Chapter Fourteen

Bitcoin Is a Rally Cry

Originally published

on 26 March 2020

A Fundamental and Inalienable Right

To the People of Texas and all Americans in the world.

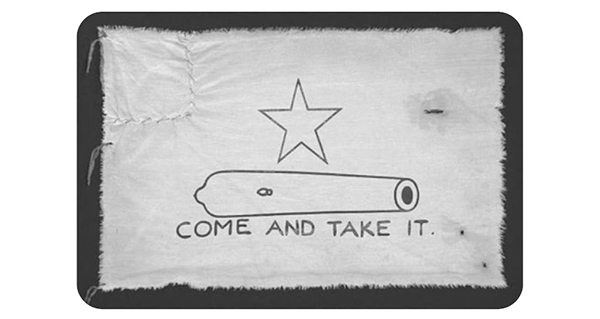

In his open call to arms from the Alamo, Lt. Colonel William B. Travis began with an expression of America as an idea extending beyond borders, to “all Americans in the world.” It was a plea to all those who valued the fight for liberty and freedom. Outnumbered ten-to-one, Travis responded to the demand for surrender with a cannon shot. He was no more than twenty-seven years old at the time. Texas declared its independence a week later, but within days, the Alamo fell. The Travis letter became the rallying cry of a revolution. Remember the Alamo. Ultimately, Texas won its independence. Always outnumbered, it is a reminder that the endless pursuit of freedom is a most powerful equalizer. And it is something inherent to the character of all Americans in the world. Not just American citizens but everyone who values individual liberty.

Minus the lionized heroes and a literal declaration of independence, bitcoin is still very much a fight for freedom. It is becoming a rallying cry to all those that refuse to sit back and accept the fate of our tenuous financial system. The very idea of freedom may be the single most important tenet underpinning the monetary revolution to which bitcoin is giving rise. When the war is won, bitcoin will likely find its way into a constitutional amendment even though the first amendment already covers it—the right of the people to keep and bear bitcoin. Prior to bitcoin, there was no practical choice but to opt in to a broken currency system. That all changed in 2009 when bitcoin was released into the wild. Controlled by no one, bitcoin is an entirely voluntary system. It affords everyone the ability to store and transfer value in a currency that cannot be manipulated. Bitcoin may not be synonymous with the right to life, liberty, and the pursuit of happiness, but it is a fundamental and inalienable right for those who choose to rely upon it as a better path forward.

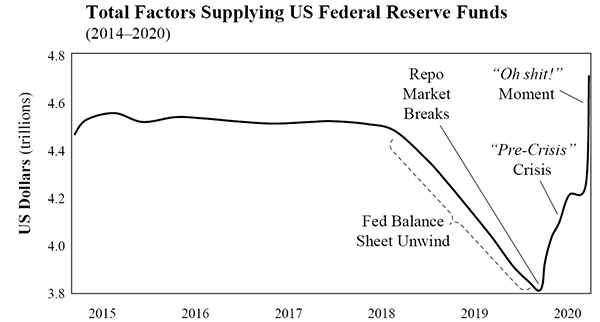

While bitcoin is valued for different reasons, it consistently appeals to those that have identified the inherent level of freedom afforded by such a powerful tool, particularly in a world full of never-ending economic calamities. As the fragility and instability of the global financial system become more apparent by the day, central bankers and politicians scramble in a race to see who can provide more stimulus to an economy that is flatlining. Lest we forget, the instability in the financial system is not just appearing. It is reappearing. The structural issues now resurfacing are the same ones that existed during the 2008 financial crisis. Before the oil war and the global pandemic in 2020, the repo funding markets broke in September 2019.[78] The writing was not just on the wall. It was in the repo markets. If it were not these recent events acting as the accelerant, it was inevitable that an exogenous shock would expose what remained under the surface all along—a highly leveraged financial system primed to break at the first signs of any material stress.

Source: Federal Reserve Economic Data (FRED)

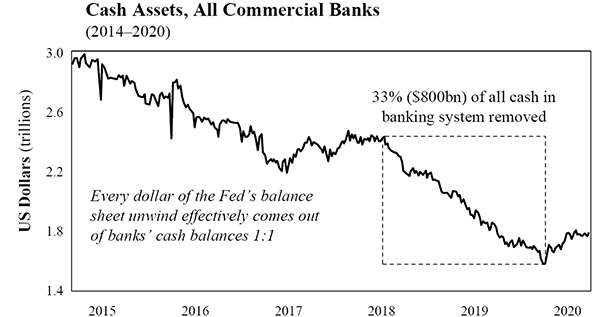

Source: Federal Reserve Economic Data (FRED)

A Game of Guess and Check

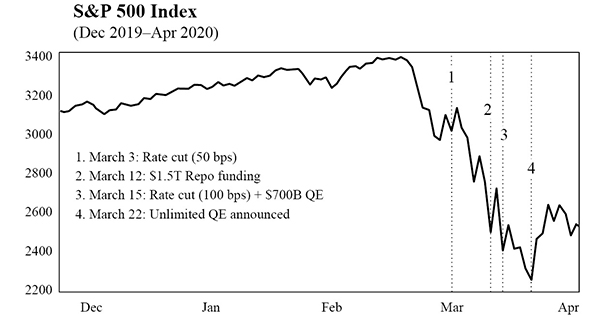

From October 2017 to September 2019, the Fed reduced the supply of dollars in the US financial system by $700–$800 billion, effectively reducing the cash available in the banking system by 33%, in an attempt to unwind post-2008 financial crisis quantitative easing. The Fed functionally starved the financial system of liquidity it needed to function, which ultimately caused the repo markets to break. This is what induced the need to rescue financial markets initially six months ago (in September 2019). Prior to the global economic shutdown, the Fed had already supplied ~$500 billion in emergency funding to the repo markets to quell market turmoil. But matters have since materially worsened, and now the fuel is really being dumped on the proverbial fire. It is not just the scale that is alarming but the clear demonstration of control being lost through a meandering path of incrementalism. After the stock market crash in late February 2020, the Fed issued an emergency 50 bps interest rate cut. The market then cratered further, and the Fed responded with an incremental $1.5 trillion in short-term funding (one to three months) to be supplied in the repo markets. The market crashed yet again, and three days later, the Fed announced a formal $700 billion “quantitative easing” program to purchase $500 billion in US government treasuries and $200 billion in mortgage-backed securities. Coinciding with this move, short-term interest rates were cut by 100 bps, down to zero.

Yep, you guessed it. The market crashed again. Credit markets became dislocated, and the Fed followed with a “whatever it takes” response, announcing an unlimited QE program.[79] Its three most aggressive moves to date all transpired within a ten-day window. And as part of its latest unprecedented act, the Fed will begin buying corporate bonds on the secondary market while also participating in the primary issuances of corporate credit. It also expanded its purchases of mortgage-backed securities to include commercial mortgage-backed securities (commercial real estate). In addition, the Fed established a facility to issue asset-backed securities in order to purchase student loans, auto loans, credit card loans, etc. All this without a price tag and just a promise to do whatever it takes. It would be funny if it weren’t so serious. But the real question remains: if the Fed were in control, why was it so reactionary? Why did its plans change so drastically in a ten-day period if it genuinely understood the extent of the issue? Never mind the unintended and unknowable consequences. It merely demonstrates that the Fed is not in control. Why would it have announced a $700 billion QE program if it didn’t expect it to work? It is a classic game of guess and check, except the consequences can never be checked (only the immediate market reactions). The problem is that the entire US economy is at stake.

Source: S&P Dow Jones Indices

There’s an infinite amount of cash at the Federal Reserve.

To lend to a bank, we simply use the computer to mark up the size of the account they have with the Fed, […] it’s much more akin to printing money than it is borrowing.

The New Normal

Make no mistake. The $1.5 trillion supplied to the repo markets will be converted to increment the Fed’s formal quantitative easing program, and the entire unquantified program should conservatively be expected to exceed $4 trillion when all is said and done. The Fed cannot put out the fire that is a liquidity crisis through short-term funding. It will have no choice but to monetize a larger share of the credit system than it did in 2008 because the problem is now larger. In addition, while not yet passed as of the time of writing, Congress is working on an initial $2 trillion stimulus package in response to the global pandemic. With a market already suffering a liquidity crisis, the banking system does not magically have this cash on hand to finance a massive expansion of the federal government’s deficit. As a result, the Fed will be forced to finance any fiscal response through an ever-expanding quantitative easing program. It is the only way for the banks to get the cash needed to finance such a fiscal stimulus. All roads lead back to the Fed and endless QE.

As the world looks on, amidst the fear and panic, it often seems like there is no alternative. While it’s unclear precisely when so many people began to view the government’s role as one of fighting global pandemics (rather than the free market), that is the world aggressively being demanded by many. It is a symptom of failing to understand the root problem. Misdiagnosing the fallout of a global pandemic—and falsely believing the only hope is to allocate money created out of thin air by central banks and governments—is predictably irrational. There is no reason that even a few months of complete economic shutdown should put the world on the brink of a global depression. Instead, it is the output of an inherently fragile financial system, one that is dependent on perpetual credit expansion and would collapse without it. The fragility of the global financial system itself is the problem, not a global pandemic. Do not be fooled. The present instability is not a pandemic-induced failure of the financial system. Failure was an inevitability, pandemic or not.

The world would not be waking up to the S&P 500 futures locked “limit-down” with seeming regularity if not for its heavy dependence on credit and an unsustainable degree of leverage. Economic dependence on credit and the high degree of system leverage are not a natural function of either capitalism or a free market. Instead, it is a system and phenomenon engineered by central banks. While the instability is not by design, the market structure very much is. Over the last four decades, central banks (including the Fed) have responded to every economic slowdown (or crisis) by increasing the money supply and reducing interest rates, such that existing debt levels could be sustained and more credit could be created. Each time the system as a whole attempted to deleverage, central banks worked to prevent it through monetary stimulus, ultimately kicking the can down the road and allowing decades of economic imbalance to accumulate in the credit system. This is the root cause of the inherent fragility within the financial system. And it is why each time an economic disruption surfaces, the monetary response from central banks needs to be larger and more extreme than before. With greater imbalance and more debt comes the need for even more QE to stem a liquidity crisis.

Each time, the entire system is pushed further and further out onto the same ledge. The terminal risk to the system (the stability of the underlying currency) becomes greater and greater. Everyone is unwittingly forced to be along for this most unnerving of rides. This is the new normal, and there is nothing sustainable about it. But it is not a reality anyone must accept. There is a better way. For those paying attention to the actual game being played, bitcoin is increasingly becoming the clearest path to opt out of this insanity.

An Instrument of Freedom

At a very basic level, quantitative easing is a forced debasement (or devaluation) of monetary savings. It distorts every pricing mechanism within an economy, and its intended goal is the expansion of credit. When history books are written of this pre-bitcoin era, the failure to understand the consequence of distorting global pricing mechanisms will be identified as the source of all other critically flawed assumptions in modern central banking doctrine. There is no escaping it. You can only hope to manage the fallout. But where don’t-tread-on-me meets the come-and-take-it mentality, freedom-loving Americans of all the world and of all walks of life are beginning to say enough is enough. There has to be a better way because there always is.

That is core to the very idea of hope and the very nature of human ingenuity. It is an unwillingness to accept the new normal as a fait accompli. If quantitative easing can be simplified down to a debasement of monetary savings, bitcoin can be simplified down to the freedom to convert value into a form of currency that cannot be printed. In The Road to Serfdom, Hayek describes the function of money most aptly: “It would be much truer to say that money is one of the greatest instruments of freedom ever invented by man.”[82] As he goes on to further explain, it is money that ultimately affords people a range of choice through trade, which is far greater than otherwise imaginable. It does so by distributing knowledge through its pricing mechanism, the single most important market signal (in aggregate), which facilitates economic coordination and the allocation of resources. However, as the freedoms afforded by one monetary medium become impaired, it should be no surprise that human ingenuity would find a way to route around and spawn a new creation that performs that same function more effectively. That is bitcoin, and there is no going back. The proverbial cat is out of the bag and the distribution of knowledge is naturally exponential.

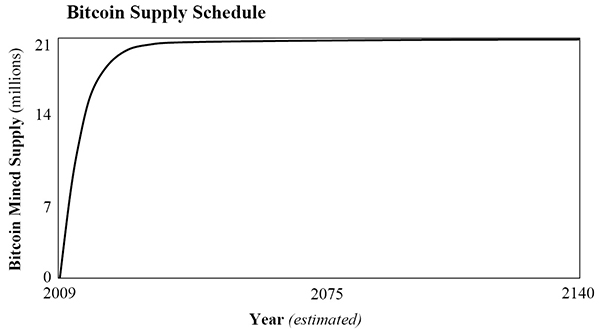

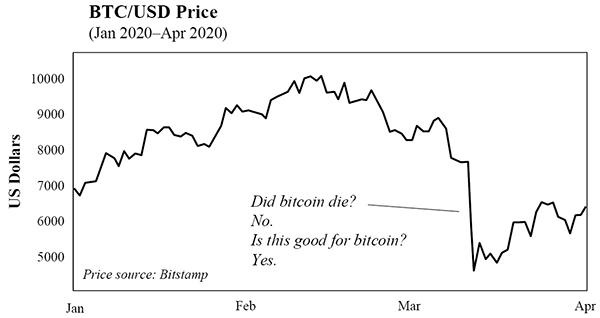

The promise of bitcoin is a more stable monetary system. There are no promises as to its value on any given day. The only assurance it provides is that its supply is not subject to manipulation or systematic debasement by a central bank (or anyone else). There is the seemingly constant question as to whether bitcoin is a “safe haven” and more recently, why bitcoin has become correlated to the broader (collapsing) financial markets. The simple reality is that bitcoin is not a safe haven, at least not as commonly defined in the mainstream. It is not widely held enough to possibly be a safe haven. It remains nascent, and it is perfectly predictable that, at the onset of a global deleveraging event and dollar liquidity crisis, a liquid asset would be sold along with everything else. However, what remains true, despite the turbulent times, is that bitcoin is the antifragile competitor to the inherently fragile financial system. It is the solution to the dollar.

Maximally Accountable

In his book Antifragile, Nassim Taleb describes antifragility as a quality that is not just robust or resilient but, instead, the opposite of fragile. Antifragile systems actually gain strength and feed on volatility.[83] The recent volatility in bitcoin is likely just the beginning, but it really represents uninterrupted and unceasing price discovery. There are no circuit breakers in bitcoin, and there are no bailouts. It is a market devoid of moral hazard, with each participant maximally accountable. When the dust settles, what does not kill bitcoin only makes it stronger—and in a literal sense. It is surviving and thriving in the wild without any central coordination. It is not for the faint of heart, but it is the land of the free and the home of the brave. When it survives, there will still only be 21 million bitcoin, and its very survival will reinforce its place in the world. With each monetary stimulus injected into the legacy financial system, bitcoin’s core value function will become more apparent and more intuitive to more people. This will not just occur by chance either. It will be because of the stark contrast bitcoin provides. Even with its volatility, bitcoin is laying the foundation for a more stable monetary system.

Price Source: Bitstamp

Because bitcoin’s supply cannot be manipulated, its price and its supply of credit will similarly and forever be unmanipulable. Both will be determined on the market. As a result, the size of the bitcoin credit system will never sustain otherwise unsustainable imbalances. Beyond the nature of its fixed supply, this is where the contrast lies in practical application. The accumulation of sustained credit system imbalances (induced by central banks) is the inherent source of fragility in the global economy today. In a market built on the foundation of a currency that cannot be manipulated, as soon as imbalances arise, economic forces will naturally course-correct, preventing the system-wide and systemic credit risk that plagues the legacy financial system. Rather than impair the future by allowing imbalances to accumulate beneath the surface, the unmanipulable supply of bitcoin will act as a governor to stamp out fires as soon as they appear. Fragile individual components of the system will be sacrificed, and the system as a whole will become more antifragile by that very same function.

For Joe Kernen, host of CNBC’s Squawk Box (your modern-day average Joe), it was Facebook’s Libra project that made bitcoin more intuitive. For others, it is hyperinflation in Venezuela. And now for many, it will increasingly become the incessant reality of recurring financial crises and QE. No matter how many cycles of QE the Fed and its global counterparts have in their bag of tricks, bitcoin is inevitably becoming a rallying cry for all those who see the impending train wreck and are unwilling to stand idly by. It is not just a collective act of civil disobedience. It is an individual recognition of the need to act in self-preservation. There comes a time for most everyone when common sense and survival instinct naturally take the reins. The avenue may be different for each individual, but at the end of the day, bitcoin is a means to preserve some form of freedom that is otherwise being impaired or infringed. Whether governments attempt to ban bitcoin or it is mistakenly blamed for the failures of the legacy system, always remember the simplicity of what bitcoin represents. It is nothing more than the individual freedom to convert real-world value into a form of money that cannot be manipulated. It is a most basic and fundamental freedom, but one that must be earned. So to all Americans in the world, stay humble, stack sats, and hold the damn line. Whatever it takes.

The enemy has demanded a surrender. […] I have answered the demand with a cannon shot.

-

William Barret Travis, “To the People of Texas & All Americans in the World,” an open letter from the Alamo, 24 February 1836. ↩

-

Summer Said and Benoit Faucon, “Inside Saudi Arabia’s Decision to Launch an Oil-Price War,” Wall Street Journal, 10 March 2020; Liz Capo McCormick and Alexandra Harris, “The Repo Market’s a Mess. (What’s the Repo Market?),” Bloomberg News, 19 September 2019. ↩

-

Board of Governors of the Federal Reserve System, “Federal Reserve Announces Extensive New Measures to Support the Economy,” press release, 23 March 2020. ↩

-

Neel Kashkari, “Coronavirus and the economy: Best and worst-case scenarios from Minneapolis Fed president,” 60 Minutes, Interview, 22 March 2020. ↩

-

Ben Bernanke, “The Chairman: Part 1,” interview by Scott Pelley, 60 Minutes, 15 Mar 2009. ↩

-

Friedrich A. Hayek, The Road to Serfdom, condensed version (Reader’s Digest, April 1945), 62. ↩

-

Nassim N. Taleb, Antifragile: Things That Gain from Disorder (Random House, 2012). ↩

-

Travis, “To the People of Texas.” ↩