Chapter Nine

Bitcoin Is Not Too Slow

Originally published

on 23 August 2019

The Ultimate Technology Leap

In the book Zero to One, Peter Thiel outlines the impact of new technologies in building a non-zero-sum future.[49] From the advent of the steam engine to the shift from typewriters to computer processors, he presents several examples of individuals and companies who have introduced innovations that resulted in step-function changes. Thiel distinguishes between true step-function innovation as being 0 to 1—innovation that creates something entirely new—and the scaling or incremental improvement of such innovation as being 1 to n.

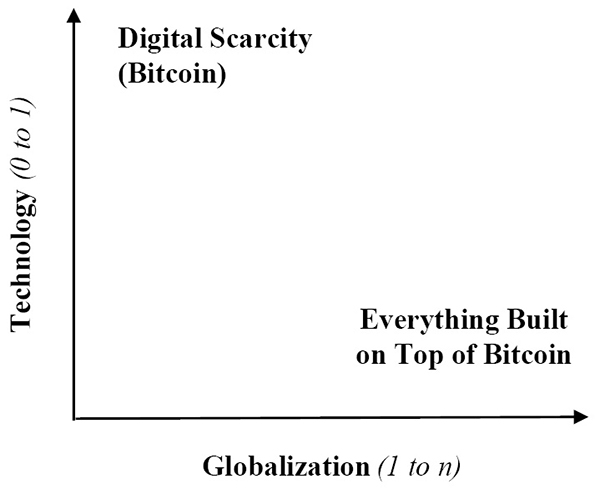

However, Thiel also expressed the view that innovation has largely stagnated since the early 1970s, with technological progress being primarily 1 to n rather than 0 to 1, which may have been true until the advent of bitcoin. As a monetary system, bitcoin is the ultimate 0 to 1 technology leap, and it is fundamentally differentiated from the class of step-function innovation that is the book’s focus. Bitcoin is a monetary protocol built on digital scarcity, the impact of which will be far more consequential than steam engines and computer processors because of the critical role money plays in coordinating virtually all other economic resources.

Source: “Steam Engine” by Jacob Leupold (Theatri Machinarum Hydraulicarum II, 1725

A Step-Function Change

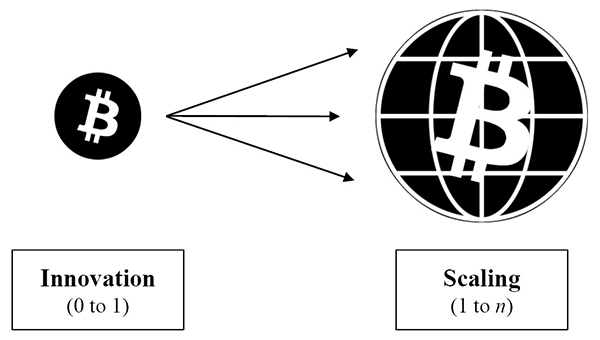

There’s a new meme floating around the internet; whatever the problem, bitcoin fixes this. Negative yielding debt? Bitcoin fixes this. Endless global war? Bitcoin fixes this. Cancel culture? Bitcoin fixes this. Financial crises? Bitcoin fixes this. We’re not exactly sure how just yet, but it is an articulation of the balancing effect a sound and stable monetary system will have on every aspect of society. As the coordination function of society, money allows people to cooperate who otherwise would not have a basis to do so via trade. Bitcoin represents a form of money that cannot be printed, which solves a problem for practically every living being on earth. It is global, permissionless, and resistant to all forms of censorship, which makes it functionally accessible to anyone and everyone. The collective benefit that follows may not literally cure every ill in the world. But the invention of a step-function change monetary network is fundamentally different from any single product or company because money is the economic good that coordinates and makes possible the production of all other economic goods. Bitcoin is 0 to 1, and the solutions to scale bitcoin (from 1 to n) will naturally be incremental.

The problem is precisely how to extend the span of our utilization of resources beyond the span of the control of any one mind; and therefore how to dispense with the need of conscious control and how to provide inducements which will make the individuals do the desirable things without anyone having to tell them what to do.

Hayek writes about the invention of money and the price mechanism as the tool that allows society to dispense with the need for “conscious control.” Bitcoin is the superior successor to this mechanism, and its 0 to 1 innovation is finite scarcity, not payments or transaction speed. While bitcoin’s property of scarcity still needs further stress testing, it is a profound achievement, and it is what makes bitcoin unique. Never before has any form of money, let alone a digital one, been finitely scarce. The significance (and relevance) is that finite scarcity serves as the foundation for the hardest form of money that has ever existed—hardest in the sense that, in a terminal state, no one can produce any more or at all—and anyone in the world can use it. There will only ever be 21 million bitcoin. That is the 0 to 1 achievement and a phenomenon that almost certainly will not be repeated (see “Bitcoin Cannot Be Copied”).

Source: Inspired by Zero to One by Peter Thiel (2014)

Every other problem that bitcoin will have to overcome is more pedestrian relative to scarcity. Digital payments? The idea that human ingenuity could create finite digital scarcity but could not then layer on payments technology to scale does not logically follow. Payments technology is just one of the many 1 to n innovations that will be built on top of bitcoin to globalize its adoption. Not only are payments an easier problem to solve, but they are not a critical path that needs solving today—as of the time of writing. The primary use case for bitcoin today is as a savings mechanism. Over time, as adoption increases and more infrastructure is built, bitcoin will evolve into a transactional currency facilitating direct commerce, but that process will occur on a gradual basis. In most cases, an individual or business would reasonably need to first understand why bitcoin will store value into the future as a savings mechanism before accepting bitcoin as a form of payment in direct commerce or trade. It’s a logical progression. And as the shift occurs, bitcoin adopters will continue to leverage legacy monetary systems and payment rails in parallel until a time when the world is fully on a bitcoin standard.

Not a Payment Rail

As traditionally defined, a payment rail is a network or platform that acts as financial plumbing, moving money from payer to payee in return for goods or services. The bitcoin blockchain will likely never be a layer for mass payments, but there is considerable debate on this topic. Many believe that for bitcoin to be “successful,” it needs to be a one-stop shop, combining the roles of currency issuer, settlement layer (confirming transactions), and payment rail. While bitcoin fulfills the first two functions beautifully (currency issuer + settlement layer), it is categorically not a payment rail as traditionally defined. For reasons of speed and scale but most importantly due to the nature of payments, bitcoin fails the payment rail test. The good news? The bitcoin network does not need to be a payment rail—in the Visa sense—to function perfectly well as money and solve a massive problem.

Much of the confusion in the philosophical (rather than technical) debate stems from the opening salvo of the bitcoin whitepaper: “a Peer-to-Peer Electronic Cash System.”[51] It does say “purely peer-to-peer” after all. But this has been interpreted by some to imply that bitcoin needs to be able to handle every last transaction in the world between any two peers. Separately, others contend that if bitcoin transactions cannot occur at the scale or speed of Visa or Mastercard, the network is structurally flawed. Essentially, the argument made by skeptics is that if bitcoin cannot meet both of these standards, it fails on its promise. Thankfully, it does not. Visa and Mastercard are not money themselves. Each is a credit system that settles the transfer of money between two parties. It is also not practical or sensical for every person on earth to retain records of every transaction by and between every other person, which is what functionally occurs for each individual or business running a bitcoin node maintaining records of all bitcoin transactions throughout history.

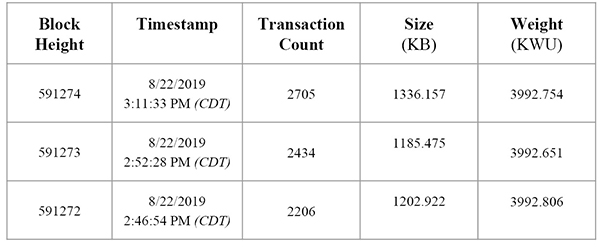

For additional background, valid bitcoin transactions are confirmed in timestamped batches and included in a “block.” Blocks are solved every ten minutes on average (but not precisely). The next block may be solved in one minute or twenty minutes, thirty seconds or thirty-six minutes. The network adjusts such that blocks are solved on average every ten minutes. How could a merchant or transaction processor operate in a world this slow or this unpredictable? Separately, each bitcoin transaction includes data, and each block has a defined maximum (or limited) amount of data it can include, typically defined as block space, to be accepted as valid. While the bitcoin network does not have a fixed transaction capacity by count, each bitcoin transaction consumes a certain amount of block space, which limits capacity. As a function of limited space and capacity, blocks include approximately 2,700 transactions on average. With ten-minute average block intervals, six blocks per hour, twenty-four hours per day, 365 days per year, that equates to a network transaction capacity of approximately 145 million transactions per year, equivalent to approximately 4.6 transactions per second. Visa, on the other hand, processes 124 billion transactions per year at a rate of ~4,000 transactions per second.[52]

Source: blockstream.info

How can bitcoin be the purely peer-to-peer engine that powers the global financial system if it operates at nearly one one-thousandth the scale and speed of Visa alone? It is a false dilemma. The reality has always been that if bitcoin were to have a non-zero value, the consequence would be a system so valuable to so many people that any base layer would not be able to handle all transactions without sacrificing decentralization or censorship resistance. Each of which is fundamental to bitcoin credibly enforcing its fixed supply. Without these properties, bitcoin would not be a 0 to 1 innovation, and its value function would break down entirely.

Ultimately, the bitcoin protocol layer provides the function of currency issuance and final settlement. It is not capable of storing every small purchase, including your Starbucks coffee, for the rest of time for everyone, nor is that necessary for bitcoin to function as money. If it were the case, all transactions by all people, no matter how big or how small, would have to be validated and stored by every other person on earth. Without a mechanism to align the interests of network participants, a “tragedy of the commons” problem would exist. The result would be a less secure currency system subject to centralization. Instead, bitcoin has a mechanism to limit transaction throughput at the base layer, prioritizing security and decentralization, while necessarily shifting aspects of bitcoin’s peer-to-peer transactional architecture to separate layers that interoperate with bitcoin. These trade-offs have been made very intentionally in order to secure the foundation of bitcoin’s monetary system.

Decentralization → Censorship Resistance → Fixed Supply

The scarcity of the currency (i.e., the fixed supply) is tied to the scarcity of block space and derivatively, transaction capacity. The latter preserves and promotes decentralization in importantly distinct ways and aligns incentives throughout the bitcoin network at each a security, transactional, and node level. But more importantly, everything critical in bitcoin is enforced by a consensus of network participants, including its fixed supply and the space within each bitcoin block, which limits the number of transactions it can process. This is the fundamental difference between bitcoin and the legacy financial system: monetary policy by consensus rather than by central bank. Bitcoin’s creator and early contributors collectively produced a system that ultimately removed critical decisions from any central authority, instead deferring to the wisdom of market consensus. It is a system that is flexible enough to be adapted but rigid enough that any material change is exceptionally difficult. As a consequence, network peers have to decide, on a decentralized basis, how best to scale bitcoin. Through this consensus mechanism, bitcoin dispenses with the need for “conscious control.”

Security Trade-Offs

Everything comes with trade-offs, but there are two holy grails in bitcoin: enforcing a fixed supply and preventing individual units of the currency from being spent multiple times (the double-spending problem). The value of bitcoin is derived from its ability to secure each of these functions on a decentralized, trustless basis, and both are inextricably linked to the bitcoin network’s limited transaction capacity. Think of the space within each bitcoin block as valuable digital real estate. All market participants seeking to clear bitcoin transactions have to compete for block space. Scarcity in block space is the function by which bitcoin’s shared resource is optimized and how bitcoin solves for the “tragedy of the commons” problem. Competition for this scarce resource ensures that it is used efficiently and that its value is maximized. Scarcity causes market participants to compete with each other, bidding up the value of block space rather than shifting negative externalities onto the rest of the network.

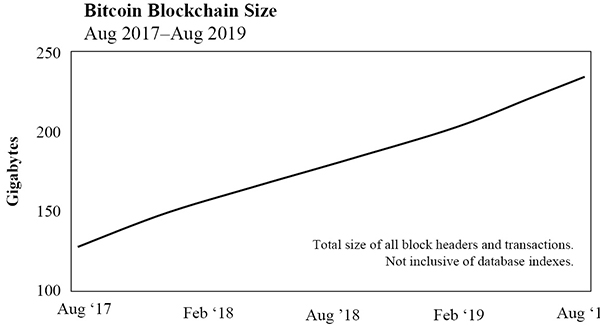

Source: blockchain.com

In bitcoin’s free market, the highest-value and most profitable transactions are prioritized. Without scarcity in block space, this market mechanism would break down. It is less important that bitcoin optimizes for transaction capacity and more critical that scarcity in block space exists. No one really knows the optimal amount of transaction capacity at any point in time, partly because demand is ever-changing but also because it generally grows over time. The critical piece is that block space is both known and scarce, which enables market participants to plan and, ultimately, compete. The commons are never depleted. Instead, innovation is spurred to figure out how best to utilize a scarce resource (e.g., improving transaction efficiency and moving lower-value transactions to new payment layers). Scarcity of block space also has the effect of creating a predictable and limited rate of growth in the overall size of bitcoin’s blockchain, which directly correlates to the cost and complexity of running a bitcoin node, protecting and promoting decentralization as a derivative but intentional consequence.

As discussed in “Bitcoin Does Not Waste Energy,” miners secure the bitcoin network by devoting real-world energy resources to run cryptographic hashing functions in an attempt to solve bitcoin blocks. By solving blocks, miners validate history and clear current transactions, which are then checked, validated, and propagated by the rest of the network nodes. In return for devoting resources to perform this function and secure the network, miners get paid in the network’s native currency (bitcoin). The actual compensation paid to miners comes in two forms: newly issued bitcoin and transaction fees. Miners have to reliably expect that aggregate compensation will hold its value into the future in order to devote resources today.

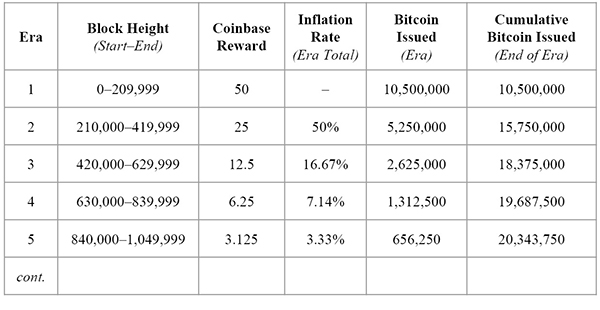

Approximately every four years, the amount of newly issued bitcoin paid to miners is cut in half (referred to as the bitcoin “halving” or “halvening”). Today, with each block, 12.5 new bitcoin are issued. When the next halving event occurs in approximately May 2020 (as of the time of writing), that amount will be reduced to 6.25 new bitcoin per block. And approximately four years after that, 3.125 new bitcoin per block will be issued. This process will continue until the smallest unit of bitcoin (1/100,000,000th) is reached—after which, no new bitcoin will be issued. It is this issuance function that governs bitcoin’s fixed supply of 21 million. It also shifts compensation to secure the network from (mostly) new bitcoin today to a system relying entirely on transaction fees paid by users of the network to bitcoin miners in the future.

How does this relate to transaction capacity? If it were not for the scarcity of capacity in each bitcoin block, there would not be a mechanism to create a transaction-fee market. Scarcity in block space limits transaction capacity and creates competition between market participants to clear transactions, in turn causing users to bid up the value of that space (i.e., digital real estate), while also incentivizing efficient use because it comes with cost. Without a transaction-fee market, the only mechanism to pay miners to secure the network would be to alter bitcoin’s fixed monetary policy and perpetually increase supply. But recall that bitcoin’s fixed supply (21 million) is the basis of its store-of-value property, which is where the rubber meets the road. By creating scarcity in block space, the network also ensures the integrity of bitcoin’s fixed supply, which makes the whole value function work. Hence, scarcity is a far more important property than either the speed or ultimate capacity of transaction throughput.

Fixed Block Space → Limited Transaction Capacity → Fee Market → Fixed Supply of Bitcoin

The real problem bitcoin is intending to solve is that of money and the endless printing of money, not “payments” as the term is loosely and commonly used. Accordingly, there is nothing more important than securing the money supply and its long-term integrity, especially not transaction throughput to support everyday payments. It’s not a chicken-and-egg problem either. Security necessarily comes first. In short, the future of bitcoin is far more secure in a world where all market participants can depend on it having a reliably fixed and scarce supply while accepting lower transaction throughput or speed today as trade-offs. What good are high transaction throughput and faster speeds if the fundamental value of the underlying currency is at risk? The existing financial system has already made the opposite trade-off—high transaction throughput and fast transactions by way of centralization but with the cost of an architecture susceptible to systemic monetary debasement. Bitcoin represents the alternative, and it would not be rational to make the same mistake twice. But luckily, it is not an either-or dilemma. Rather, it is one of logical order. Prioritize security first, and then allow the market to innovate to scale transaction capacity in a way that does not sacrifice security.

Bitcoin ≠ Visa

Ultimately, bitcoin is not competing with Visa for supremacy in global payments. Instead, bitcoin is competing with the dollar, euro, yen, and gold as money. Any comparison to Visa, its transaction volume, or its transaction speed is fundamentally flawed. Bitcoin fulfills the role of currency issuer and final settlement. As a result, the proper comparison would be between bitcoin and the Federal Reserve as both a currency issuer and clearinghouse of dollars. No one makes the mistake of confusing the functions of Visa for that of the New York Fed, but for some reason, the comparison is often made between Visa and bitcoin.

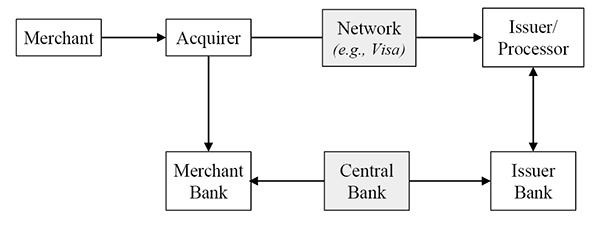

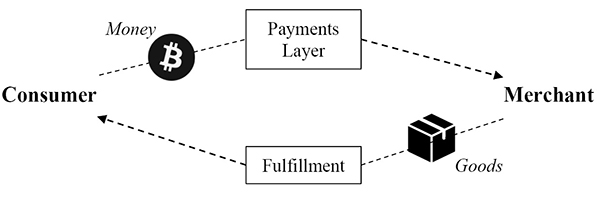

While it would require time and investment, Visa’s payment network could sit on top of the bitcoin network much as it sits on top of the existing banking system. Rather than clearing dollars through a central bank, the final settlement of transactions would clear in bitcoin through the bitcoin network. In the existing architecture, the payment layer (Visa) and the settlement layer (banking network/central bank) are separate and distinct. Visa helps move dollars, but Visa is not the dollar. Visa is a technology company that provides a service. It has 17,000 employees.[53] Bitcoin has none.

Consumers generally associate swiping a Visa card (or the equivalent) at a point-of-sale terminal with instantaneous payment, but this is not the case. Whether using credit or debit, Visa is an inherently trust-based credit system. Balances must first be checked, transactions are then authorized, and only then may settlement occur. Dollars are not actually cleared through a central bank or settled at the point of sale every time a transaction is processed either. Individual transactions are also never really cleared. Instead, transactions are batched, netted, and settled at a later point in time. Only then are accounts credited with proper balances. So when someone attempts to equate a Visa transaction at point of sale with final settlement, that is simply not the way the world works. But that is the comparison implicitly being made when someone attempts to compare Visa with bitcoin.

Bitcoin vs. the Federal Reserve

When compared to its real competition (the dollar, euro, yen, etc., and the Fed, ECB, BoJ, etc.), bitcoin begins to look like a Ferrari—final global settlement approximately every ten minutes, twenty-four hours per day, seven days a week, 365 days a year on a permissionless basis. Compare this to the existing permissioned financial system, which is subject to multiple layers of bank and central bank intermediaries and only open during “business” hours. This is the great misnomer that exists within bitcoin. Those who believe bitcoin is too slow or lacking in transaction capacity are comparing it to the wrong application. A network of banks could be set up on top of the bitcoin network, and the payments system could function as it does today.

The pushback on this as a method to scale bitcoin is the risk of centralization. If bitcoin were to just sit in banks, it would increase the possibility that the bitcoin network could be co-opted and undermined by a network of banks and central banks, whether to force changes to network consensus rules or censor end users. The point is that it would be functionally possible and that money and payments technology are distinct problems. The fundamental reason is that there are two sides to every value transfer. One side almost always involves money, and the other is the fulfillment of goods and services. The nature of trade is such that the two sides of a value transfer generally occur through different processes and at different points in time.

Think about the settlement of currency on one side and the transfer of title to a home on the other. Or perhaps, payment for a good on Amazon and the fulfillment of that good two days later. Two different processes inevitably occurring at two different times. It is also important to recognize that bitcoin has no knowledge of the outside world, whether the identities of the parties involved or the second leg of a value transfer. All bitcoin knows is how to issue and validate currency (whether a bitcoin is genuinely and validly a bitcoin). This is really the function and limitation of any base currency system. Payments layers provide a bridge to a problem with two-sided risk, between currency settlement and the fulfillment of goods and services. Gold solved mass payments via bank centralization, the dollar, the Fed, and large payments processors such as Visa. Bitcoin likely solves payments through a technologically superior mechanism, but more to the point, solving for payments is a separate and distinct problem from that of money issuance and settlement. And it is one that will undoubtedly be solved in time and only when bitcoin holders demand payments applications in greater mass, which will follow from broader adoption and the need to use bitcoin in direct commerce.

Scaling Bitcoin Is 1 to n

If humans solved the problem of money through digital scarcity, a 0 to 1 innovation, then the technology advancements to scale transactions and ultimately solve payments are certainly 1 to n. It is absurd to believe that human ingenuity could solve the former but then fail on the incremental derivatives. It is not just a matter of hope and faith but one of reason and logic, considering both the advancements in scaling solutions that are already being pursued and the challenges relative to the problem bitcoin has already solved. Permissionless innovation and the economic incentives inherent in bitcoin will coordinate and accelerate solutions to any number of future challenges. It takes humility to accept the magnitude of bitcoin’s technological leap and to forgo the need or desire to precisely predict every next innovation or how each next problem gets solved. Market participants have an incentive to innovate to scale the network, but the solutions will have to work within the network’s consensus or garner sufficient consensus to change the rules.

The nature of bitcoin’s economic incentives makes it far more likely that scaling solutions work within existing consensus rules because bitcoin’s value—notably its fixed supply—is predicated on its consensus rules being very difficult, if not impossible, to change. One such example is the Lightning Network.[54] The Lightning Network builds on top of bitcoin, within the network’s consensus rules, as a trust-minimized protocol to scale transaction capacity, which remains fundamentally distinct from final settlement. If successful, Lightning will be used to create a network of bitcoin payment channels between individual users and businesses that enable far greater transaction throughput at far lower cost, the scale and speed of which would rival Visa. But to be clear, even Lightning as a protocol is not an analogue to Visa, which is a company providing a service. Visa itself will likely be facilitating bitcoin transactions using Lightning in the event it is successful as a protocol. While Lightning may not be the ultimate solution, it is an example of the innovation that bitcoin is fostering. And Lightning is just one of many solutions that are actively being developed. The free market and competition will drive toward the best scaling solutions, which may be a combination of many. Importantly, however, the problem that Lightning or any other transaction-scaling protocol intends to solve is distinct from the problem bitcoin solves in issuing currency and effecting final settlement.

Protecting the Foundation at All Costs

The approach to scaling bitcoin is a slow and conservative process. Bitcoin is too important to follow the Silicon Valley mantra of “move fast and break things.” Instead, it’s “move slowly and don’t break anything.” If a global financial system is to be built on a decentralized monetary system, the foundation must be protected at all costs. Ensure the security of the base monetary layer first (bitcoin) and then allow network participants to innovate on top of it in a permissionless manner. Remember that bitcoin is only ten years old. Today, bitcoin remains at the very inception of its monetization event, and infrastructure is still being built to allow for the proliferation of this new technology and form of money.

It is a bit ridiculous to contemplate the problem bitcoin has already solved, to recognize very few people in the world yet understand it and then immediately pivot to a stance of expecting mass payments here and now. Especially when considering that bitcoin, in its clearing function, is already faster and more reliable than comparable mechanisms for final settlement of dollars, euros, yen, or gold. Separately, in understanding that the fundamental use case for bitcoin today is as a long-term savings mechanism, it becomes clearer that the problem of payments is misdiagnosed and that the desired solutions can wait. In fact, bitcoin payments en masse will invariably have to wait until the market demands that solutions be created, which itself is logically dependent on more people using bitcoin as a savings mechanism. Every bitcoin user will need the ability to fulfill day-to-day payments in the future, and that day will come. In due course, we’ll have our cake and eat it too. Just not at the cost of compromising bitcoin’s fixed supply of 21 million, which is the 0 to 1 innovation.

-

Peter Thiel and Blake Masters, Zero to One: Notes on Startups, or How to Build the Future (Crown, 2014). ↩

-

Friedrich A. Hayek, “The Use of Knowledge in Society,” American Economic Review 35, no. 4 (September 1945): 527. ↩

-

Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System (whitepaper, 31 October 2008). ↩

-

Visa Inc., Form 10-K: Annual Report, United States Securities and Exchange Commission (SEC) archives, fiscal year ended 30 September 2018. ↩

-

Visa Inc., Form 10-K. ↩

-

Joseph Poon and Thaddeus Dryja, “The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments,” (whitepaper, 14 January 2016). ↩