Bitcoin Does Not Waste Energy

First published on Unchained Capital Blog

How many times have you heard the safety instructions before a standard commercial flight? You probably know them by heart, but every time, prior to takeoff, flight attendants instruct passengers traveling with children to put their oxygen mask on first and then tend to the children. Instinctively, it’s counterintuitive. Logically, it makes all the sense in the world. Make sure you can breathe, so that the child dependent on you can breathe too. The same principle applies to the coordination function of money in an economy and the resources required to protect that function. In a more philosophical safety warning, the flight attendant may say, “please make sure the money supply is secure so that we can continue to coordinate the activity of millions of people to build these hyper complex planes that afford you the opportunity to even contemplate the problem I’m about to explain.”

We will come back to this, but you will never hope to understand the justification for the amount of energy bitcoin consumes without first developing an appreciation for the fundamental role money plays in coordinating economic activity. What is money? How does it work? How should it work? What is its function in society? If you haven’t stopped to ask these questions, you can’t begin to grasp the weight of the problem bitcoin intends to solve. And without an appreciation for the problem, the cost to secure the solution will never seem justified.

Any number of concerned onlookers raise the red flag about the amount of energy consumed by the bitcoin network. This concern stems from the idea that the energy consumed by the bitcoin network could otherwise be utilized for more productive functions, or that it is just plain bad for the environment. Both ignore the fundamental magnitude of how critical bitcoin’s energy consumption actually is. In the long-game, there may be no greater, more important use of energy than that which is deployed to secure the integrity of a monetary network and constructively, in this case, the bitcoin network. But, that doesn’t stop those that do not understand the problem statement from raising concerns.

“In the context of climate change, raging wildfires, and record-breaking hurricanes, it’s worth asking ourselves hard questions about Bitcoin’s environmental impact.”

“The fundamentally wasteful nature of bitcoin mining means there’s no easy technological solution coming.”

Bitcoin Energy Consumption

For background, bitcoin is secured by a decentralized network of nodes (computers running the bitcoin protocol). Economic nodes within the network generate, validate and relay transactions as well as validate and relay bitcoin blocks (time sequenced groups of transactions). Mining nodes perform similar functions but also perform bitcoin’s proof of work function to generate, solve and transmit blocks to the rest of the network. By performing this work, miners validate history and provide a “clearing” function for current transactions, which all other nodes then check for validity. Think the clearing function of the New York Fed but on a completely decentralized basis every ten minutes (on average).

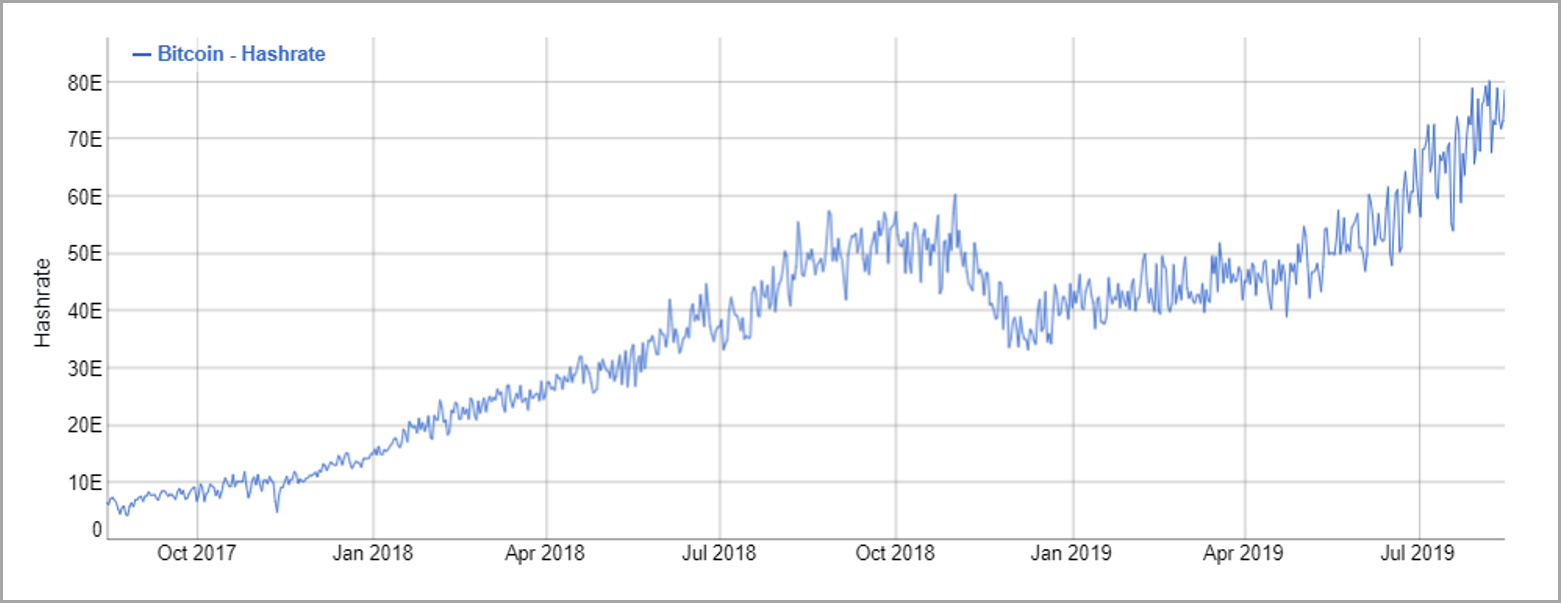

The work performed requires massive amounts of processing power contributed by miners all over the world, running 24 hours a day, 7 days a week. This processing power requires energy. For context, at 75 exahashes per second, the bitcoin network currently consumes approximately 7-8 gigawatts of power, which translates to ~9 million per day (or ~3.3 billion per year) of energy at a marginal cost of 5 cents per kWh (rough estimates). Based on national averages in the U.S., the bitcoin network consumes as much power as approximately 6 million homes. Yeah, it is definitely a lot of power, but it is also what secures and backs the bitcoin network.

How could this much energy be justified? And what will bitcoin consume when a billion people are using it? The dollar works just fine, right? Well that’s just the thing, it doesn’t. These resources are being devoted to fix a problem most don’t understand exists, which makes justifying a derivative cost challenging. To help ease the pain of environmentalists and social justice warriors, we often point out a number of countervailing narratives to make it seem more palatable:

- A significant portion of bitcoin’s energy consumption is generated from renewable resources.

- Bitcoin will spur innovation in the development of renewable energy technology & resources.

- Bitcoin consumes energy that is otherwise wasted, if not, flared into the a sphere.

- Bitcoin consumes only the energy that the free market will bear at a free market rate.

- Bitcoin consumes energy resources that would otherwise not be economic to develop.

- The nature of bitcoin energy demand will improve the efficiency of energy grids.

These considerations help enumerate why a simple view that bitcoin’s energy consumption is necessarily wasteful or necessarily bad for the environment fails the proverbial test. However, without an appreciation for the enormity of the monetary problem bitcoin intends to solve, the marginal cost could never be justified. Bitcoin represents a solution to the systemic issues that exist within our legacy monetary framework and it relies on energy consumption to function. Economic stability depends on the function of money and bitcoin provides a more sound monetary framework which is why there is no more important long-term use of energy than securing the bitcoin network. So rather than expand on the many individual counterpoints to the mainstream narrative, there is no better place to focus than the first principle problem itself: the money problem or the global QE (quantitative easing) problem, see here.

The Function of Money

The problem of money is enormous, though most people do not recognize it. Most can feel it in their daily lives but cannot identify the root cause. Working harder, longer hours, going into debt and still barely getting by. There has to be a better way, but in order to identify a solution, one has to first see and understand the problem. The problem that exists is with our money and the impact it has on society is pervasive.

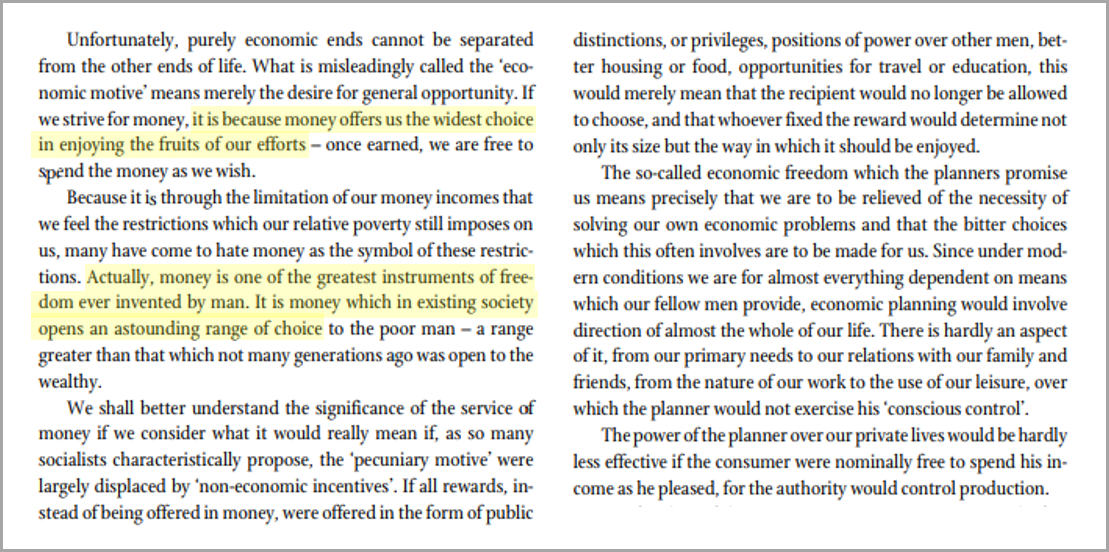

Without getting into the details of what money is (read The Bitcoin Standard or Nick Szabo’s “Shelling Out”), we can more easily describe its function in society. Money is the good that facilitates economic coordination between parties that otherwise would not have a basis to cooperate. Put simply, it is the good that allows society to function, and it allows us to accumulate the capital that makes our lives better, which takes different forms for different people. There is a saying that money is the root of all evil, but as Hayek more appropriately describes it in the Road to Serfdom, money is an agent of freedom.

“Money is one of the greatest instruments of freedom ever invented by man.”

More specifically, money is the good that allows for specialization and the division of labor. It allows individuals to pursue their own interests; it is how individuals communicate their preferences to the world, whether in work or in leisure, and it is what creates the “range of choice” we all take for granted. Our modern economy is built on the foundation of freedom that money provides, but the end result is a highly complex and specialized system.

To simplify the concept, Milton Friedman explains the complexity of a pencil (see here), detailing how no one individual is capable of producing a standard lead pencil. He details the wood required, the saw to cut the wood, the steel to make the saw, the iron ore to make the steel, the lead, the rubber for the eraser, the brass ring, the yellow paint, the glue, etc. He explains how making a single pencil requires the coordination and cooperation of thousands of people, including people who don’t speak the same language, who likely practice different religions and who may even hate each other if they were ever to meet in person. And he explains that the ability to cooperate is a function of the price system and the economic good we call money.

Abstracting from the pencil, now consider the complexity of our modern economy. From cars to airplanes to the internet to mobile phones, even to your local grocery store. Modern supply chains are so complex and so specialized that they require the coordination of millions of people to deliver any of these basic functions. The orchestration of all this activity which fuels global trade is only made possible by the function of money.

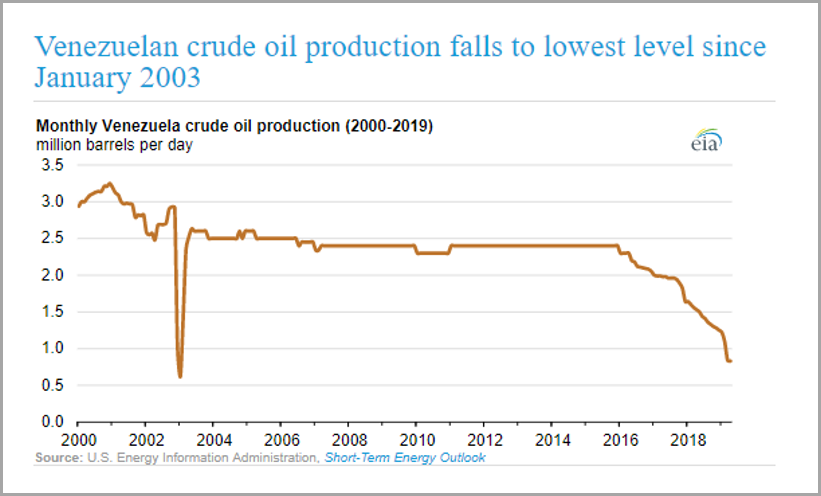

A Living Example: Venezuela

Venezuela provides a tangible macro and micro example of the vital role money plays in economic coordination and the dysfunction that follows when a monetary good fails. Venezuela is one of the most oil rich countries in the world, but as an end game function of monetary debasement, Venezuela’s currency has recently hyperinflated. As its currency has deteriorated, basic economic functions have broken down to the point where getting food at grocery stores or basic healthcare is no longer the baseline. It is a full-on humanitarian crisis, and at the root level, it is a function of Venezuela no longer having a stable currency to coordinate economic activity and to facilitate the production of the goods it needs to trade within the global economy.

How does this relate to bitcoin and energy consumption? Being an energy rich country, oil was (and is) Venezuela’s primary export; or rather, the good it needs to produce in order to trade. Despite being one of the most energy rich countries in the world, Venezuela’s oil production is plummeting.

Venezuela can no longer import the technology or coordinate the resources it needs to extract its primary trading currency (oil). This has caused significant deterioration in its local economy, impairing its ability to produce the electricity needed to power its own energy grids, causing extended blackouts and preventing the delivery of basic services such as power, clean water or healthcare.

What is occurring in Venezuela is devastating, and it is a function of the economic deterioration caused by hyperinflation. Monetary debasement distorts the price mechanism of a currency, which then creates economic imbalances. As economic coordination deteriorates, complex supply chains become disrupted resulting in a decline in the supply of real goods (e.g. food on shelves, oil production, etc.) and an imbalance between supply and demand. As more money is created, real goods become relatively scarce compared to the supply of money, which causes the very function of money to breakdown. Individuals have a disincentive to hold currency as real goods become more and more scarce, instead choosing to sell currency as quickly possible, creating a run on basic necessities and causing the currency to hyperinflate. Economic deterioration by monetary manipulation 101.

The Developed World Application

Now, many sitting comfortably in the developed world will look at Venezuela and think, “it could never happen here,” but that ignores all first principles. Whether it is well understood or not, the market structure of the Venezuelan bolivar or the Argentine peso is identical to that of the dollar, the euro or the yen. The Fed, the European Central Bank or the Bank of Japan may be better at managing stability (for now), but it does not change the fact that the underpinnings of all fiat currency systems are the same.

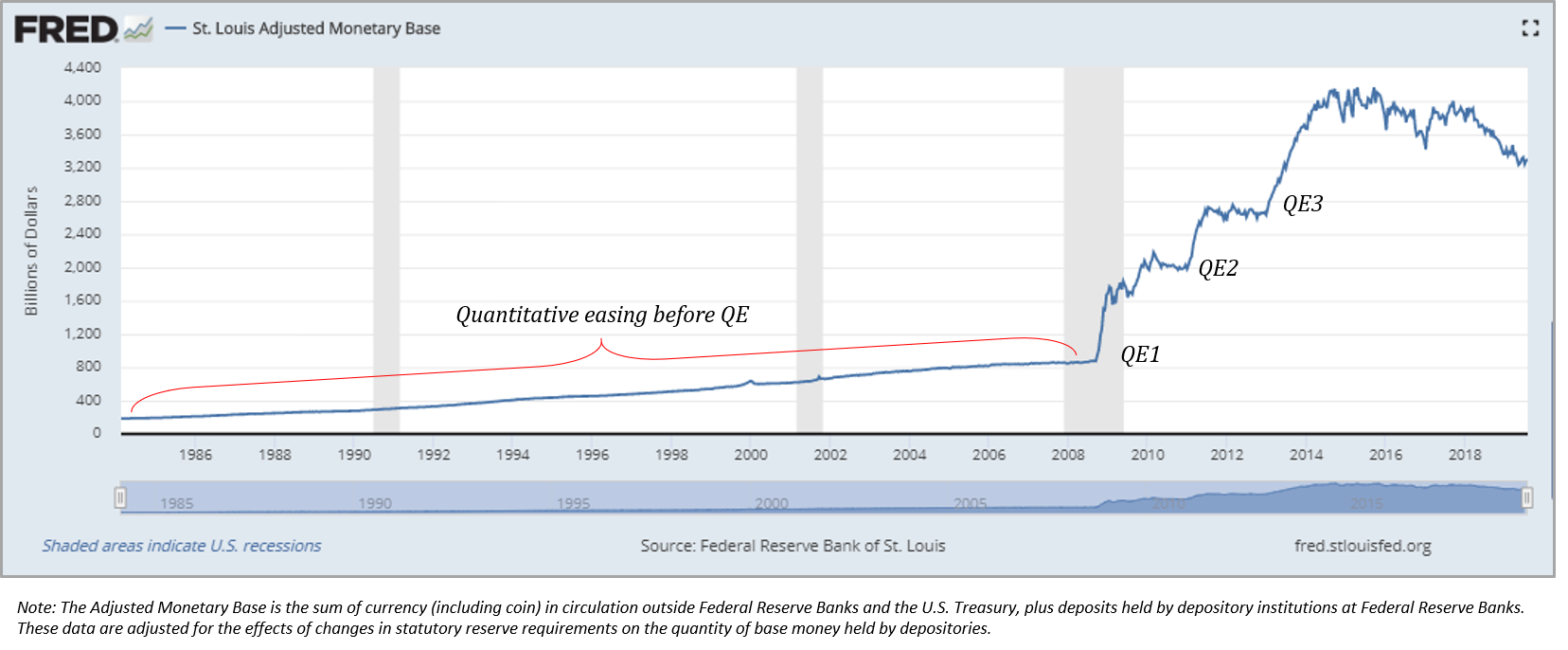

To highlight the U.S. as an example, the Federal Reserve expanded the monetary base from 180 billion in 1984 to a peak of 4.2 trillion following QE3, an increase of 23x. Because of the nature of the Fed’s credit-based economy, the economic distortion of this debasement occurred gradually (see here) until the financial crisis which occurred suddenly, and as a function of quantitative easing, we presently sit further out on the same ledge. If you believe the developed world is not in a precarious situation or not subject to a similar monetary foundation as Venezuela, I would respectfully point to patients zero: the Fed, the ECB and the Bank of Japan. Often, faith placed in these institutions is blind to both first principles and common sense, but consider the quote below from a resident Fed economist during the aftermath of the financial crisis and as the Fed was in the middle innings of creating $3.6 trillion new dollars as part of quantitative easing:

“Also, I want to just emphasize that I think the gaps in our understanding of the interactions between the financial sector and the real sector are profound”

An honest review of history demonstrates the ill-temperament of those put in charge of managing our economies from central command. While admitting profound gaps in their ability to understand the implications of actions taken on the real economy, the response was to continue down the same path (but in a bigger way) while expecting a different result, the definition of insanity. Now, as we face the consequences of the response to the crisis, we have a choice between two great contrasts. A) a centrally-planned form of currency that is designed to lose its value; or B) a decentralized currency with a fixed supply. The latter comes with cost in the form of energy consumption, but the positive externality will be long-term economic stability.

Economic Stability via Energy Consumption

Future economic stability is fundamentally why there can be no more important source of demand for the consumption of energy than the security of bitcoin’s monetary system, especially when the alternatives (fiat and gold) are structurally flawed. If we wait to see the signs of hyperinflation, we’re already lost. But Venezuela is not just an example of what transpires as a result of hyperinflation, it is a living example of the importance of energy production to the functioning of society. Some energy input is required for everything that we consume in our daily lives. The coordination of those energy inputs is dependent on the reliability and stability of the money we use.

Ignore your morning coffee for a minute and think basics: clean water, sanitation, food, medicine, basic healthcare, etc. The coordination of resources to deliver these basic services is dependent on a functioning monetary system. When a monetary system breaks down, social coordination and even the social fabric begins to go with it. If the basis of all trade is energy, and if we need money to coordinate trade, the highest and best use of that energy should first be to protect the monetary system. Put your proverbial “oxygen mask” on first and then shift to dependents. Secure the foundation of trade and then focus on all of the derivatives.

Any and all concerns about the amount of energy bitcoin consumes or will consume is a red-herring. It is not that we should sacrifice electricity that could otherwise power homes; instead, it’s that we will never have the electricity to power those homes if we do not have a reliable monetary system to coordinate economic activity and marshal resources. In practice, bitcoin will not practically compete for the same energy resources that fuel the basic productive and consumptive functions of our economy (not zero sum); instead, bitcoin’s function as a currency system will ensure that those very energy needs can continue to be fulfilled.

What would be bad for society is if more countries deteriorated into the economic and humanitarian disaster that is Venezuela, where basic health and human services cannot be reliably provided. And this is not to present a draconian vision or a dystopian future; instead, it is to articulate the importance and interconnectedness of both the money function and the energy function in complex, highly specialized economies.

“If it prevents one instance of hyperinflation such as Venezuela from happening […], bitcoin’s energy consumption would be the best bargain humanity ever got.”

Bitcoin represents a backup switch to the current architecture of the global financial system and is soon to be its primary engine. Setting aside the systemic risks that currently plague our financial system, bitcoin is a fundamentally more sound monetary system from the ground up. And, it is one secured by the production and consumption of energy. You do not have to believe that the dollar’s fate will be that of the Venezuelan bolivar to recognize the importance and interplay between the stability of a monetary function and the production of energy resources that provide basic economic necessities. And the risk inherent in even the possibility of hyperinflation is so negatively asymmetric that the price of bitcoin energy consumption is of small relative cost.

Bitcoin will consume any and all energy resources necessary to secure its monetary network, which is inherently driven by the base demand to hold it as a currency. The more people that value the long-term stability it provides, the more energy it will consume. In the end, this consumption will ensure all other derivatives of energy consumption will continue to be fulfilled, which is why there is no more important long-term use of energy than securing the bitcoin network. Put a price on economic stability and the economic freedom a stable monetary system provides; that is the true justification for the amount of energy bitcoin should and will consume. Everything else is a distraction.

Views are expressly my own and not those of Unchained Capital or my colleagues. Thanks for Will Cole and Phil Geiger for reviewing this version of Gradually, Then Suddenly and providing valuable feedback.