Chapter Seven

Bitcoin Is Not Too Volatile

Originally published

on 9 August 2019

A Common Refrain

Has someone you respect ever told you that bitcoin doesn’t make sense and could never be money because it is volatile? The idea that something as volatile as bitcoin could be money seems entirely inconsistent. You may have agreed after witnessing the price of bitcoin rise exponentially only to subsequently crash. Perhaps you wrote it off, assuming bitcoin was dead since it was no longer in the public spotlight. But then a few years pass, and you wake up to find that bitcoin hasn’t died, and somehow, its value is even greater. Finally, you start to think maybe you were wrong.

The list of bitcoin skeptics is long and distinguished,[22] but the noise and natural skepticism also contribute directly to the antifragile nature of bitcoin. People who store wealth in bitcoin are forced to think through first principles to understand the characteristics of bitcoin that otherwise seem to contradict an establishment view of money, which ultimately hardens their understanding and conviction. Bitcoin volatility is one of these oft-criticized characteristics. A common refrain among skeptics, especially central bankers, is that bitcoin is too volatile to be a store of value, medium of exchange, or unit of account. Given its volatility, why would anyone use bitcoin as a savings mechanism? And how could bitcoin be effective as a transactional currency for payments if its value could suddenly drop tomorrow?

The principal use case for bitcoin today is not as a payments rail but instead as a store of value, and those storing wealth in bitcoin are typically not doing so for merely a day, a week, or even a year. Bitcoin is a long-term savings mechanism, and stability in the value of bitcoin will emerge over time as a function of mass adoption. In the interim, volatility is the natural result of price discovery as bitcoin advances down the path of its monetization event and toward full adoption. Separately, bitcoin does not exist in a vacuum. Most individuals or businesses are not singularly exposed to bitcoin, and exposure to multiple assets, as in any portfolio, mutes the volatility of any single asset.

Not Volatile ≠ Store of Value

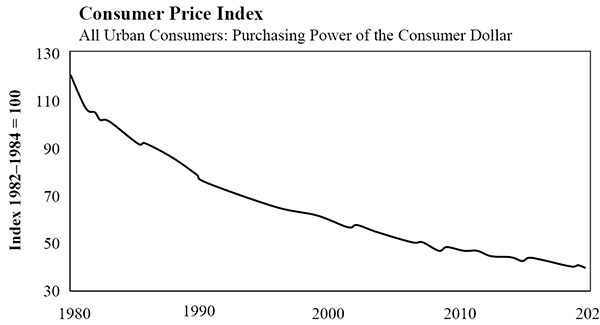

Volatility and an asset’s ability to store value are often misunderstood as being mutually exclusive. If an asset is volatile, it does not mean that asset will be an ineffective store of value. The opposite is also true. If an asset is not volatile, it will not necessarily be an effective store of value. The dollar is a prime example. The dollar is not volatile (today, at least), and it is a poor store of value.

Volatile things are not necessarily risky, and the reverse is also true.

The Fed has been highly effective in slowly devaluing the dollar, but always remember: gradually, then suddenly. Many people experience this critical mental block when thinking about bitcoin as a currency, and it is largely a function of time horizon. When central bankers across the world point to bitcoin as a poor store of value and not being functional as a currency due to volatility, they are thinking in days, weeks, months, and quarters while the rest of us plan for the long term: years, decades, and generations.

Source: US Bureau of Labor Statistics

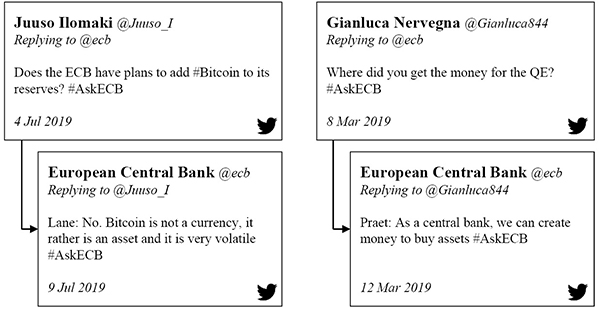

Despite the logical explanations, volatility is one aspect of bitcoin that particularly confounds the experts. For example, Bank of England Governor Mark Carney recently commented that bitcoin “has pretty much failed thus far on […] the traditional aspects of money. It is not a store of value because it is all over the map. Nobody uses it as a mediumof exchange.”[24] The European Central Bank (ECB) has mused on Twitter that bitcoin is “not a currency,” noting that it is “very volatile” while at the same time reassuring everyone that the ECB can “create” money to buy assets—the very same function that causes the euro to persistently lose its purchasing power.

The lack of self-awareness is not lost on anyone here, but Mark Carney and the ECB are not alone. From former Fed Chairs Ben Bernanke[25] and Janet Yellen[26] to current US Treasury Secretary Mnuchin[27] and US President Trump[28]—all have at times trumpeted the idea that bitcoin is flawed as a currency or as a store of value due to its volatility. None seem to fully appreciate, or at least admit, that bitcoin is a direct response to the systemic problem of governments creating money via central banks or that bitcoin volatility is a necessary and healthy function of price discovery. Luckily, bitcoin is not too volatile to be a currency, and often the “experts” are not experts at all. The empirical evidence shows that bitcoin has proven to be an exceptional store of value over any extended time horizon despite its volatility. So how could an asset such as bitcoin be both highly volatile and an effective store of value?

Source: Bitstamp

Bitcoin Value Function Revisited

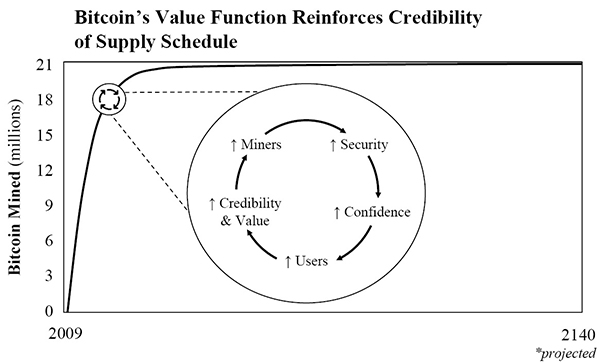

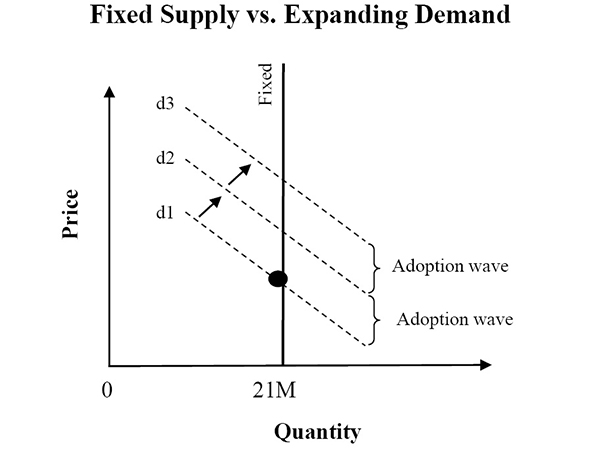

Consider why there is fundamental demand for bitcoin and why bitcoin is naturally volatile. Bitcoin is valuable because it has a fixed supply, and it is volatile for the very same reason. The fundamental demand driver for bitcoin as money is its scarcity. To revisit bitcoin’s value function, decentralization and censorship resistance reinforce the credibility of bitcoin’s scarcity (and fixed supply schedule) which is the basis of bitcoin’s store-of-value use case.

While demand is increasing by orders of magnitude, there is no supply response because bitcoin’s supply schedule is fixed. The disparity in the rate of increase in demand (variable) versus supply (fixed) combined with imperfect knowledge among market participants causes volatility as a consequence of price discovery. In “The Black Swan of Cairo,” Nassim Taleb writes, “Variation is information. When there is no variation, there is no information.”[29] As bitcoin’s value increases, it communicates information despite its volatility. In fact, volatility itself is information. The variation is the information. A higher value (dependent on variation) causes bitcoin to become relevant to new pools of capital and new entrants, which then stokes a wave of adoption.

Adoption Waves and Volatility

Distribution of knowledge and development of infrastructure fuel adoption waves and vice versa. It is a virtuous feedback loop and a function of both time and value. As bitcoin’s value rises, it captures the attention and mindshare of a much wider audience of potential adopters, who then begin to learn about the fundamentals of bitcoin. Similarly, an appreciating asset base attracts additional capital, not only to use bitcoin as a store of wealth but also to build incremental infrastructure (e.g., more on-ramps and off-ramps, custody solutions, payments layers, hardware, mining, etc.). Developing an understanding of bitcoin is a slow process, as is building infrastructure. However, both fuel adoption, which further distributes knowledge and justifies building more infrastructure.

Knowledge → Infrastructure → Adoption → Value → Knowledge → Infrastructure

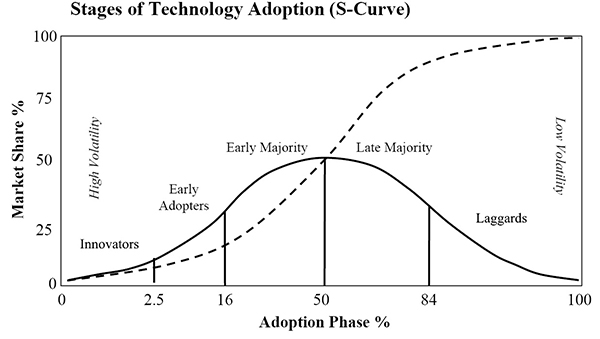

Source: Diffusion of Innovations by Everett M. Rogers (1962)

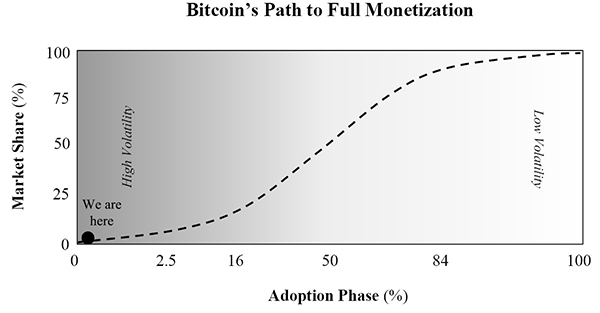

Today, bitcoin is still nascent, and current adoption likely represents <1% of terminal adoption. As a billion people adopt bitcoin, new adoption will represent an increase by orders of magnitude relative to the embedded base of demand for any foreseeable future period, which is the fundamental source of volatility—high variable demand relative to a lower stable base. However, with each new adoption wave, the value of bitcoin will also reset higher because of higher base demand. Bitcoin volatility will only decline as the holder base reaches maturity and as the rate of new adoption stabilizes. Said another way, when one billion people are using bitcoin, adoption will have increased by 20x, but the next billion adopters would only represent an increase of 50%. All while the supply of bitcoin remains on a fixed schedule.

So long as increases in adoption represent orders of magnitude, volatility is unavoidable. But on the path to full adoption, volatility will naturally and gradually decline, and practically only when incremental adoption begins to represent a fraction of embedded base demand.

Establishment economists deride the fact that bitcoin is volatile, as if you can go from something that didn’t exist to a stable form of money overnight. It’s completely ludicrous.

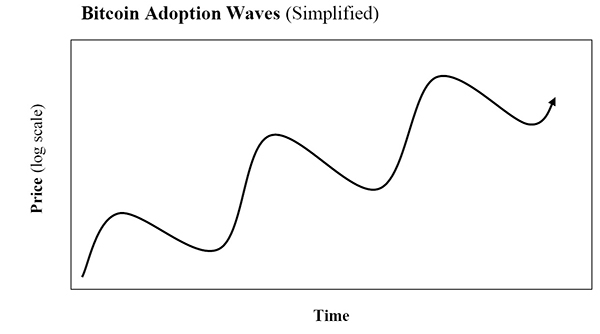

At present, what happens between adoption waves is the natural function of price discovery as the market converges on a new equilibrium, which is never static. In bitcoin hype cycles, the rise, fall, stabilization, and rise again are almost rhythmic. It is also naturally explained by speculative fear, followed by the accumulation of fundamental knowledge and the addition of incremental infrastructure. Rome wasn’t built in a day, and neither is bitcoin. Volatility and price discovery are core to the process of bitcoin adoption.

Historical Adoption Wave

For a more tangible explanation of the relationship between volatility and value, it is helpful to think about the most recent wave of adoption (as of the time of writing), a four-year period between mid-2015 and mid-2019.

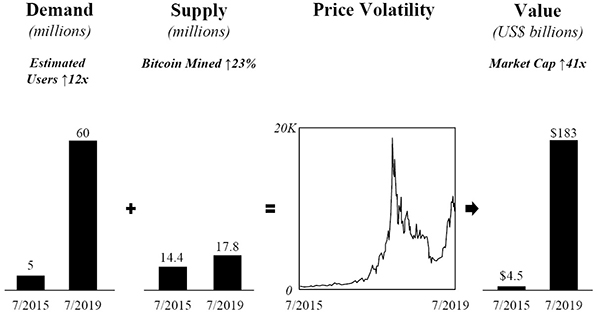

While adoption can never be fully quantified due to the decentralized and pseudonymous nature of the network, for illustrative purposes, let’s assume adoption increased by ten times over a four-year period (Coinbase users increased 13x, from 2.3 million to 30 million, between mid-2015 and mid-2019).[31] Yet, over the same period, the supply of bitcoin only increased by approximately 23%. As a massive adoption wave occurred, it was met by bitcoin’s fixed supply schedule. What would one expect when demand increases by an order of magnitude, but supply only increases by 23%? And what would happen if the knowledge and capital of the new entrants naturally vary a great deal? Recognize that every first-time bitcoin buyer is pricing it for the first time. So in a hypothetical scenario of adoption increasing by ten times, nine out of every ten market participants are necessarily pricing bitcoin for the first time.

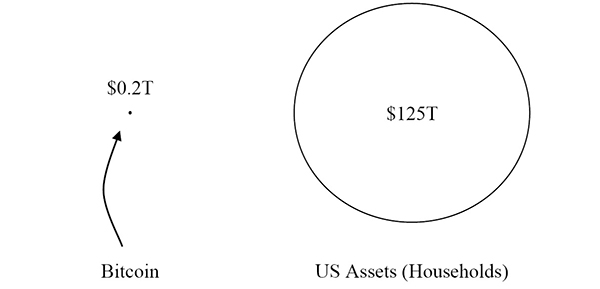

The very logical end result is higher volatility and a higher terminal value if even a small percentage of new entrants convert to long-term holders (which is exactly what happened). New adopters who initially purchased bitcoin as a speculative investment during its astronomical rise slowly accumulate knowledge and convert to long-term holders. This stabilizes base demand at a far higher terminal value compared to the prior adoption cycle. Because bitcoin is nascent, the aggregate wealth stored in it is still very small on a relative basis (~$200 billion). Hence, the rate of change between marginal buyers and sellers (price discovery) represents a significant percentage of the base demand, resulting in volatility. As base demand increases, the rate of change will come to represent a smaller and smaller percentage of the base, reducing volatility over time and likely only after several more adoption cycles.

Managing Volatility

If someone can accept that bitcoin volatility is both natural and unavoidable, the question becomes why does bitcoin adoption continue to grow despite the volatility? Turned around, why does volatility not prevent the adoption of bitcoin as a monetary standard? Very simply: diversification, portfolio allocation, time horizon, and knowledge distribution. A global network (bitcoin) exists through which you can store value in a currency with a fixed supply and transfer value over a communication channel to anyone in the world, and it is currently valued at less than $200 billion (as of the time of writing) because very few people understand it. Today, Facebook alone is worth more than $500 billion, and US household assets are estimated to be valued at $125 trillion.[32]

Bitcoin volatility would be an issue if it existed in a vacuum. However, it does not. Diversification comes in the form of real productive assets as well as other monetary and financial assets, which mutes the impact of bitcoin’s present volatility. Separately, information asymmetry exists. Those who understand bitcoin also understand that, in time, the cavalry is coming. More people will adopt bitcoin for the reason that it has fixed supply, but only as knowledge distributes. These concepts are obvious to those with exposure to bitcoin who actively account for its volatility in short- and long-term planning. But it is less obvious to the skeptics, who struggle to grasp that bitcoin adoption is not an all-or-nothing proposition.

Bitcoin will continue to steal market share in the global store of value competition because of its superior monetary properties. But the function of an economy is to accumulate capital that improves quality of life, not money. Money is merely the economic good that enables the coordination required to accumulate that capital through trade. As a fundamentally better form of money, bitcoin will gain purchasing power relative to inferior monetary assets (and money substitutes), despite being less functional as a transactional currency today in direct trade. As it does, bitcoin will reduce the need for, but not eliminate, stocks, bonds, real estate, and other real assets as stores of value. During its monetization, these assets will continue to represent sources of diversification that mute the impact of bitcoin’s day-to-day volatility.

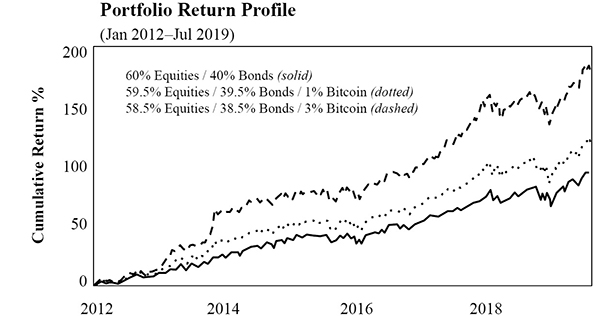

The example below highlights the risk and return profile of a portfolio with 1% and 3% exposure to bitcoin, compared to a traditional 60% equity, 40% bond portfolio.[33] It provides a look into how all volatility is typically managed and how a very small allocation to bitcoin historically would have resulted in greater return, with the volatility of bitcoin muted by exposure to other assets in a diversified portfolio.

Source: “The Investment Case for Bitcoin,” VanEck, 2019

It would be irresponsible to have an exposure to Bitcoin that one cannot afford to lose because the risk of losing the principal is very real. But it would be almost as irresponsible to not have any exposure at all.

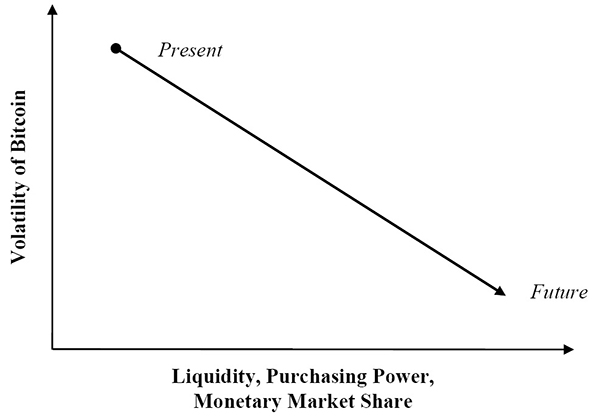

While failure is a possibility and significant drawdowns are inevitable, each day that bitcoin does not fail, its survival becomes more and more likely.[35] And over time, as bitcoin’s value and liquidity increase due to its superior monetary properties, its purchasing power will also increase in terms of real goods and services. As its purchasing power represents a larger and larger share of the economy, its volatility relative to other assets will inevitably and proportionally decrease.

The End Game

Bitcoin will become a transactional currency over time. In the interim, it would be far more logical to spend a depreciating asset (dollars, euros, yen, or gold) and save in an appreciating asset (bitcoin). On bitcoin’s path to full monetization, its use as a store of value must come as a logical first step, and bitcoin has proven to be an incredible store of value despite its volatility. As adoption matures, volatility will naturally fall, and bitcoin will increasingly become a medium of direct exchange.

Consider the individual or business that demands bitcoin in direct exchange for goods and services. Logically, that individual or business would first need to have determined that bitcoin would hold its value over a particular time horizon. If one did not believe in the fundamental demand case for bitcoin as a store of value, they simply would not trade real-world goods and services in return. Bitcoin will transition to a transactional currency only as more people first understand why it will store value. As that occurs, bitcoin’s liquidity will gradually migrate from other monetary assets (dollar, euro, yen, etc.) to the direct exchange for real goods and services. It will not be a flash cutover or a binary process. On a more standard path, adoption fuels infrastructure, and infrastructure fuels adoption. Transactional infrastructure is already being built, and more material investment will be prioritized as a sufficient number of individuals first adopt bitcoin as a store of wealth, necessitating the need for bitcoin payments.

Bitcoin’s day-to-day liquidity will scale and diversify as a function of both, reducing volatility over time, but unavoidably, bitcoin’s fixed supply and rapid growth in adoption will continue to result in near-term volatility. Stability will emerge organically as bitcoin is adopted by the entire world. It is the literal opposite model of that pursued by the Bank of England, the European Central Bank (and its Twitter account), the US Federal Reserve, and the Bank of Japan. Central banks manage currencies to mute short-term volatility, creating instability that leads to long-term volatility. Volatility in bitcoin is the natural function of monetary adoption, and it ultimately strengthens the resilience of the bitcoin network by eliminating market imbalances, driving long-term stability. Variation is information.

Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. This is one of life’s packages: there is no freedom without noise—and no stability without volatility.

The Federal Reserve is not currently forecasting a recession.

-

“The Skeptics: A Tribute to Bold Assertions,” Satoshi Nakamoto Institute, accessed 8 August 2019. ↩

-

Nassim N. Taleb, Skin in the Game: Hidden Asymmetries in Daily Life, (Random House, 2018). ↩

-

David Milliken, “BoE’s Carney says Bitcoin has pretty much failed as currency,” Reuters, 19 February 2018. ↩

-

Ben Bernanke, “Ben Bernanke on Bubbles, Bitcoin, and Why He’s Not a Republican Anymore,” interview by Matt Phillips, Quartz, 19 November 2015. ↩

-

Janet Yellen, speech, Canada Fintech Forum, 29 October 2018, Montreal, Canada. ↩

-

“White House Press Briefing by Treasury Secretary Steven Mnuchin on Regulatory Issues Associated with Cryptocurrency,” news release, US Department of the Treasury, 15 July 2019. ↩

-

Billy Bambrough, “Donald Trump Unleashes Sudden Attack on Bitcoin,” Forbes, 12 July 2019. ↩

-

Nassim N. Taleb and Mark Blyth, “The Black Swan of Cairo: How Suppressing Volatility Makes the World Less Predictable and More Dangerous,” Foreign Affairs 90, no. 3 (May/June 2011), 6. ↩

-

Vijay Boyapati, “How Bitcoin Mentally Captures People,” interview by Stephen Livera, Stephan Livera Podcast (ep. 2), 28 July 2018. ↩

-

Coinbase User Data, compiled by Alistair Milne, Altana Digital Currency Fund, 2019. ↩

-

Board of Governors of the Federal Reserve System, Z.1 Financial Accounts of the United States: Flow of Funds, balance Sheets, and Integrated Macroeconomic Accounts, First Quarter 2019, Federal Reserve Statistical Release, 6 June 2019, 138. ↩

-

“The Investment Case for Bitcoin,” VanEck, 21 October 2019. ↩

-

Wences Casares, “The Case for a Small Allocation to Bitcoin,” Kana and Katana, 1 March 2019. ↩

-

This dynamic is known as the Lindy Effect. For more information, see “Lindy Effect,” Wikipedia. ↩

-

Nassim N. Taleb and Mark Blyth, “The Black Swan of Cairo: How Suppressing Volatility Makes the World Less Predictable and More Dangerous,” Foreign Affairs 90, no. 3 (May/June 2011), 6. ↩

-

Ben Bernanke, “Financial Markets, the Economic Outlook, and Monetary Policy,” remarks before Women in Housing and Finance and Exchequer Club, Washington, DC, Speech, 10 January 2008. ↩