the pricing mechanism play in coordinating economic activity, it becomes clear as day that sustaining imbalance is precisely what occurs each time the Fed intervenes to stabilize price levels. Stability when achieved through manipulation merely suppresses volatility. It creates an unnatural rigidity in price, when price fluctuation is both a desired state and the natural function of a market communicating changes in preferences. When imbalances that would otherwise be eliminated are allowed to be sustained by artificial means and for extended periods of time, it ultimately creates greater volatility in the long run and critically impairs the ability of a monetary medium to coordinate economic activity, which is its singular utility. Each time and cumulatively, it advantages and further embeds the incumbents, just as the market is working to eliminate imbalance.

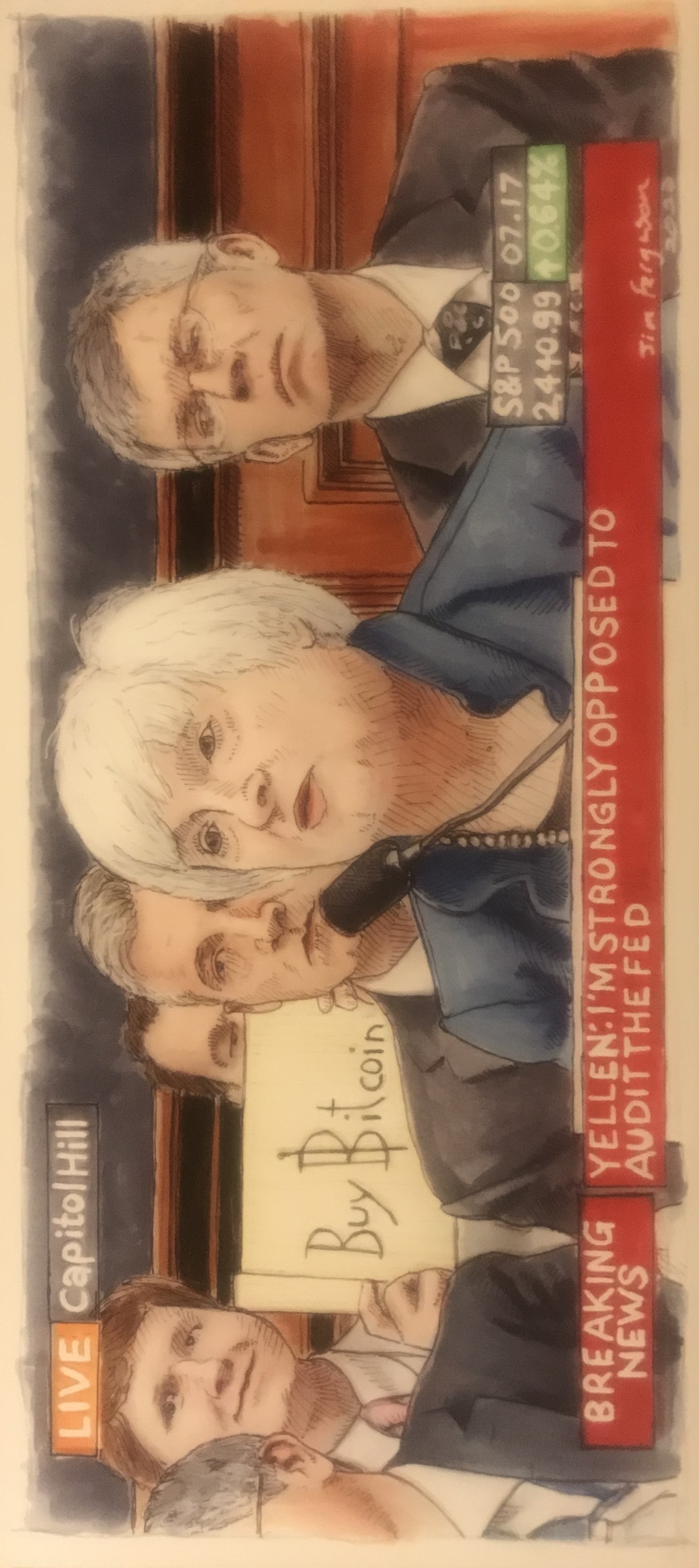

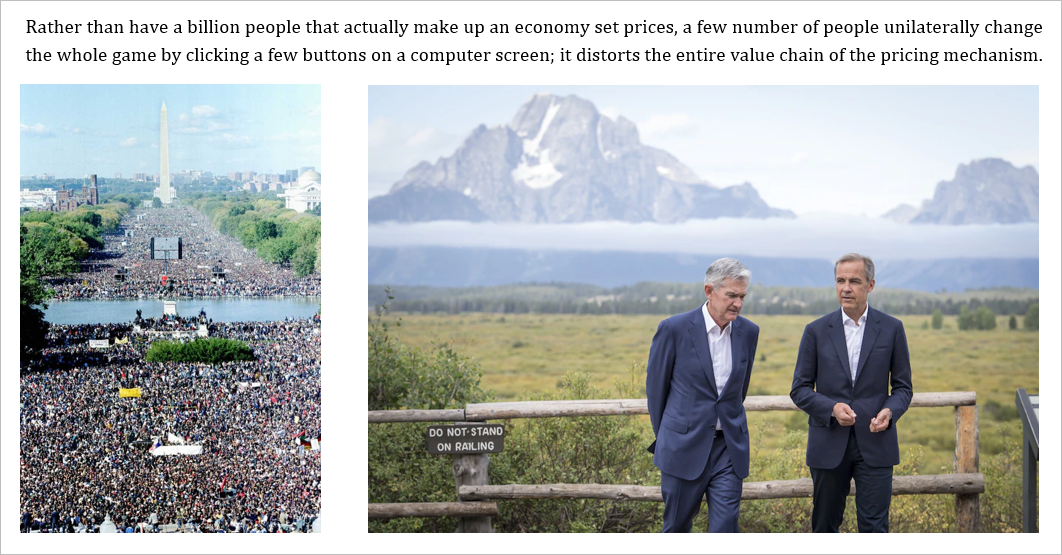

By manipulating price levels, the Fed isn’t just preventing smaller intermittent fires from naturally running their course while creating larger fires down the road. Instead, think of the Fed’s actions as the arsonist that lights a fire, leaves through the back door in the middle of the night, and then is celebrated as the hero when it arrives through the front door to fight the fire with gasoline. A change in price levels, even if particularly volatile, is not a fire that needs putting out. Artificially preventing changes in price, aka a price stability mandate, is what lights the fire in the first place. The Fed coopts the entire value chain of the pricing mechanism. Change in price is actually desired and the central bank works in opposition to that change by manipulating the money supply. The formation of imbalance within an economy is natural; creating a centralized mechanism which prevents imbalances from being eliminated is the unnatural and damaging part. It also creates long-term economic instability by distorting price signals over decades and widens the wealth gap by constantly advantanging those on the right side of imbalance. Predictably and unironically, the existence of the central bank’s price stability mandate, combined with the power to print money, causes both long-term instability and sustained economic imbalances.

Most mainstream economics professors would readily agree that price fixing or setting quotas on certain economic goods naturally creates economic inefficiency and imbalance. However, the same cohort of experts would then turn around and avidly defend central bank monetary policy, not realizing the fundamental inconsistency. Economic manipulation is economic manipulation. Rigidity in price or quantity of any economic good driven by exogenous forces results in imbalance; variance allows for balance and equilibrium. Very logical and not controversial. Why then is the same not understood when applied to money? Imbalances are created when central banks target interest rates through the manipulation of the supply of money, just as imbalances are created when the Venezuelan government arbitrarily sets the price of a gallon of gas below its market value. Ironically, the manipulation of the money supply happens to be economically more destructive because it distorts all prices within an economy, and all relative price signals as individual price levels do not adjust ratably (in fact, far from it). When the Fed pursues its price stability mandate, it is actively sending false price signals throughout an economy and causing imbalances in supply and demand structures to be sustained. Price stability is price manipulation, and it is perfectly predictable that when the price of money is manipulated to achieve any definition of stability, the very action causes a degree of economic distortion far worse than the manipulation of any single market.

Consequences of Sustaining Imbalance

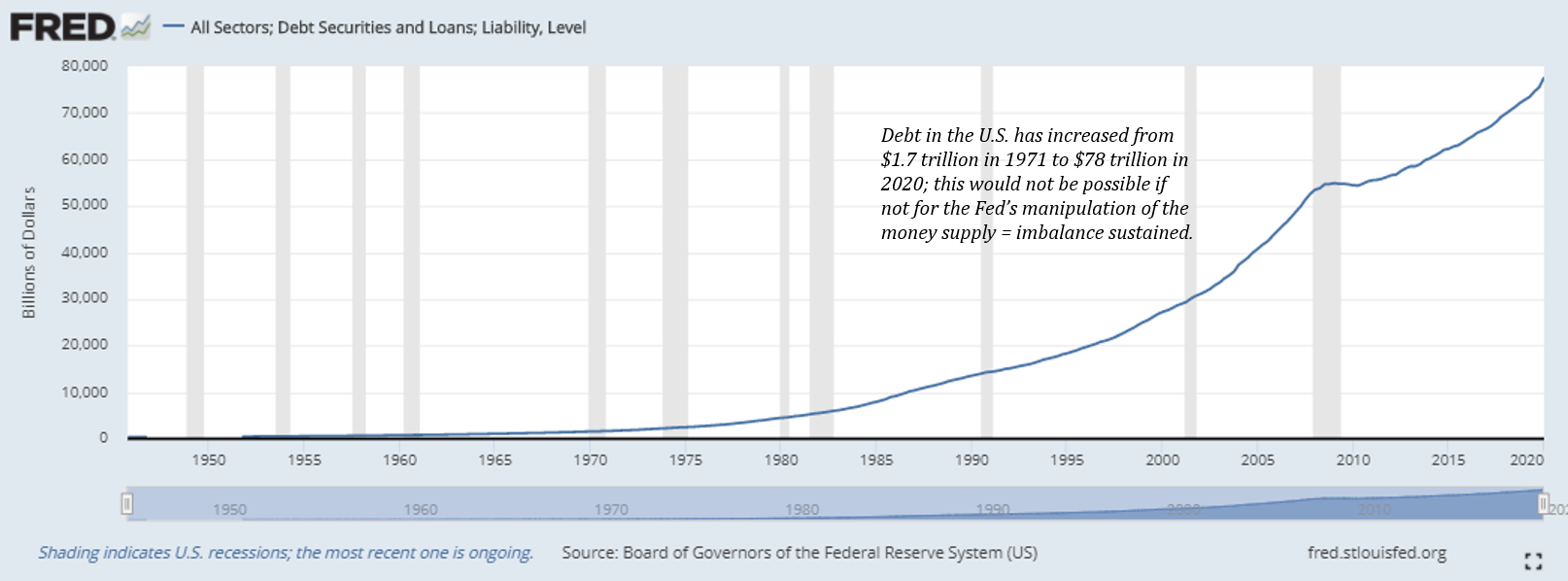

The effects of sustaining imbalance can be best understood and observed through the credit system because that is where the Fed directly intervenes and consequently where the greatest distortion and imbalance exists. As the economy slows and as price levels begin to change counter to the Fed’s desired course, the Fed increases the supply of dollars in the financial system by purchasing debt instruments (typically government treasuries) and crediting the accounts of the sellers with newly minted dollars. At the onset, the credit system was just a tool to effect monetary policy; it was the mechanism through which the Fed pursued price stability. Increase the supply of dollars by purchasing credit instruments, reduce interest rates by that same mechanism, induce economic expansion via cheap credit and cause general price levels to stabilize. That was the theory and intent. However, predictably, this pattern caused imbalances to form and be sustained in the credit system itself. Now the tail is wagging the dog. Today, the credit system in the U.S. stands at 77.9 trillion system wide, whereas there are only 4.5 trillion actual dollars within the banking system. For every dollar that exists, approximately $17 dollars of dollar-denominated debt exists (debt-to-dollars of 17:1). Again, this is an imbalance only made possible and sustained as a function of the Fed. Each time the credit system attempts to contract, the Fed creates more dollars to help maintain the size of the credit system, such that it can further expand. Because the credit system is now orders of magnitude larger than the base money supply, economic activity today is largely coordinated by the allocation and expansion of credit rather than by the base money itself. In aggregate, the credit system is the marginal price setter given its size relative to the base money supply. Because of its price stability mandate, the Fed has an implicit mandate to maintain the size of the credit system, and in order to do so, it must target asset prices that support existing debt levels. It has become circular. The Fed used the credit system as a tool to stabilize price levels but now it must maintain the size of the credit system in order to maintain stable prices.

This vicious cycle was only ever made possible because the Fed has unilateral control of the money supply. In 1971, President Nixon officially ended all convertibility of dollars to gold, and the U.S. government later decoupled the value of the dollar from gold altogether in 1976. While the creation of the Federal Reserve in 1913 was the beginning and President Roosevelt’s executive order in 1933 banning private ownership of gold set the stage, the complete departure from gold as a monetary anchor in the 1970s removed constraints that otherwise prevented the true centralization of the money supply, and which ultimately enabled the great monetary inflation which Paul Tudor Jones recently wrote about. Once the final constraints were removed, it opened the door for the Fed to take a more central role in actively managing the economy via the money supply, which it ultimately effects through the credit system. As a direct consequence, the base money supply and the credit system have expanded in ways that would otherwise not have been possible, allowing imbalances to consistently grow over time and creating long-term economic distortions.

When imbalances emerge in the credit system (i.e. too much debt existing), the Fed supplies more dollars such that existing debt levels can be sustained. Rather than write off bad debt and reduce existing debt levels, imbalances are actively sustained rather than eliminated. This is the real reason why the banking sector and the function of credit has become as large as it has; it would not have been possible if the Fed were not able to print money to artificially sustain unsustainable levels of debt, all in the interest of “price stability.” Effectively, each time the banking sector would otherwise contract, the Fed takes measures to actively prevent it. It sounds crazy because it is, but it exists the way it does because the credit system is the primary transmission mechanism of the Fed’s monetary policy. The Fed needs the credit system to be maintained because it is through this vehicle that the Fed attempts to “manage” the economy. The Fed sees targeting asset prices to sustain debt levels as less disruptive than allowing debt to be restructured and written off. In the Fed’s eyes, it’s six one way, half a dozen the other; effectively the same, but with less disruption. In reality, one path is economic manipulation of the worst kind, and the other is the natural and organic balancing of an economy in imbalance. The Fed chooses the former, trading short-term stability for long-term instability and distortion.

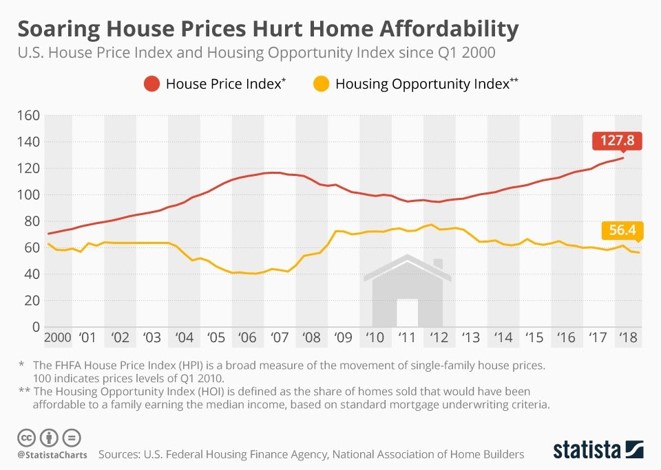

While it should be obvious that asset price targeting advantages those with assets (wealthy) and is a regressive tax on those without assets (poor), the Fed has its price stability mandate. For those on the lower end of the economic spectrum with little to no savings, cash naturally represents most, if not all, of one’s savings. On the other hand, those at the higher end of the economic spectrum typically hold cash in addition to equity in businesses, real estate and financial assets, such as stocks and bonds. Again, consider the 2008 financial crisis. There were imbalances in both the housing market and financial markets; prices within these markets were at unsustainable levels. As imbalance was being eliminated and as price levels were correcting, the Fed stepped in to “stabilize” asset prices. Imagine that you were someone just entering the economy, without any savings, or you could not afford to purchase a home and likely did not own stocks or bonds. Everyone who owned assets was bailed out at the expense of those who did not, all in the interest of price stability.

By increasing the supply of dollars to prop up asset prices, each dollar naturally becomes worth less. For those lowest on the economic spectrum, wages paid in dollars (labor) were devalued, and asset prices were directly manipulated higher. Inflation of most all consumer goods broadly followed. It is the equivalent of being hit from both sides. Wages purchase less and less day-to-day, and it becomes measurably more difficult to accumulate the amount of savings necessary to purchase assets. Initially, the effects are at best zero-sum. Those at the top benefit, those at the bottom suffer. In the end, everyone loses because the end game is economic instability. Notice the negative correlation below between housing prices and housing affordability, and then recognize that housing prices are actively manipulated by the Fed. Also recognize that housing prices are at an all-time high (above 2007 bubble levels), when nearly half the country has no savings. That equation only exists in a manipulated world, and it crushes those without savings.

Economists running the show and those that benefit the most will overwhelmingly agree it has to be done (every time); history is written by the winners but it is still all smoke and mirrors.

“Sure, it was a crazy experiment, but the Fed had no other choice. Just imagine all those on the lower end of the spectrum that would have lost their jobs if not for the Fed’s actions. Without a job, the poorest on the economic spectrum would have been far worse off and would not have been able to afford a home.”

At least, this is the common, predictable defense. The same line has certainly been used to defend the Fed’s most recent actions in response to the global pandemic (printing $3 trillion with a T). While it may seem like logic, it is an anecdote that lacks any fundamental economic argument in defense of the manipulation of price levels. The narrative is caught in a vicious cycle that begins with economic imbalance as a starting point (and one created by decades of the same distortive monetary policy). Recall the role of arsonist hailed as a hero fighting the fire. You cannot dig yourself out of a hole by continuing to dig in the same direction. At a fundamental level, manipulating price levels allows imbalances that would otherwise course correct to be sustained. It disproportionately advantages those that contributed to, and benefited the most from, the very existence of imbalance – like having your cake and eating it too, or like getting a second bite at the apple. Those most directly bailed out took an inadvisable risk, and rather than be penalized, the world of imbalance is sustained. The advantages gained from manipulated incentive structures are allowed to continue in a way that would not be possible absent the Fed’s policy decisions.

An Unmanipulated Economic Structure

While there is never perfect balance, the existence and fluctuation of price levels is how an economy works toward balance through trial and error. Every individual reacts to an ever-changing set of price signals. It is how people evaluate which businesses to create, which skillsets to acquire, and which jobs to pursue, all of which are interdependent on each individual’s own interests and capabilities. Imbalances can naturally arise within an economy as individuals speculate and over-invest in certain segments based on imperfect expectations of consumer preferences. That is the nature of trial and error. Nobody knows or can predict the future; they use price signals to best guide decisions. A business or individual produces a good for X and attempts to sell it for Y, and if insufficient demand exists to make the activity profitable, that is the market communicating information to the producer. Better luck next time; build it for less or build something else that is of greater value or valued by more people. Imbalances are eliminated. Those that took the risk own the consequences, and it’s back to the drawing board in a never-ending game aimed at marrying individual ideas and skillsets with the preferences of other market participants.

“Prices and profits are all that most producers need to be able to serve the needs of men they do not know. They are tools for searching — just as, for the soldier or hunter or seaman, the telescope extends the range of vision.”

Money is the tool that is used to coordinate resources and to test the market by trial and error; it becomes the lifeblood of an economy because it is the foundation of a price system. It is how information is distributed to all participants. The better the money, the more reliable its price system. And the more reliable a price system, the greater the balance in an economy. Those within an economy that deliver the greatest value to the largest number of people are naturally rewarded with the most money, but money would be of little value to the producer if others were not producing goods that they themselves valued. The system would not sustain itself if balance did not exist; in order to purchase a good or service from another individual, one must have earned money in the first place. Acquiring money by voluntarily providing a service valued by others is a far better outcome for everyone in aggregate than if money were to be acquired through any other means. It is so because it’s the only way for the cycle to be repeatable and symbiotic rather than one-off and zero-sum. What good is a customer that runs out of money or doesn’t have any in the first place? In a balanced economy, every producer is a customer of someone else and vice versa.

“Give a man a fish and you feed him for a day; teach him how to fish and you feed him for a lifetime.”

One need not be religious to understand the wisdom. Each individual benefits by having a larger number of people producing more goods or services, and everyone is incentivized to produce output valued by others within an economy. Everyone has a selfish interest in both delivering value to others and in helping others to contribute value in return. But, it is not just a naïve or hopeful economic view of the world; there are discernible benefits to trade, specialization and ultimately, in a broader range of choice for all individuals, which organically dictates a division of labor. Money coordinates the division of labor, and the form of money with the most reliable pricing mechanism will consistently deliver the greatest value with the greatest range of choice and balance. The pricing mechanism with the least distortion provides the clearest signals as to what other people value, and derivatively, provides the greatest assurance that the information communicated is not a false signal. The undistorted function of a monetary medium and its price system is what ensures imbalance is eliminated; it is the governor that allows for balance to be restored and for symbiotic relationships to continuously be discovered in a constant process of trial and error.

A Manipulated and Broken Economic Structure

The Fed’s monetary policy actively prevents the economy from restructuring and from finding balance. Efforts to maintain price stability when imbalance exists equates to maintaining otherwise false price signals. Productive assets remain in the hands of a few, and the world remains suspended in a state of imbalance. Money that makes its way to those on the lower end of the spectrum eventually finds its way back to those that control the productive assets like a steel trap because structural imbalances are never fixed. Instead, the natural healing process is stymied when the Fed intervenes. The structure of the economy cannot sustainably cycle money in a symbiotic way because balance does not exist; skillsets and preferences of market participants are not aligned. The Fed pumping money into a structurally broken economy is akin to giving a man a fish and feeding him for a day, while at the same time preventing him from learning how to fish by sustaining false signals. The existence of imbalance signals that the composition of an economy is not meeting the needs of the participants that make up the market. Or rather, that the assets and individuals which capture the lion’s share of wealth would not continue to do so if the economy was allowed to restructure.

The Fed’s economic structure produces inequity by preventing imbalances from rebalancing. That is what the market attempts to do every time the Fed steps in to keep the dream alive. Giving all benefits of the doubt, the Fed believes it is helping. The starting point of the Fed’s economic theory is that active management of the money supply is a positive driving force. That is in its DNA. It is not questioned or debated. It sees its activities as smoothing out market signals rather than manipulating them. The question for all those within the four walls of the Fed is how much and when to manipulate the money supply, not if. Would anyone expect the Fed to be an honest evaluator of its actions? It would be like grading your own test; no one would reasonably expect an objective assessment because there can be no objectivity. Certain false assumptions are encoded in their brains as true which prevents the possibility of objectivity. They look everywhere for answers but in the mirror, and try the same policies over and over again, always expecting a different result.

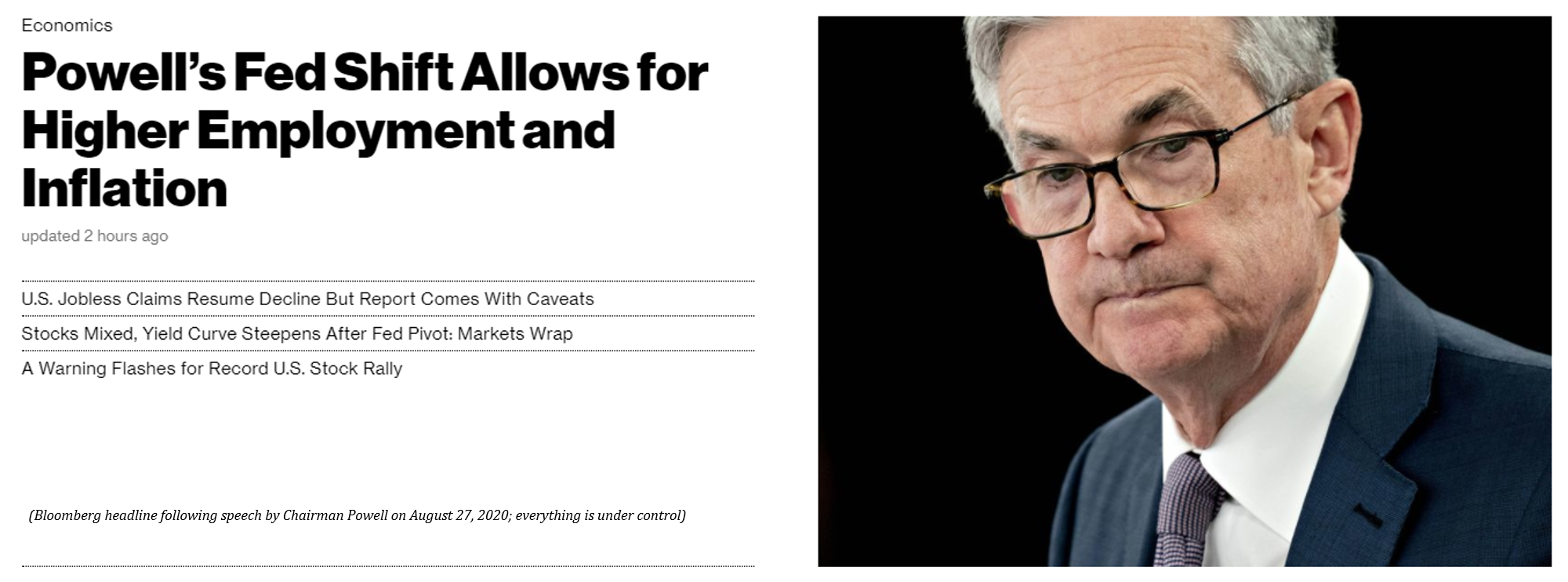

“Inequality is something that has been with us increasingly for more than four decades, it’s not really related to monetary policy. It’s more related to [stutter] there are a lot of theories on what causes it, but it’s been something that’s more or less been going up consistently for more than four decades and there are a lot of different theories, one of which is just that globalization and technology call for rising levels of skills and aptitudes and education and that U.S. educational attainment flattened out, certainly relative to our peers, over that period[.]”

Fed Chairman Powell recently provided this as a response to a question asking whether Fed policy contributes to increasing wealth inequality. Notice how the response is not an argument as to why central bank policy does not cause imbalance and inequality. It is more of a pronouncement followed by a “look over there” defense. Never believe the myths about globalization and technology driving wealth inequality. There is nothing about technology, innovation and globalization that causes sustained economic imbalance or a structurally expanding wealth gap within an economy. For innovation to be valuable, it by definition must solve problems for a range of people, but if those that valued it did not have money or means to afford the innovation, it wouldn’t be valuable. Value becomes self-referencing in that sense. Economic balance is a governing input to value. In order to believe the tall tales of technology and globalization causing economic imbalance, one would have to be willfully blind to the impact of centralizing the money supply, which in turn caused banking to become the epicenter and lifeblood of the economy, and which made it possible for imbalance to actively be sustained over decades as a policy decision. There may be many theories, but the manipulation of every price signal within the economy is ground zero to economic imbalance and inequity; it is the structural flaw in the foundation which creates the unlevel playing field off of which all other contributing factors compound.

##If A then B; if not A then not B

Money is the bedrock of economic systems. Understanding the fundamental and foundational role money plays in the economic engine establishes the logical connection between systemic economic issues of imbalance and the artificial manipulation of the money supply. Of course, there are other factors at play. The money supply is not the only way economic activity is manipulated. Tax policy, government spending and the regulatory apparatus all contribute. But, focusing there would be like trying to fix the windows on the 100th floor when the bottom ten stories are each being supported by a single Jenga block. That is the relationship between the issues inherent in the monetary system (the foundation) and all other economic issues (higher levels). The core problem that bitcoin solves is the foundation. If everyone were to display a little bit of humility, each would recognize that there is no silver bullet to solve the structural problem of a widening wealth gap and economic imbalance. There is no individual with a plan or piece of legislation that will make everything better. Imbalance created by central command does not get solved by central command. Quite the opposite. The only real hope is to first fix the foundation, such that everyone on net can get back to doing the desirable things without the need for conscious control. Balance will follow from there.

“But those who clamor for “conscious direction”—and who cannot believe that anything which has evolved without design (and even without our understanding it) should solve problems which we should not be able to solve consciously—should remember this: The problem is precisely how to extend the span of our utilization of resources beyond the span of the control of any one mind; and therefore, how to dispense with the need of conscious control, and how to provide inducements which will make the individuals do the desirable things without anyone having to tell them what to do.”

With a fixed supply of 21 million, enforced on a decentralized basis and controlled by no one, bitcoin has taken away the ability to manipulate the monetary function entirely. If misbehaving children cannot find a way to share a toy and play nice, what do you do? You take the toy away and put the kids in the penalty box. That is kind of like the relationship between bitcoin and central banks. No human (or institution) can be trusted with control over the money supply, so the only practical solution is to take away the ability and temptation all together. The one constant in bitcoin is its fixed supply; there will only ever be 21 million bitcoin, and there is nothing anyone can do about it. Everything will change around bitcoin, but its supply as a constant will increasingly become the guidepost off of which all other activity is measured. It ensures a level playing field and represents a source of truth, which is absent in the existing economic structure. Because its supply cannot be manipulated, neither can its price signal. Undistorted price signals communicate more perfect information. But never confuse more perfect information and a level playing field with price stability or the issue of volatility. If the value of bitcoin is 12,000 today and 10,000 tomorrow, that is the undistorted communication of information.

“Variation is information. When there is no variation, there is no information. […] There is no freedom without noise—and no stability without volatility.”

A fixed supply ensures that any change in price is exclusively driven by a change in demand rather than an artificial and unpredictable change in the supply of money (i.e. communicating a change in preferences to the entire economy). It eliminates an entire side of the equation, which heavily influences changes in prices today, and which distorts the communication of preferences. Imagine knowing with absolute certainty that every change in price were dictated by a change in consumer preferences rather than the effects of increases or decreases in the money supply. That is the difference between being able to consistently rely on true economic price signals and playing musical chairs knowing someone else is in control of the stereo. Today and into the future, the same principle will hold true. Everyone will be able to rely upon and trust that changes throughout bitcoin’s price system will always be true and never be influenced by unpredictable changes in supply.

This fundamental difference between the existing monetary structure and bitcoin changes the entire game. False price signals vs. true price signals. False price signals are the equivalent to believing you have a cheat sheet for a test, training yourself based on that information and then showing up only to find out that the test was entirely different. Everyone believes they are responding to true price signals, not realizing that the information communicated would be fundamentally different if the money had not been manipulated. Each time a violent shock occurs within the system, everyone gets a hint that price signals were communicating bad information, but then the Fed steps in to stabilize prices and everyone becomes reassured that it’s ok to come back outside and play, relying on the same bad signals. The primary reason a violent shock to the system is even possible is because this process has occurred every time the economy has attempted to structurally rebalance over the past 50 years. Bad signals attempt to correct, only to be sustained and exacerbated by exogenous forces. With a fixed money supply, this wrong is permanently righted. It will no longer be possible to sustain imbalance. So long as bitcoin exists, the monetary medium will not be capable of distributing distorted price signals. There is a difference between right, wrong and true. True price signals merely ensure that the information being communicated is reflective of the individual and aggregate preferences of an economy. In that sense, there is no right or wrong, so long as the information can reasonably be relied upon as accurate and undistorted. No one has to trust or question whether bitcoin’s price signals are true because its fixed supply will guarantee it.

And no longer does anyone need to figure out how to play a rigged game because that game is ending. The days of monetary inequity will soon be past as bitcoin distributes throughout the world. It will shift the balance of power back to those that actually create value, as defined by true price signals, which are communicated by individuals that hold the currency. Setting aside taxes and regulatory capture for a moment, if one wants to acquire bitcoin, he or she will have to provide value in return, and bitcoin will become the arbiter of that value. Of 21 million, approximately 18.5 million bitcoin are already in circulation. The 18.5 million in circulation are all held by some individual or entity. In order to acquire any, bitcoin must be earned by delivering value to those that hold the currency. Even for those not yet circulating, every single bitcoin must be earned by contributing value. The same is not true of the current monetary system. In the current structure, dollars can either be earned by delivering value to others within the economy, or conversely, if the Fed decides to hand out more money. And this happens quite frequently. Of all the dollars that exist today, over 80% have been created and allocated by the Fed since 2008 (source link), rather than by the alternative – delivering value to others within the economy. Which system sounds more fair, balanced and conducive to aligning incentives throughout an economy over decades and generations?

As more people adopt bitcoin, the currency is transferred from those that have to those that have not. By making the nominal amount of bitcoin zero-sum, it ensures that the economic system is non-zero sum. In order to join the economy, you must deliver value to someone within the network. No value leaks outside the system; no inefficiency can be introduced through the production of money. Whether new entrants are joining the network or trade occurs from within, value is always transferred, and through that transfer, value is actually created. Recall that the valuable function of money is to coordinate economic activity. The production of money, on the other hand, produces no value and only serves to distort and impair the ability of a monetary medium to properly function. The nominal amount of money is not important. What is important is its ability to communicate accurate information to a broad set of economic participants.

That is why people demand money, and with a terminal rate of change set at zero, each participant can use bitcoin to best understand the value of his or her own output relative to that of others and relative to the preferences of others, undistorted by any changes in the money supply. Each person can make better decisions (on average) in the pursuit of his or her own interest, while by definition delivering value to others as a means to that end. A fixed amount of currency plus more people valuing it equals greater distribution of the currency. With a fixed supply, no more than 21 million bitcoin can ever be saved and paradoxically, that change in the incentive structure will cause more people to save. By introducing an incentive to save (i.e. a fixed supply), more people will. And as more people save in a currency which has a fixed supply, it results in more and more people owning less and less but through that function of more people saving, it creates greater stability. Whereas the centralized control of the money supply and the ability to sustain imbalance causes wealth to consolidate, a fixed money supply naturally causes the currency to become further decentralized and more distributed, delivering greater balance.

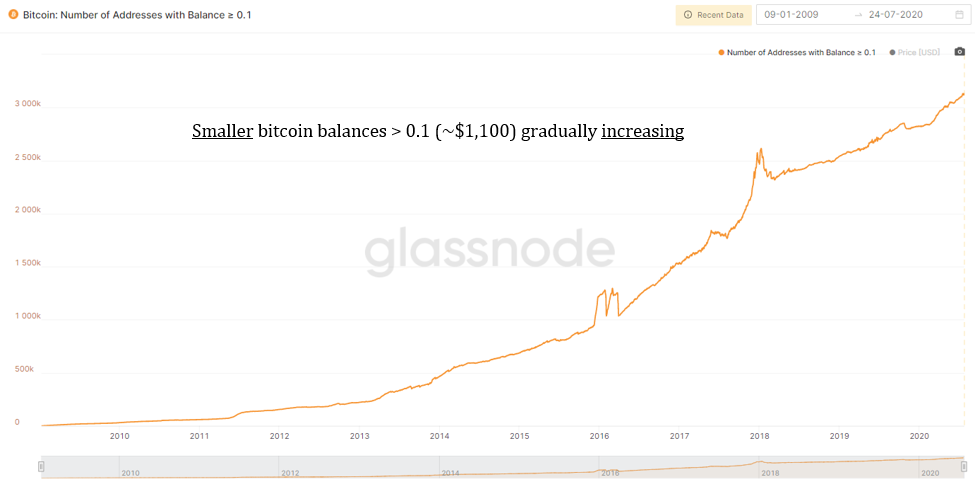

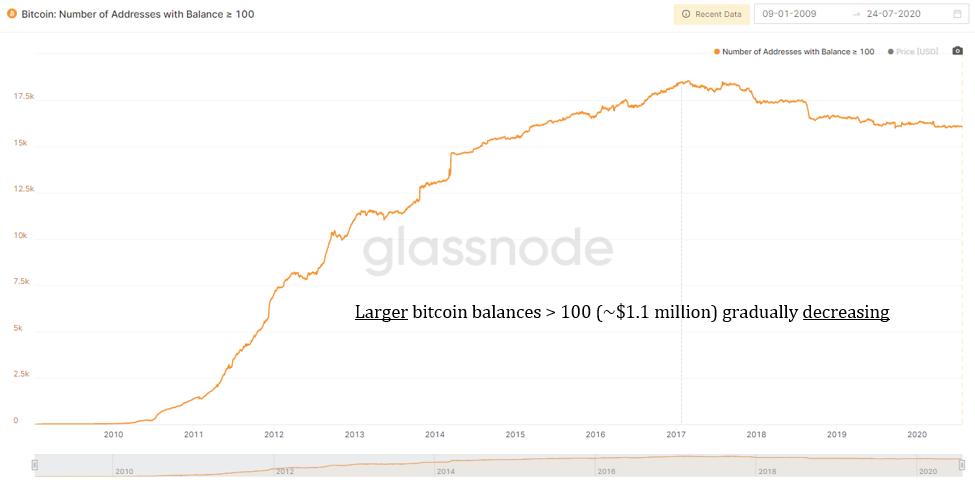

Centralized governance of the money supply allows the distribution to consolidate as new units of the currency are created and as imbalance is sustained; whereas, a decentralized governance model enforcing a fixed supply ensures that the distribution of the currency becomes greater and greater over time. The structure of the currency dictates the opposite effect, and the trend can be seen in actual data. Bitcoin held in smaller denominations continues to grow steadily, while bitcoin held in larger denominations continues to decline. As the currency and economic system grows, the currency becomes more widely distributed. Rather than consolidate, the currency distributes to more people, and the nominal amount held by each declines, while purchasing power increases. As more people demand the currency, its value rises. However, there is a terminally fixed supply. As increases in demand naturally outpace ever diminishing increases in supply, there is one principal way to acquire bitcoin: by delivering value to an existing holder of the currency. The currency transfers from relatively few early holders to a more widely distributed base as a function of time. Everyone wins; the network utility increases as more participants voluntarily opt in and the distribution of the currency becomes less and less concentrated, ensuring greater balance and reducing systemic risks created by the existence of a few extremely large holders.

When the incentives of a monetary medium align both individual and aggregate interests, non-zero sum outcomes become the default, as does balance. Bitcoin is accessible to anyone, and everyone that chooses to use it is afforded the same protections. Anyone that produces value and exchanges it for bitcoin is assured that their output will not be devalued in the future merely as a function of someone in a far-off land creating new units of money. Separately, everyone is assured the benefit of undistorted price signals. In bitcoin, rich and poor are provided these same protections equally. It is no guarantee that someone else will value the currency more or less, but it eliminates the possibility of an involuntary forced devaluation of labor and output stored in a monetary medium, which distorts economic activity and creates false price signals. When presented with that opportunity relative to a certainty of the worse outcome, it becomes a clear choice. Compared to the current economic structure in which the wealthiest better understand the effects of active monetary debasement and are best equipped to combat and exploit it, there is a reality that those on the lower end of the economic spectrum have more to gain by leveling the playing field. Even still, it is not about rich and poor. Everyone benefits from the elimination of money production and an economy that provides greater balance through the communication of more perfect information.

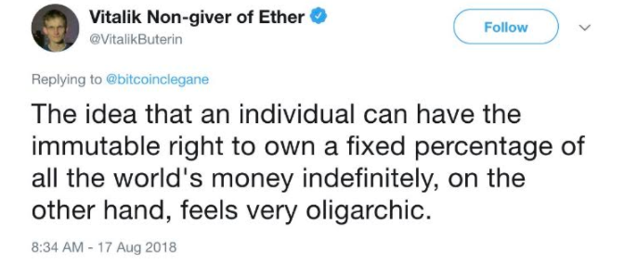

In a tweet from 2018, the founder of Ethereum (Vitalik Buterin) beautifully and ironically described the power of holding a currency with a fixed supply that could not be manipulated, while actually arguing for the opposite. He both made the precise argument which central bankers use to defend their actions while also articulating the power it would place in the holder of a currency with a fixed supply. While Buterin believes it to be oligarchic to have the immutable right to own a fixed percentage of all the world’s money indefinitely, what if that right were extended to the poorest people on earth? What if it were applied equally to every single person on earth? That is the power of bitcoin. If you are living in one of the poorest countries in the western hemisphere, such as Nicaragua, and choose to exchange your value for bitcoin, you now have an immutable right to own a fixed percentage of all the world’s money indefinitely. Only you can decide when, how and to whom to transfer that for value received in the future. The poorest in Nicaragua suddenly are elevated to the exact same leveled playing field as a billionaire in New York like Paul Tudor Jones. Within the bitcoin network, there is no distinction. Equal rights are the default. That cannot and does not exist in the legacy financial system. It is infinitely more oligarchic to indiscriminately devalue someone’s monetary savings by increasing the supply of money while at the same time determining to whom that new money should be “rewarded.” There can be no comparison between that world and allowing those that earn money honestly by producing value for others to determine how best to allocate it for value returned in the future.

The idea that bitcoin could solve problems today for rich and poor alike stumps quite a few. Most consider bitcoin to be a speculative asset, and many will look at its volatility and believe it unfit for people without a level of savings that one could afford to lose. That view is fortunately flat wrong and economically unsupported. It is easy to look at an economic disaster like Venezuela, where the vast majority of people are struggling to have very basic needs fulfilled, and believe reliable access to food, water, power and healthcare is more important than “buying” bitcoin. However, it is harder to ignore that the economic collapse was caused by a deterioration in the money that previously coordinated economic activity and that the only long-term solution to build it back up is to use a form of money that better fulfills that coordination function. Reliable access to food, water, power and healthcare doesn’t exist without the use of money to coordinate resources. In rebuilding an economy on top of a new monetary medium, someone has to go first, and just because it is hard to imagine, it does not change the reality that it’s the only way out. One action triggers another. And another and another. Whether it’s Venezuela, any other country suffering from rapid economic deterioration, or any poverty-stricken area in the developed world, the need for assistance is immediate, but there is no quick fix. Bitcoin can’t remove a socialist dictator, it can’t take the kleptocrats out of the kleptocracy, it can’t reverse damaging tax policy or social programs, and it can’t magically turn poor people into rich people or vice versa. It can, however, solve problems today for anyone that is determined enough to use it, regardless of poverty level or economic status.

There is no reason why a superior form of money would perform one function for some and not for others, regardless of wealth, income levels or any other reason. It is a vicious cycle to break, but the inception point of elevating any individual or society is finding a way to produce more value than is consumed or demanded of others. The best way to accomplish that goal is by using money to exchange value and coordinate economic activity. Bitcoin isn’t just a rich person tool that will become serviceable to poor people once enough rich people have it. That is nonsensical. It is the opposite; it is the best way anyone can level the playing field, regardless of whether the path may be harder for some than others. The demand for money is near universal, and over time, anyone using the form of money with the strongest foundation and the most true price signals will benefit. Whereas the dollar (and other fiat currencies) are one for a few in the short-term and all for none in the long-term, bitcoin is one for all, now and in the future, because it fixes the economic foundation for everyone.

“Whether in Rome, Constantinople, Florence, or Venice, history shows that a sound monetary standard is a necessary prerequisite for human flourishing, without which society stands on the precipice of barbarism and destruction.”

Views presented are expressly my own and not those of Unchained Capital or my colleagues. Thanks to Phil Geiger, Will Cole and Robert Breedlove for reviewing and for providing valuable feedback.