Chapter Eleven

Bitcoin Cannot Be Banned

Originally published

on 8 November 2019

Is Bitcoin Functional as Money?

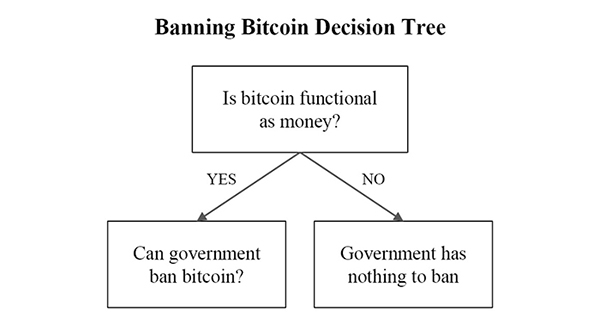

As individuals get closer to the precipice of understanding bitcoin as money, there is commonly an instinctive and reactionary thought that the government will never allow it. However, the idea that governments can somehow ban bitcoin is just the final stage of grief, right before acceptance. The consequence of the statement (or thought) is an admission that bitcoin “works.” In fact, it posits that bitcoin works so well that it will threaten government-run monopolies on money and that governments will regulate bitcoin out of existence to eliminate the threat. Think about the claim that governments will ban bitcoin as conditional logic. Is bitcoin functional as money? If not, governments have nothing to ban. If yes, then governments will attempt to ban bitcoin. So the anchor point for this line of criticism assumes that bitcoin is functional as money. And then, the question becomes whether government intervention could successfully cause an otherwise functioning bitcoin to fail.

As a starting point, anyone trying to understand how, why, or if bitcoin works should assess the question entirely independent of the implications of government regulation or intervention. While bitcoin will undoubtedly have to coexist alongside various regulatory regimes, imagine for a moment that governments did not exist. Would bitcoin be functional as money on a standalone basis if left to the free market? This will inevitably lead to a number of rabbit hole questions. What is money? What are the properties that make a particular medium a better or worse form of money? Does bitcoin share those properties? Is bitcoin a better form of money based on its properties? If the conclusion becomes that bitcoin is not functional as money, the implications of government intervention are irrelevant. However, if bitcoin is functional as money, government intervention then becomes relevant to the debate. This first-order question is key for anyone evaluating whether a ban would be possible.

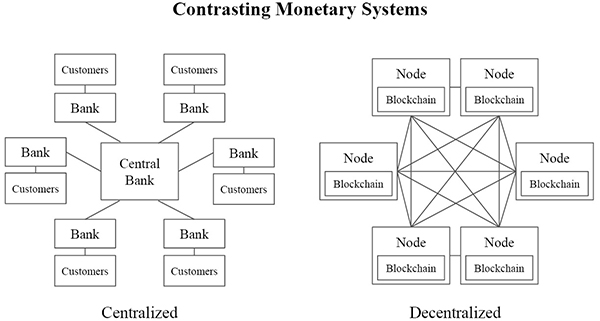

By design, bitcoin exists beyond governments. But it is not just beyond the control of governments. Bitcoin functions without the coordination of any central third parties. It is both global and decentralized. Anyone can access bitcoin on a permissionless basis, and the more widespread it becomes, the more difficult it becomes to censor the network. The architecture of bitcoin is practically purpose-built to resist and immunize any threats, including governments wishing to ban it. This is not to say that governments worldwide will not attempt to regulate, tax, or even ban its use. There will certainly be a fight to resist bitcoin adoption. The Fed and the Treasury (and their global counterparts) are not just going to lie down as bitcoin increasingly threatens the government monopoly on money. However, before debunking the idea that governments could outright ban bitcoin, first understand the very consequence of the statement and the messenger.

The Progression of Denial and the Stages of Grief

The core narrative employed by the skeptic continuously shifts over time. The first stage of grief is the conclusion that bitcoin could never work and that it is backed by nothing. It is nothing more than a present-day tulip mania. With each hype cycle, the value of bitcoin rises dramatically and is then followed by a correction. Often extolled as a crash by skeptics, bitcoin fails to die, and in each instance, it finds support at levels higher than prior adoption waves. The tulip narrative becomes tired, and the skeptics move on to more nuanced issues, re-anchoring the debate. The second stage of grief follows: bitcoin is flawed as a currency. It is too volatile to be money, or it is too slow to be a payment system, or it cannot scale to satisfy all the payments in the world, or it wastes energy. The list goes on. This stage is a progression of denial and a significant departure from the idea that bitcoin lacks any substance.

While the skeptics are busy pointing out flaws, bitcoin never sleeps. The value of the bitcoin network continues its upward march. Each time bitcoin does not die, it gains strength. An increase in value is driven by a very simple market dynamic: more buyers than sellers. That is all, and it is a function of adoption increasing over time. More and more people figure out why there is fundamental demand for bitcoin and how it works. This is what creates long-term demand for bitcoin. As more people increasingly demand it as a store of wealth, there is no supply response. There will only ever be 21 million bitcoin. No matter how many people demand bitcoin, the supply side is completely fixed and inelastic. As the skeptics continue to shout the same tired lines, the crowd continues to parse the noise and demand bitcoin due to the strengths of its monetary properties. And no constituency is more well-versed in the arguments against bitcoin than adopters of bitcoin themselves.

Bitcoin FUD! Dice (v2) by Nic Carter (2019)

Desperation begins to kick in, and the debate re-anchors once again. The narrative predictably shifts. It is no longer that bitcoin is not backed by anything or flawed as a currency. Instead, the debate centers on regulation and government authorities. In the final stage of grief, the criticism is that bitcoin actually works too well, and as a consequence, the government will have no choice but to ban it. Really? So human ingenuity somehow reinvents money in a technologically superior medium—an achievement with mind-bending consequences—and the government is somehow going to ban that? Recognize that in claiming as much, the skeptics are admitting defeat. It is the dying whimper in a series of failed arguments. The skeptics simultaneously accept that fundamental demand for bitcoin exists and then pivot to the unfounded belief that governments can ban it.

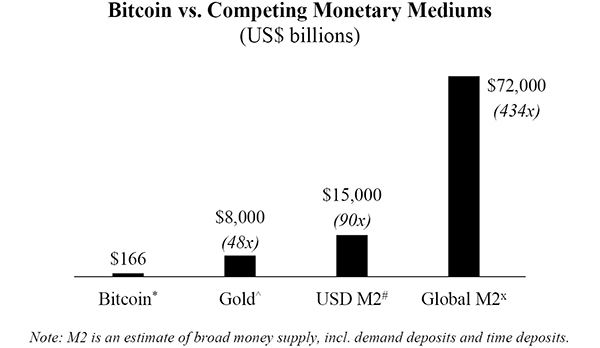

Play this one out. When exactly would developed-world governments step in and attempt to ban bitcoin? Today, the Fed and the Treasury do not view bitcoin as a serious threat to dollar supremacy. In their collective mind, bitcoin is nothing more than a cute little toy and is not functional as a currency. The bitcoin network represents a total purchasing power of less than $200 billion at present. Gold, on the other hand, has a purchasing power of approximately $8 trillion (40x the size of bitcoin), and the broad money supply of dollars (M2) is approximately $15 trillion (75x the size of bitcoin). When does the Fed or Treasury start seriously considering bitcoin to be a credible threat? Is it when bitcoin in total represents $1 trillion of purchasing power, $2 trillion or $3 trillion? Pick your number, but the implication is that bitcoin will be far more valuable and held by far more people globally by that point.

I won’t be talking about bitcoin in ten years, I can assure you that […] I would bet even in five or six years I’m no longer talking about bitcoin as Treasury Secretary. I’ll have other priorities.

I am not a fan of bitcoin […], which [is] not money, and whose value is highly volatile and based on thin air.

The skeptic’s logic is as follows: bitcoin does not work, and if it does, the government will ban it. But governments in the free world will not attempt to ban bitcoin until it becomes more apparent that it is a threat. At which point, bitcoin will be more valuable and undoubtedly harder to ban, as it will be held by far more people in far more places. So, ignore fundamentals and the asymmetry inherent in a global monetization event because the government will step in to regulate bitcoin out of existence if it actually works. On which side of the fence would a rational economic actor rather be? Owning a monetary asset that has increased in value so dramatically that it threatens the global reserve currency, or forgoing ownership of that asset? Assuming an individual possesses the knowledge to understand why it is a real possibility (and increasingly a probability), which is the more defensible and logical position? The asymmetry alone dictates the former, and any fundamental understanding of the demand for bitcoin as money only reinforces the same position.

Sources: *Messari, ^Unchained, #US Federal Reserve, xBloomberg. As of original publication.

An Affront to the Most Basic Freedoms

Setting all else aside, think about what bitcoin represents at an atomic level and then consider what a ban of bitcoin would represent. Bitcoin represents the conversion of subjective value, created and exchanged in the real world, for information controlled by digital keys. More plainly, it is the conversion of an individual’s time into money. When someone demands bitcoin, they are at the same time forgoing demand for some other good, whether it be a dollar, a house, a car, food, or anything else. Bitcoin represents monetary savings that comes with the opportunity cost of other goods and services. Banning bitcoin would be an affront to the most basic freedoms it is designed to both provide and preserve. Imagine the response by all those that have adopted bitcoin: “Well, that was fun. The tool that the experts said would never work now works too well, and the same experts and authorities say we can no longer use it. Everybody go home. The show’s over, folks.” To believe that all the people in the world who have adopted bitcoin for the financial freedom and sovereignty it provides would suddenly lie down and accept the ultimate infringement of that freedom is not rational.

Money is one of the greatest instruments of freedom ever invented by man. It is money which in existing society opens an astounding range of choice to the poor man—a range greater than that which not many generations ago was open to the wealthy.

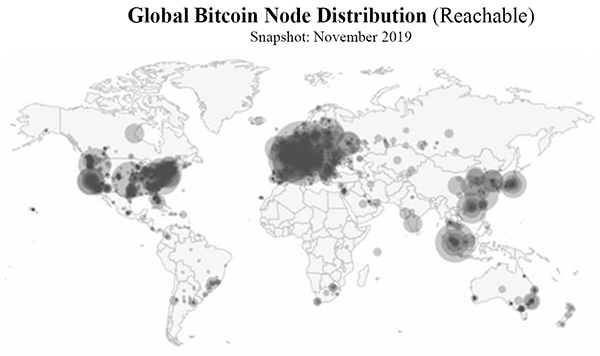

Governments could not successfully ban the consumption of alcohol, the use of drugs, the purchase of firearms, or the ownership of gold. While a government can marginally restrict access or even make possession illegal, it cannot make something of value demanded by a broad and disparate group of people magically disappear. When the US made the private ownership of gold illegal in 1933,[63] gold did not lose its value or disappear as a monetary medium. It actually increased in value relative to the dollar, and just thirty years later, the ban was lifted. Not only does bitcoin provide a greater value proposition relative to any other good that any government has ever attempted to ban (including gold), but it is also far harder to ban given its disparate nature. Bitcoin is global and decentralized. It is without borders, secured by nodes and cryptographic keys all over the world. Banning bitcoin would require preventing open-source software from being run and preventing digital signatures (created by cryptographic keys) from being broadcast on the internet. Governments would have to coordinate across numerous jurisdictions, with the understanding that there is no way to know where the keys reside or to prevent more nodes from popping up in different jurisdictions. Constitutional issues aside, it would be technically infeasible to enforce a ban in any meaningful way.

Source: bitnodes.io

Even if all countries in the G20 coordinated to ban bitcoin in unison, it would not kill bitcoin. Instead, it would be the fait accompli for the fiat system. It would reinforce to the masses that bitcoin is a formidable currency, and set off a global (and hopeless) game of whack-a-mole. There is no central point of failure in bitcoin. Bitcoin miners, nodes, and keys are distributed throughout the world. Every aspect of bitcoin is decentralized, which is why running nodes and controlling keys is core to bitcoin. The more keys and the more nodes that exist, the more decentralized bitcoin becomes, and the more immune bitcoin is to attack. The more jurisdictions in which mining occurs, the less risk any single jurisdiction represents to bitcoin’s security function. A coordinated state-level attack would only serve to build the strength of bitcoin’s immune system. It would ultimately accelerate the shift away from the legacy financial system (and legacy currencies) and accelerate innovation within the bitcoin economic system. With each passing threat, bitcoin innovates to immunize the threat. A coordinated state-level attack would be no different.

Permissionless innovation on a globally decentralized basis is why bitcoin gains strength from every attack. The attack vector itself causes bitcoin to innovate. It is Adam Smith’s “invisible hand” on steroids. Individual actors may believe themselves to be motivated by a greater cause, but in reality, the utility embedded in bitcoin creates a sufficiently powerful incentive structure to ensure its survival. The self-interests of millions of uncoordinated individuals, aligned by their individual and collective need for money, incentivizes permissionless innovation on top of bitcoin. Today, it may seem like a cool new technology or a nice-to-have portfolio investment, but bitcoin is a necessity even if most people do not yet recognize it. It is a necessity because money is a necessity, and legacy currencies are fundamentally broken.

Two months ago, the repo markets in the US broke (September 2019), and the Fed quickly responded by increasing the supply of dollars by $250 billion, with more expected to come.[64] This—print money, in massive quantities—is precisely why bitcoin is a necessity, not a luxury. Bitcoin represents a step-function change innovation in the global competition for money. When an innovation happens to be a basic necessity for the functioning of an economy, no government force could ever hope to stop its proliferation.

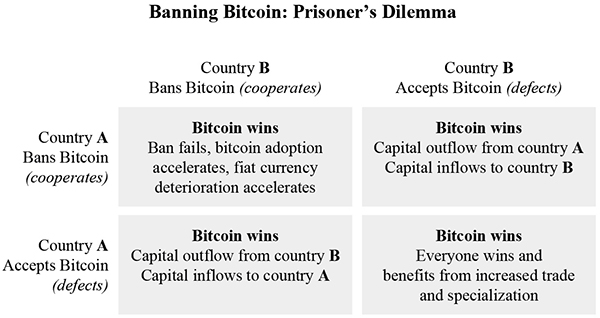

And more practically, any attempt by any jurisdiction to ban bitcoin or heavily regulate its use would directly benefit a competing jurisdiction. The incentive to defect from any coordinated effort to ban bitcoin would be far too high to sustain such an agreement across jurisdictions. If the United States made the possession of bitcoin illegal tomorrow, would it slow down the proliferation, development, and adoption of bitcoin? Presumably. Would it cause the value of the network to decline temporarily? Probably. Would it kill bitcoin? No. Bitcoin represents the most mobile capital in the world. Countries and jurisdictions that create regulatory certainty and place the least restrictions on the use of bitcoin will benefit significantly from capital inflows of sound money and immigration of individuals with the foresight to save in bitcoin.

The regulatory prisoner’s dilemma is not one to one. It is multidimensional, involving numerous jurisdictions with competing interests. Under these conditions, any attempt to successfully ban bitcoin becomes that much more impractical. Human capital, physical capital, and monetary capital will flow to the countries and jurisdictions with the least restrictive regulations on bitcoin. If you believe individuals will not move for freedom and opportunity, your denial is one of America. It may not happen overnight, but attempting to ban bitcoin is the equivalent of a country cutting off its nose to spite its face. It doesn’t mean that countries won’t still try. India has already attempted to ban bitcoin. China has attempted to heavily restrict its use. Others will surely follow. But each time a country takes an action to restrict the use of bitcoin, it actually has the unintended effect of promoting bitcoin adoption. As it turns out, attempted bans are an extremely effective marketing tool for bitcoin. Bitcoin exists as a non-sovereign, censorship-resistant form of money. It is designed to exist beyond the state. Attempts to ban bitcoin merely serve to reinforce bitcoin’s reason for existence and, ultimately, its value proposition. And in the end, every government is going to need bitcoin as money too.

The Only Winning Move Is to Play

Banning bitcoin is a fool’s errand. Some will try. All will fail. The very attempt to ban bitcoin will only accelerate its adoption and proliferation. It will be the hundred-mile-per-hour wind that fuels the wildfire. It will also make bitcoin stronger and more reliable, further immunizing it from future attack and reinforcing its antifragile nature. And in any case, believing governments will ban bitcoin if it becomes a credible threat to global reserve currencies is an irrational reason to discount it as a savings technology. It cedes that bitcoin is viable as money while at the same time ignoring the principal reasons as to why: decentralization and censorship resistance. Imagine understanding the greatest present secret in the world and not capitalizing on the asymmetry and utility that bitcoin provides in fear of the government. More likely, either someone understands why bitcoin works and that it will not fail at the hands of a government, or a knowledge gap exists as to how bitcoin is able to function in the first place. Begin by understanding the fundamentals and then apply that understanding as a baseline to assess any potential risk posed by future government intervention or regulation. And never discount the value of asymmetry. The only winning move is to play.

To govern well is a great science, but no country is ever improved by too much governing. Govern wisely and as little as possible!

-

Steven Mnuchin, interview by Joe Kernen, CNBC Squawk Box, 23 July 2019. ↩

-

Donald J. Trump (@realDonaldTrump), Twitter, 12 July 2019. ↩

-

Friedrich A. Hayek, The Road to Serfdom, condensed version (Reader’s Digest, April 1945), 62. ↩

-

Franklin D. Roosevelt, Executive Order 6102—Forbidding the Hoarding of Gold Coin, Gold Bullion and Gold Certificates, 5 April 1933. ↩

-

Brian Chappatta, “Fed Brings a Bazooka to Its Fight with the Repo Market,” Bloomberg Opinion, 11 October 2019. ↩

-

Sam Houston, The Autobiography of Sam Houston, ed. Donald Day (University of Oklahoma Press, 1954). ↩