Introduction

Authored March 2023

Perfect Timing

On March 12, 2008, CNBC reporter David Faber asked Bear Stearns CEO Alan Schwartz to respond to reports that Goldman Sachs “would not accept the counterparty risk of Bear Stearns.” Within a few days, the collapse of the Wall Street investment bank was complete. The Federal Reserve and US Treasury Department stepped in to engineer a bailout, which ultimately came through an acquisition by J.P. Morgan. Bear Stearns was the first major domino to fall in the 2008 financial crisis, but the entire financial system was on the verge of collapse. Six months later, on September 15, 2008, Lehman Brothers filed for bankruptcy. This time there was no bailout. The bank runs were on in full force across Wall Street. Within a few weeks, President George W. Bush passed the Emergency Economic Stabilization Act, signed into law on October 3, 2008, approving a $700 billion package to bail out major US banks.

No one could have predicted what would happen next. On October 31, 2008, a shadowy super coder working under the pseudonym Satoshi Nakamoto sent an email to a cypherpunk mailing list, sharing a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” On January 3, 2009, bitcoin was officially launched, and the world would be changed forever. Satoshi mined the first bitcoin block inscribed with the text, “the Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” the front-page headline of the Times of London for that day—a timestamp with a message. Within less than a week, the code was publicly released. A day later, California software developer Hal Finney became the first known person to join the network, tweeting two simple words: “Running bitcoin.” The rest is actively becoming history.

Just as the financial system was on the brink of collapse, a new system was put forward that would fundamentally fix the root cause. At the time, I was working at Deutsche Bank, just down the road from the New York Fed, at 60 Wall Street. I had a front-row seat to the chaos that was the Global Financial Crisis. Admittedly, it was impossible to know what was really happening or why. Something was fundamentally broken, but beyond that, it was unclear what exactly had gone wrong. I had no knowledge of bitcoin’s release and would not become interested in it until 2016. During that time, I began to understand what had caused the financial crisis and what the implications would be going forward. In hindsight, it has become clear that bitcoin was purpose-built to fix what was broken—the money and the financial system built on top of it. The right place at precisely the right time.

The financial crisis was triggered by extreme levels of leverage, built up over decades. This leverage was both unnatural and unsustainable. It could not and would not have existed without the function of a central bank with the ability to create money. Moral hazard was everywhere, and everything broken in the financial system could be traced back to a central bank with the unilateral power to print money. The only logical solution to an economic system plagued by a form of money that can be easily printed is one built on a form of money that cannot. This is what bitcoin ultimately represents. A form of money that cannot be printed—at all or by anyone—and an entirely new economic system is being built on top of it. While the idea of a digital cash system had been around for decades, none had ever worked. A system built on trust was broken, and Satoshi put forward the idea of a system that eliminated centralized third parties from the issuance and settlement of money. Essentially, bitcoin could only work if it removed the need for trust entirely.

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

Ever since its release, bitcoin has been hiding in plain sight for all to see, yet it remains difficult to see. The same is true of the issues stemming from the legacy system. Every day, more people figure it out, but the overwhelming majority of individuals remain in the dark. Skepticism is logically high. Bitcoin is a better form of money that will replace all other currencies, including the US dollar? The idea sounds outrageous. Warren Buffett has referred to bitcoin as rat poison—or more specifically, rat poison squared. Charlie Munger, Buffett’s longtime partner at Berkshire Hathaway, has taken to the Wall Street Journal to deride bitcoin as an evil scourge, arguing it should be banned. Munger even praised the leader of the Chinese Communist Party for pursuing measures to make its use illegal. JP Morgan CEO Jamie Dimon has called bitcoin a fraud on multiple occasions. Many political leaders in the US, from sitting senators to congressmen, presidents, and cabinet members, have warned that bitcoin is a national security threat or otherwise dismissed it as nothing more than a pet rock.

Despite its critics, bitcoin exists and continues to operate fourteen years after its launch. Today, bitcoin has a purchasing power of approximately $480 billion, ranking it somewhere around the twenty-second largest currency system in the world. People may think of bitcoin as new, niche, or nascent, which is not inaccurate, but bitcoin is significant at the same time. It may be small relative to the legacy financial system, but it is also material in size. It has been in the wild for over a decade, processing transactions without fail and without anyone in control. And adoption continues to grow. Individual after individual who intentionally and consciously evaluates bitcoin consistently arrives at the conclusion that bitcoin is a superior form of money.

The question to ask yourself is why? No matter how confusing bitcoin may seem, it is upon each individual to explain the reality that exists in front of them. It does not matter if most people in the world do not understand bitcoin. Even if 999 out of 1,000 people cannot fathom or explain how bitcoin could be money, what explains the emergence of a consensus among millions of people that runs counter? Truth and objectivity exist in the world, and the only way to explain how millions of people have arrived at the consistent endpoint that bitcoin is money is through reason and logic. Either everyone is collectively hallucinating, or an objective truth exists that allows each to come to the same answer. One or the other.

In the 1841 book Extraordinary Popular Delusions and the Madness of Crowds, Charles Mackay wrote about the Dutch tulip bubble, an episode in history to which bitcoin is often compared, as a hallmark example of mass delusion. Rare tulips traded at ever more extreme prices, reaching multiples of the average person’s salary, followed by a crash back to reality as the speculative craze subsided. Speculative asset bubbles can and do exist. Markets can also persist in irrational states for extended periods. While the tulip bubble lasted only three years, bitcoin remains either a popular delusion or the output of rational thought. It cannot be both.

This book is intended to help readers establish a rational and logical framework from which to understand bitcoin as money—to see what is otherwise difficult to see. The only way for anyone to consistently arrive at the same conclusion about anything—let alone bitcoin—is through reason and logic. When evaluating bitcoin, this is also the best way to determine whether everyone else is crazy. If you cannot arrive at the conclusion that bitcoin is money through reason and logic, then it is more likely just a popular delusion. However, the reverse is also true.

Bitcoin Is Money—My Journey, Reason, and Logic

Bitcoin is money. Or rather, bitcoin has become money to me. It was a slow process and one that required me to break through a number of mental blocks along the way. But it all began with asking the question: what is money? That is the beginning of the real rabbit hole. At the root level, it is an attempt to answer the question, why is the dollar in my pocket money? Why do hundreds of millions of people exchange their hard-earned, real-world value every day for a piece of paper (or digital deposit)? These are difficult questions to ask and even harder ones to answer. I realized that everyone has to approach it in their own way, on their own timeline, and guided by their own life experiences. But people must first be interested in that question—what is money—to begin to understand bitcoin.

For me, the path involved first understanding why gold had emerged as money over thousands of years. What properties made one form of money better or worse than another, and what differentiated money as a unique economic good when compared to all other economic goods? _The Bitcoin Standard _(2018) by Saifedean Ammous was a formative resource for me in exploring these questions. When I applied the core principles to my own life experiences and separately to my understanding of the legacy financial system, bitcoin started to become intuitive. As part of my process, I found it helpful to consider bitcoin relative to two tangible guideposts: gold and the dollar. Does Bitcoin share the properties of either gold or the dollar? Is bitcoin better than either or both? Because what makes something money is not absolute. Money is an A/B test. It is a choice between storing value in one medium rather than another, which always involves trade-offs. Without first understanding the flaws of the legacy financial system and the currencies native to it (be it the dollar, euro, yen, pound, bolivar, peso, lira, etc.), I could never have arrived at the idea of bitcoin being money in a vacuum.

Source: Yahoo Finance

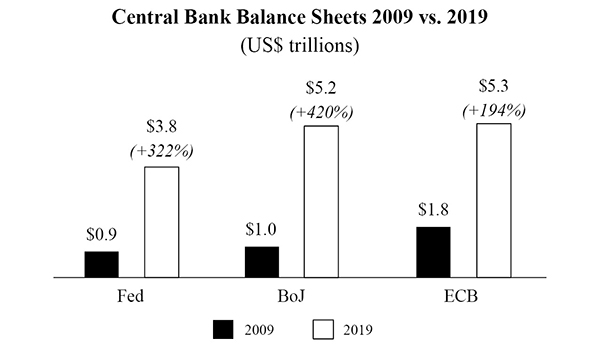

In 2016, the Federal Reserve had signaled plans to remove liquidity it had injected into the financial system in the years following the Great Financial Crisis—approximately $3.6 trillion from 2009 to 2014, increasing the money supply fivefold. At the time, I was trying to understand the impact this would have on financial markets, and to do so, I needed a better understanding of why the Fed had taken these emergency measures in the first place. My research led to the realization that, prior to the crisis, the financial system had been leveraged 150 to 1, the ratio of total debt in the US credit system to dollars available to banks. There was too much debt and too few dollars. The liquidity provided by the Fed, often referred to as quantitative easing (QE), was designed to prevent the collapse of the credit system. However, it became apparent that QE not only prevented deleveraging but also caused an unsustainable credit system to metastasize. I came to the conclusion that the Fed was always going to have to print more money, in massive quantities, functionally without end. QE led to more QE. I recognized that this was a problem because it would eventually lead to a complete failure of the currency.

On one hand, the Fed was going to have to print a lot more dollars, and on the other, I began to form a perspective as to why bitcoin had fundamental value, which was directly related to the problem of printing money. In the simplest terms, bitcoin derives value from the fact that it has a fixed supply. It represents a form of money that cannot be printed. There will only ever be 21 million bitcoin. As I developed a deeper knowledge of how bitcoin credibly enforced its fixed supply, I came to the principal conclusion that bitcoin was the solution to the dollar—and more generally, to the problem of printing money. My thought process followed simple logic: if bitcoin credibly enforces its fixed supply of 21 million, then it will emerge as the global reserve currency and will replace the dollar entirely. I also connected that the logic was binary. If bitcoin could not enforce its fixed supply, then it would not emerge as money. It would not be a global reserve currency, and it would not replace the dollar. Everything hinged on whether or not bitcoin could credibly enforce its fixed supply. Understanding how and why this is possible is the basis of understanding bitcoin as money.

There are two economic principles (or assumptions) that connect the dots between the importance of a fixed supply and global adoption of bitcoin as money, both of which will be explored in detail in the chapters to come. First, scarcity in supply is key to a currency’s ability to store value over time, and second, economic systems converge on one form of money. If both are true, the world will converge on the scarcest form of money for the reason that it will store value better than any other form of money. Economic systems converge on a single form of money due to the nature of trade—the intersubjective problem money helps to solve. At the most basic level, I must have the form of money you are willing to accept in order for us to trade or exchange value. It is not a coincidence that local economies overwhelmingly facilitate trade in one common currency because the identical problem extends out to every person in the economy. It is also not by random chance that one form of money emerges over another. There is rhyme and reason. The form of money that is hardest to produce wins, provided it is widely accessible and capable of facilitating exchange. Bitcoin is global, permissionless, and finitely scarce, and it can be transacted over a communication channel. It is outcompeting all other currencies, including the US dollar, based on the credibility of these properties in aggregate.

In the essays that follow, I lay out the logical case for readers to further connect these dots. Or rather, I will provide my logic and the framework that allowed me to consistently arrive at the most fundamental conclusions about bitcoin. Understanding why bitcoin’s fixed supply is relevant is just as important as understanding how it is credibly enforced. By the end, you will have a framework with which to form your own conclusions about a number of key questions surrounding bitcoin. Is bitcoin money? If bitcoin can credibly enforce its fixed supply, will it emerge as the global reserve currency? Can bitcoin credibly enforce its fixed supply?

Historical Context

This book is a collection of essays originally published from July 2019 to December 2020. I titled the series Gradually, Then Suddenly, which is a common adaptation of how Hemingway described the process of going bankrupt. It’s also the way that government-backed currencies hyperinflate, and often how people come to understand bitcoin (gradually, then suddenly). I wrote the essays as standalone pieces, on a specific subject or concept, with the idea that anyone could read a single essay without needing any prior knowledge of the others or bitcoin. I have packaged the essays in this book in a more linear order to create a roadmap for the reader, but I have also preserved the original idea of the series. Each essay is designed to be read as a standalone, and collectively, the essays provide a comprehensive framework for understanding bitcoin. In order to explain certain concepts, there is some built-in redundancy but only to the extent necessary to help the reader establish a grounding to think about a particular principle or question.

I have preserved the essays in as close a form and substance to the originals as possible for intentional reasons. While I have edited the essays for copy, readability and to better knit them together (or eliminate unnecessary redundancy), the historical context of when the pieces were written was and remains relevant. Historical narratives often shift to adapt to inconvenient facts, which turn out to be inconsistent with original arguments. I was sensitive to this and did not want the reader to be left wondering whether the narrative of a particular essay shifted based on a changing set of facts. For people who have read these essays and might want to pass the book along to family and friends, I also wanted to provide an assurance that the form of essays included herein are holistically consistent with, and substantively the same as, the originals.

When I was researching the issues related to the Federal Reserve and the US dollar system in 2016, I went back and read Fed meeting transcripts from the period during and following the Great Financial Crisis. Federal Reserve transcripts are released five years after the actual meetings take place and provide a verbatim record of the discussions that occurred. I found the exercise to be particularly valuable because it provided a unique historical context and objectivity for the reader. It was like reading a story where the main characters did not know the ending, but the reader did. People can debate the benefits or detriments of the Fed printing money, but the Fed meeting transcripts provide a historical account that is not editorialized or altered. When I read the transcripts, I had the benefit of knowing what actually happened with a minimum of five years having passed. The preservation of a historical record provided a baseline to objectively evaluate how accurate the experts were and whether the experts were really experts at all. The passage of time was also critical to the evaluation.

This is the spirit with which I have packaged the Gradually, Then Suddenly series of essays here. To provide historical context to the reader, I have included the original publication dates. In substance, the essays have not changed, and the original form of each essay is also preserved online under the same titles as a source of truth and comparison. As such, anyone reading these essays for the first time has the benefit of time and more knowledge of world events than I had when originally writing. For example, the Fed began printing money once again in September 2019 and proceeded to print (or digitally create) nearly $5 trillion new dollars from 2019 to 2021. In the months leading up and without the knowledge that this would occur, when it would occur, or the extent to which it would, I wrote essays in which I explained principles as to why the Fed would need to print more money. I also wrote several essays in the midst of the then-latest money-printing epoch, describing the consequences and contrast to bitcoin. In short, the historical context is relevant.

By preserving the historical record, I believe the reader will be in the best position to evaluate the arguments, through reason and logic, and to ultimately judge for themselves—in a way that would not be possible without the passage of time since original authorship. It is an exercise of using the past to inform and evaluate what is expected to occur in the future, with logical explanations as to why. Each essay is also principles-based and as such, is just as timely today as when first authored and published. Ultimately, there was nothing to lose and much to gain by preserving the historical record and substance of the original versions.

Content Roadmap

The essays have been organized in three sections: The Fundamentals, Common Misconceptions, and Bitcoin vs. the Dollar.

Focus on the fundamentals, first and foremost. Of all the sections, I would recommend reading the essays in the Fundamentals section in the order presented. While each can be read as a standalone without prior knowledge of the others, there is a logical progression of principles from essay to essay. The Fundamentals covers high-level ideas to help readers establish a bottom-up understanding of bitcoin—defining the core properties that allow money to functionally coordinate trade, explaining how these properties exist in bitcoin, and discussing how the financial system will change as a result of global bitcoin adoption. This section also demystifies what a blockchain is, why a blockchain is only viable in the application of money, and consequently, why only bitcoin’s blockchain is relevant or valuable. Certain essays describe how bitcoin works at a technical level to ground the reader in a fundamental concept. However, each is written in such a way to be accessible to non-technical readers. This section collectively answers the fundamental questions regarding what money is, why economic systems naturally converge on one form of money, how bitcoin secures its fixed supply, why bitcoin’s fixed supply is so relevant to adoption, and why the entire world is converging on bitcoin as money.

While you are reading about the fundamentals, many questions will naturally and logically arise, particularly those that stand in opposition to the ideas presented. As questions come up, I would recommend referencing the Table of Contents to address each question as it arrives, even if it means pausing and not completing a particular essay. Understanding bitcoin is as much an exercise of removing mental blocks as it is building a foundation. Everyone needs some grounding in the fundamentals to objectively and independently consider the common questions, misconceptions, or criticisms. But working through each common criticism of bitcoin is a necessary step in establishing a better grounding in fundamental concepts. The Common Misconceptions section should address just about any question or concern that logically arises, but each is also tied back to a fundamental concept.

For example, “Bitcoin Obsoletes All Other Money” is the most bottom-up of all the essays. As you read about the basic building blocks explaining why the entire world will adopt bitcoin as money, you may find yourself thinking, but bitcoin is too volatile to be money. Whereas the fundamental essay is focused on the inputs that create demand, “Bitcoin Is Not Too Volatile” is structured to help the reader think through the specific concept of volatility and why volatility does not prevent bitcoin adoption. Separately, in “Bitcoin, Not Blockchain,” I explain why a blockchain is only valuable or viable in the application of money and that economic systems converge on a single form of money. I also explain that bitcoin requires a significant amount of energy resources, by design, to secure the network. This often raises questions. If the entire world adopts bitcoin, how much energy will bitcoin consume? Is that sustainable? In “Bitcoin Does Not Waste Energy,” I lay out a framework to think about the energy resources that bitcoin demands and why this is not only sustainable but also critical to society beyond bitcoin as an application.

Naturally, the same consistent questions come up for people who are seeking to understand bitcoin on a deeper level. While it’s impossible to know which will come up for each individual and in what order, the same questions arise because they are logical to ask—but every question has an answer. Or rather, a framework to ground the reader back in the fundamentals through reason and logic. While the Common Misconceptions section is ordered in the most logical progression, there really is no way to predict which will come to the reader or when. Most importantly, recognize that everyone who has begun to understand bitcoin as money has had to cross the same bridge before you. Everyone has had to struggle through the same challenging questions. That is how bitcoin becomes intuitive. Building block by building block. One step at a time and one question at a time.

One of the most significant questions relates to problems inherent in the legacy financial system, which is why an entire section is devoted to Bitcoin vs. the Dollar. While most people do not understand that a problem even exists, some may sense that something is fundamentally broken, but not specifically what. Others may understand that creating money out of thin air does not make sense, without recognizing the critical nature of the problem or that bitcoin is a solution. While much of my writing is focused on comparisons between bitcoin and the dollar, and geared toward a US audience, it applies broadly to currencies worldwide. On my own journey, understanding that the dollar was irreparably broken, independent of bitcoin, allowed me to recognize that I personally needed a solution. That same problem applies globally, to each individual, to each community, to each company, to each country, and especially to the US. Not everyone will need the same grounding in the issues of the legacy system to understand why bitcoin is a superior form of money, but for most, this is a critical anchoring point.

While I weave in elements of the issues inherent to the dollar (and the legacy system) throughout many of the essays, the section on Bitcoin vs. the Dollar delves deepest into the fundamental problems of printing money. I wrote the first of these essays just weeks before the Fed unexpectedly began its 2019–2021 mass-scale money-creation epoch. In the essay, I explained that “future QE is not merely a possibility; it is a certainty. Future QE from the Fed, and central banks all over the world, is a ‘when’ not ‘if’ question.” The remaining essays were written over the following twelve months, a period during which the Fed created over $3 trillion in new base money. I discuss the reasons why this occurs, why it will always persist, what the consequences are, and most importantly, why it is a problem that must be fixed. For those who already accept that printing money is a problem that needs solving, this section will only be valuable if you want to understand the issues at a deeper level, and it will be less critical to understanding the fundamentals of bitcoin as money.

In all cases, anyone who adopts bitcoin as money will still need to navigate the chaos created by the Fed and its monetary policy, which functionally affects the entire world. There is no avoiding the fallout, and Fed actions will continue to impact all aspects of the economy, including bitcoin, for the foreseeable future—which is why this section is highly relevant beyond bitcoin. The Fundamentals and Common Misconceptions sections are most important to building a bottom-up framework for understanding bitcoin, but bitcoin also cannot be understood in a vacuum. As such, I would recommend consuming the essays from this section either as supplementary resources or to the extent that questions about the dollar rise to the forefront for you.

Goals for the Reader

Bitcoin is hard to see but impossible to unsee once the picture comes into focus. At the start, it is the furthest thing from intuitive. But then something will click for you. Some idea will land that allows bitcoin to become possible in your mind. It starts with a maybe. Maybe these people aren’t all crazy. Maybe bitcoin is money or can be money. Not in the sense that there is a low-probability chance—one that you cannot explain. But instead, in a logical way that allows you to actually see the path and explain to yourself why it may be possible.

Some people look at bitcoin and see it as the solution to money. Others think it’s a delusion. Someone is right. It is either nothing or a masterpiece. By building a framework to think about bitcoin as money through logic and reason, an individual will typically connect with a particular principle or life experience that triggers an idea, like a flash in the brain connecting many dots simultaneously. It may be fleeting, but that moment is the most critical point on your journey. It is when you really see bitcoin for the first time. I describe it as a silhouette emerging from the fog. At first, you can see an outline, but the picture is not yet in focus. Also, it was just an idea that opened up the possibility in your mind. The proof is being able to consistently get back to that same idea through reason and logic. That is the only way to test its objectivity and truth. If you cannot return to the same conclusion consistently, it is likely not an objective truth.

Many questions will remain, but from the point of maybe, bitcoin will start to become intuitive and then over time, it will become hyper-intuitive. My goal is to get you to the point where bitcoin starts to become intuitive as money, which depends on your ability to consistently arrive back at that conclusion. This book will lay the foundation to open up the possibility in your mind and reinforce it with logically ordered frameworks to understand the most fundamental questions about bitcoin, allowing you to be in a credible position to test each using your own reason and logic. Gradually, Then Suddenly is just a roadmap. By providing my reason and logic, I hope to accelerate the path of others, but importantly, my goal is not to convince. If you approach each essay as a construction of logical arguments and then challenge the validity of the components, that is the path to forming your own conclusions without relying on the opinions of others.

Over time, as questions arise, you will not need to reference any book but instead will reason through the questions with your own mental framework. There are no guarantees in life, but I expect you will come to the same conclusion that I did—that bitcoin obsoletes all other money. At the very least, you will have the benefit of a perspective that one would need to accept in order to come to similar conclusions. Understanding bitcoin is a personal journey. I have provided my explanation in the pages to follow. Only you can inform yours.

Synopses of Individual Essays

Part I – The Fundamentals

Bitcoin Obsoletes All Other Money | First Principles of Money

The hardest thing to understand about bitcoin starts with the question “what is money?” Money is not a collective hallucination nor a belief system. Money is a very basic necessity, which humans need to facilitate and scale trade. Economic systems converge on a single form of money due to the intersubjective problem of trade, and convergence on a particular medium is dictated by objective reasons and properties. The world is converging on bitcoin as money because it is finitely scarce, it is capable of being divided and aggregated into small and large units, and it is capable of being transferred over a communication channel. In the competition of money, everything is always relative (A vs. B), and there is no second best. If money converges to one and bitcoin is finitely scarce, practically everyone in the world will adopt it as money.

Bitcoin, Not Blockchain | A Foundation to Eliminate the Noise

Many people have been sold a bill of goods that blockchain is a technology—believing blockchain to be more relevant than bitcoin. This essay debunks that. The concept of a blockchain was one piece of a larger puzzle specifically introduced in bitcoin for the purpose of ordering and validating financial transactions without the need to trust a third party. This piece explains why a blockchain is only viable in the application of money and because money converges to one, why only one blockchain is viable. There is no utility in a blockchain beyond its function in bitcoin for very fundamental reasons, and humans only need one form of money. Grasping the fundamental concept of what a “blockchain” is and why it is relevant to bitcoin is the starting point to drowning out the noise, when considered in the broader context of money.

Bitcoin Is Not Backed by Nothing | What Secures Bitcoin’s Fixed Supply

But bitcoin isn’t backed by anything while the dollar is backed by the full faith and credit of the US government, right? Wrong. Every fiat currency that has ever failed and hyperinflated has been controlled by a government, with both the ability to tax and a military. The dollar’s origin as money began as a paper note convertible to physical gold. The dollar has no inherent monetary properties, and the same properties that allowed gold to emerge as money both exist in, and have been perfected through, bitcoin. The most important of these properties is scarcity. Bitcoin is finite in supply, and there are three primary pillars that secure bitcoin’s fixed supply: mining, nodes, and private keys. How these work independently and together is critical to an understanding of the credibility of bitcoin’s fixed supply and its position relative to the dollar.

Bitcoin Is Antifragile | Gaining Strength through Adversity

Bitcoin is often perceived as fragile or lacking permanence. However, rather than simply being resilient, antifragile systems become stronger when exposed to volatility, stressors, and error. The dollar becomes weaker when exposed to stress and volatility. Bitcoin is the opposite. The market constantly learns through trial and error. Moral hazard is eliminated and the cost of individual errors can never be socialized. Individual participants either adapt or die, but as a system, bitcoin gains strength in the face of adversity because it is decentralized at every layer and there are no single points of failure. As threats are immunized, the system becomes even more resistant to future attack. The antifragile nature of bitcoin ensures its permanence and serves as an important baseline to evaluate bitcoin’s viability as money over the long term.

Bitcoin Is the Great Definancialization | Implications and Consequences

Modern money is engineered by central banks to lose value, and economies all over the world have become increasingly financialized as a direct result. Rather than simply being able to save, individuals are forced to put savings at constant risk through investments in financial assets in an attempt to offset or outpace inflation. What people really need is just a better form of money that will preserve value into the future. As knowledge distributes, individuals will increasingly opt for the simplicity of bitcoin as a saving mechanism over the complexity and risk of financial investing. The economy will definancialize through this process. More people will have savings, and greater economic stability will follow. There is a paradigm shift underway, and the only way to understand or explain the implications is through the incentives of money.

Part II – Common Misconceptions

Bitcoin Cannot Be Copied | Finite Scarcity Only Happens Once

When people begin to understand the significance of bitcoin’s fixed supply, the question often arises, “why can’t it just be copied?” Or improved and outcompeted. Bitcoin has been functionally copied thousands of times, but none has ever come close to outcompeting it. Why? And will that ever change? The answer is anchored to the fundamentals of money. Money converges to one common medium due to the intersubjective nature of trade. Everyone is incentivized to adopt the best form of money, and in the end, that is the one that is hardest to produce. Scarcity is the foundation and bitcoin is finitely scarce. If bitcoin does have a credibly fixed supply and if money converges to one, it can never be copied and outcompeted for the reason that it already exists and can be adopted by anyone over inferior forms of money.

Bitcoin Is Not Too Volatile | Volatility Does Not Prevent Adoption

Bitcoin is volatile and that seems to fundamentally contradict common notions of money. The fact that bitcoin is volatile should prevent it from being money for the very reason that it is volatile, right? Bitcoin has existed for over fourteen years and adoption continues to grow. The better question is “why does volatility not prevent adoption of bitcoin as money?” Bitcoin has proven to be an exceptional store of value over time, which is fundamental to the function of money. While modern money is less volatile day to day, it loses value over time. Bitcoin may be volatile day to day, but it stores value over time. And its present volatility is also muted by exposure to other assets (i.e., diversification). Stability in bitcoin will emerge as a function of mass adoption, and the properties that allow bitcoin to store value over time—namely its fixed supply—drives adoption.

Bitcoin Does Not Waste Energy | Scarcity Requires Real-World Cost

All value in bitcoin is derived from the fact that there will only ever be 21 million. The foundation of bitcoin’s value proposition as money does not happen by magic either. Instead, its fixed supply is secured by real-world energy resources. Anyone who does not understand why bitcoin is valuable could never justify the cost and reasonably might believe its energy use is wasteful. However, money coordinates all other economic activity, including the fulfillment of energy. Without money and energy, reliable access to power, water, food, healthcare and other daily essentials would not be possible. Everything of value comes with a cost, and there is no more important use for energy than securing the bitcoin network because it provides a sound form of money for the entire world to use, which will ultimately ensure all other demand for energy can be fulfilled via trade.

Bitcoin Is Not Too Slow | A Fixed Supply Is the Zero to One Innovation

The criticism that bitcoin is too slow typically comes from people trying to create a copy of bitcoin, who are really just searching for an excuse to print their own money. Its origin stems from the fact that bitcoin has a limited transaction capacity and transactions (technically blocks) are processed for final settlement on average every ten minutes. In reality, bitcoin’s 0 to 1 innovation is finite scarcity—a fixed supply. A final settlement layer with a limited capacity combined with ten-minute block intervals are both part and parcel to the intricate puzzle that allows bitcoin to enforce its fixed supply. How bitcoin increases transaction volume and speed is a 1 to n problem of scaling globally, and infrastructure is actively being developed to do just that. If human ingenuity could solve for finite scarcity, every other problem is pedestrian.

Bitcoin Is Not for Criminals | Censorship Resistance Is All or Nothing

For people who cannot gather why anyone would use bitcoin, the logical explanation becomes that it must be for some criminal or illicit purpose. If not, why else? Without doubt, bitcoin is inevitably used by criminals today. However, if bitcoin works for criminals, it would just establish that bitcoin is functional as money for the entire world. Bitcoin is viable as money because of its fixed supply, which is credibly enforced because bitcoin is decentralized and resistant to censorship. If it were possible to censor criminal activity or even a single transaction, it would establish that bitcoin is not sufficiently decentralized to be resistant to other forms of censorship, which would put everything at risk, including bitcoin’s fixed supply. For bitcoin to be functional as money at all, it must be functional for everyone.

Bitcoin Cannot Be Banned | A Currency System beyond Governments

The idea that bitcoin will be banned is one of the later stages of denial on the path to adoption. It implies bitcoin being so successful as money that it threatens the government’s monopoly on money. When that becomes apparent, then the government will ban it. Otherwise, there would be nothing to ban. Bitcoin is only viable as money because of its fixed supply, and if bitcoin can credibly enforce its fixed supply, it is path dependent on being resistant to all forms of censorship, including state attacks. China and India have both attempted to ban bitcoin, and it continues to function without interruption. Bitcoin exists beyond government, and the mechanisms that enforce its fixed supply also ensure that no government or group of state actors could prevent its use. Government attempts to ban bitcoin only cause broader adoption.

Bitcoin Is Not a Pyramid Scheme | Supply Constraints and Demand

A pyramid scheme is loosely defined as an investment fraud in which new-participant fees are used to pay money to existing participants for recruiting new members. With a pyramid scheme, there is always a company purporting to offer a good or service, but in reality, there is not actual demand for the service, and functionally, the supply is unlimited relative to its demand. Bitcoin is not a company. It does not have a CEO. It has no employees, and its supply is finitely scarce. No matter how many people adopt it, there will only ever be 21 million bitcoin. Bitcoin’s utility is as money. It has a market because it solves a problem inherent in modern money. Whereas in a pyramid scheme there is not real demand for the product, everyone in the world needs money, and bitcoin represents a form of money that cannot be printed by anyone.

Part III – Bitcoin vs. the Dollar

Bitcoin Fixes This | The Solution to Money Printing

There is a saying popular among bitcoiners that bitcoin fixes this, which is generally applied to just about anything in the world. Expanding wealth gaps, endless global war, a diabetes epidemic and virtually every other real-world problem. Money serves as the foundation of the economic system because money facilitates trade. If the monetary system is broken, it is logical that many derivative problems would be created downstream as a consequence. However, what bitcoin fixes at a first-order level is the money and the problem of printing money. The term “quantitative easing” is used in mainstream economic and finance circles quite a bit. Gradually, Then Suddenly references it frequently. But what is quantitative easing? It is the modern digital equivalent of money printing, and bitcoin eliminates the ability to print money entirely, forever and for everyone.

Bitcoin Is a Rally Cry | The Only Viable Path to Opt Out

The instability in the banking system that became evident during the 2008 financial crisis reappeared in 2019. In response, the Federal Reserve began introducing emergency liquidity to financial markets and reduced interest rates back to zero in an attempt to create stability. The efforts proved unsuccessful, and financial markets functionally collapsed in early 2020 as a dollar liquidity crisis developed rapidly. Not immune, bitcoin crashed by 50% in a single day, down to $4,000. To stem the crisis, the Fed announced plans to print an unlimited amount of money. Printing money never ends, and it is the definition of insanity. Despite its volatility, bitcoin is the solution to the dollar. The fragility and instability in the global economy is caused by central banks, and bitcoin is a rallying cry for anyone who wants to opt out of the madness.

Bitcoin Is Common Sense | Simplicity vs. Complexity

The Fed ultimately created $3 trillion dollars over the months following its announcement in March 2020 that it would launch an unlimited campaign to print money via quantitative easing. In Common Sense, a famous pamphlet published anonymously on January 10, 1776, at the beginning of the American Revolution, Thomas Paine explained that time makes more converts than reason. Bitcoin is often described as an IQ test, but it is really just a “common sense” test. Bitcoin can be as simple or complicated as you wish to make it. The Federal Reserve continues to print trillions upon trillions of dollars, and bitcoin cannot be printed at all. There will only ever be 21 million and at its highest level, the competition between these two forms of money comes down to supply. One is infinite and the other is finite. Bitcoin is common sense.

Bitcoin Is One for All | The Most Equitable System for Everyone

There is a growing consensus that massive and expanding wealth gaps are a problem. No one knows how to fix it, but politicians from all sides of the aisle continue to make promises, which can never be kept and rarely fail to sow further division. Thankfully, the problem is not political in nature. The unsustainable gaps in wealth are a function of a broken monetary system. Economic inequality itself is perfectly consistent with balance. However, the dollar system creates inequities that would otherwise not exist. By printing money, the Fed actively causes imbalances to be sustained and exacerbated. While many people believe bitcoin is not suitable for those on the lower end of the economic spectrum, it solves a problem for everyone regardless of wealth and will help restore balance. Bitcoin is one currency for all to use.

| Gradually, Then Suddenly Edition | Original Author Date | Dollars in Circulation | Dollar Price | |||

|---|---|---|---|---|---|---|

| Bitcoin | Oil | Gold | S&P 500 | |||

| Bitcoin Is Money | Jul 26, 2019 | $3.85tn | $9,870 | $56 | $1,418 | $3,026 |

| Bitcoin Cannot Be Copied | Aug 02, 2019 | $3.83tn | $10,518 | $56 | $1,446 | $2,932 |

| Bitcoin Is Not Too Volatile | Aug 09, 2019 | $3.83tn | $11,863 | $54 | $1,497 | $2,919 |

| Bitcoin Does Not Waste Energy | Aug 16, 2019 | $3.83tn | $10,374 | $55 | $1,513 | $2,889 |

| Bitcoin Is Not Too Slow | Aug 23, 2019 | $3.81tn | $10,408 | $54 | $1,527 | $2,847 |

| Bitcoin Fixes This | Aug 30, 2019 | $3.8tn | $9,598 | $55 | $1,519 | $2,878 |

| Bitcoin, Not Blockchain | Sep 06, 2019 | $3.81tn | $10,353 | $57 | $1,506 | $2,979 |

| Bitcoin Is Not Backed by Nothing | Sep 27, 2019 | $3.91tn | $8,252 | $56 | $1,499 | $2,961 |

| Bitcoin Is Not a Pyramid Scheme | Oct 18, 2019 | $4.01tn | $7,973 | $54 | $1,488 | $2,986 |

| Bitcoin Cannot Be Banned | Nov 08, 2019 | $4.09tn | $8,805 | $57 | $1,461 | $3,093 |

| Bitcoin Is Not for Criminals | Nov 29, 2019 | $4.10tn | $7,761 | $55 | $1,466 | $3,141 |

| Bitcoin Obsoletes All Other Money | Jan 24, 2020 | $4.19tn | $8,445 | $54 | $1,571 | $3,295 |

| Bitcoin Is a Rally Cry | Mar 26, 2020 | $5.03tn | $6,716 | $23 | $1,650 | $2,630 |

| Bitcoin Is Common Sense | May 01, 2020 | $6.71tn | $8,864 | $20 | $1,695 | $2,830 |

| Bitcoin Is Antifragile | Jun 12, 2020 | $7.22tn | $9,480 | $36 | $1,729 | $3,041 |

| Bitcoin Is One for All | Aug 27, 2020 | $7.04tn | $11,323 | $43 | $1,921 | $3,484 |

| Bitcoin Is the Great Definancialization | Dec 23, 2020 | $7.45tn | $23,241 | $48 | $1,875 | $3,690 |

| As of Publication | May 03, 2023 | $8.61tn | $28,954 | $68 | $2,014 | $4,091 |

-

Satoshi Nakamoto, “Bitcoin Open Source Implementation of P2P Currency,” P2P Foundation, forum post, 11 February 2009. ↩